- United States

- /

- Software

- /

- NasdaqGS:INTA

Should Strong Cloud Growth and Microsoft Partnership Shift Intapp (INTA) Investors’ Focus for 2026?

Reviewed by Sasha Jovanovic

- Intapp, Inc. reported first quarter 2026 results, posting revenue of US$139.03 million and a net loss of US$14.35 million, while providing updated guidance for the second quarter and full fiscal year.

- This growth was driven by increased adoption of AI-powered cloud offerings, a deepening partnership with Microsoft, and continued expansion across legal, accounting, and financial services sectors.

- We'll examine how strong growth in cloud and AI-driven solutions may shape Intapp's investment narrative moving forward.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Intapp Investment Narrative Recap

To be an Intapp shareholder, you need to believe the company's push into AI-powered cloud solutions can sustain rapid revenue growth and deepen its relationships within legal, accounting, and financial services. The latest earnings suggest cloud adoption and vertical expansion remain key catalysts, while rising net losses highlight ongoing pressures on profitability. This news does not materially alter the biggest near-term risk: whether AI and cloud investments actually deliver true market differentiation and improved margins in the coming quarters.

The recent announcement of a completed share buyback, repurchasing 1,106,000 shares for US$49.98 million, stands out against the backdrop of revenue growth. While share repurchases can reflect management confidence or efforts to improve per-share metrics, the more immediate catalyst remains Intapp’s ability to convert cloud adoption into differentiated, profitable growth.

However, investors should also be aware that, despite high cloud adoption, Intapp’s unproven ability to translate AI investments into lasting competitive advantage means any slip in client retention or...

Read the full narrative on Intapp (it's free!)

Intapp's narrative projects $701.6 million revenue and $34.2 million earnings by 2028. This requires 13.2% yearly revenue growth and a $52.5 million increase in earnings from -$18.3 million.

Uncover how Intapp's forecasts yield a $61.12 fair value, a 60% upside to its current price.

Exploring Other Perspectives

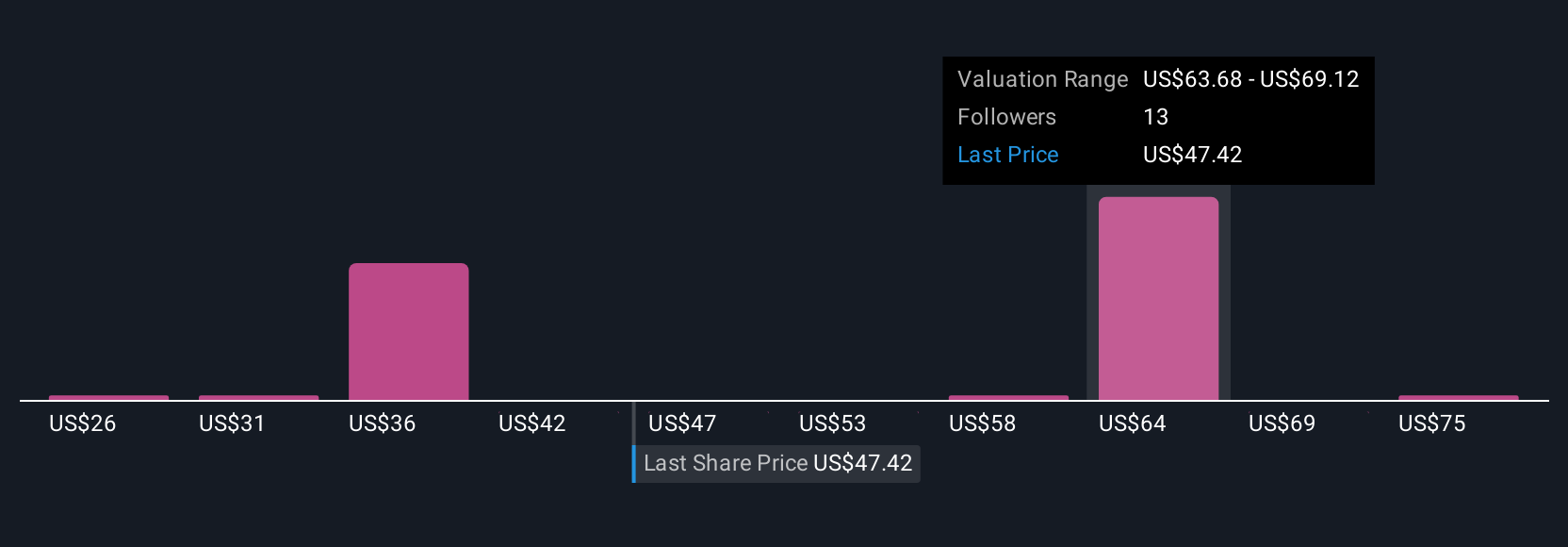

Fair value opinions from six Simply Wall St Community members for Intapp, Inc. range from US$25.60 to US$80 per share. While many see earnings growth as a catalyst, market participants should carefully consider whether recent adoption of AI and cloud features will support sustained performance going forward.

Explore 6 other fair value estimates on Intapp - why the stock might be worth over 2x more than the current price!

Build Your Own Intapp Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Intapp research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Intapp research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Intapp's overall financial health at a glance.

Want Some Alternatives?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INTA

Intapp

Through its subsidiary, Integration Appliance, Inc., provides AI-powered solutions in the United States, the United Kingdom, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

The "Sleeping Giant" Stumbles, Then Wakes Up

Swiped Left by Wall Street: The BMBL Rebound Trade

Duolingo (DUOL): Why A 20% Drop Might Be The Entry Point We've Been Waiting For

Recently Updated Narratives

Mota-Engil's Intrinsic and Historical Valuation

Ferrari's Intrinsic and Historical Valuation

SAP's Intrinsic and Historical Valuation

Popular Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Early mover in a fast growing industry. Likely to experience share price volatility as they scale