- United States

- /

- IT

- /

- NasdaqGM:III

What We Learned About Information Services Group's (NASDAQ:III) CEO Pay

This article will reflect on the compensation paid to Mike Connors who has served as CEO of Information Services Group, Inc. (NASDAQ:III) since 2006. This analysis will also look to assess whether the CEO is appropriately paid, considering recent earnings growth and investor returns for Information Services Group.

See our latest analysis for Information Services Group

Comparing Information Services Group, Inc.'s CEO Compensation With the industry

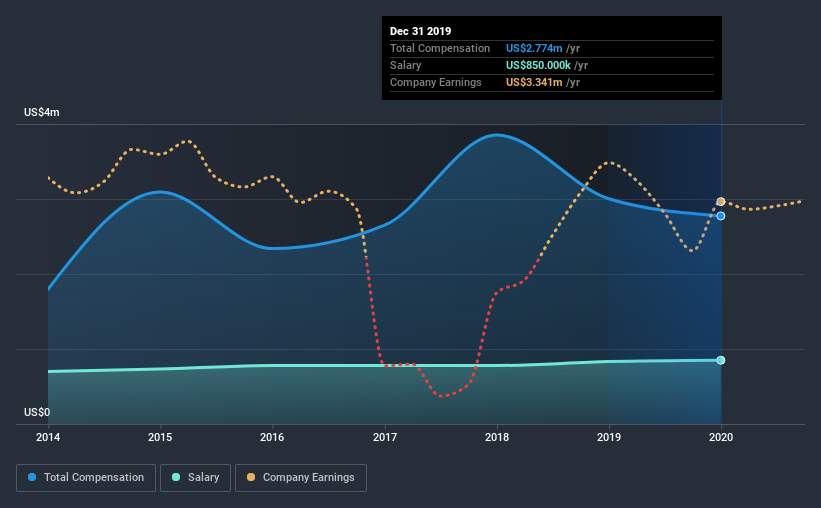

According to our data, Information Services Group, Inc. has a market capitalization of US$128m, and paid its CEO total annual compensation worth US$2.8m over the year to December 2019. That's a slightly lower by 7.6% over the previous year. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at US$850k.

In comparison with other companies in the industry with market capitalizations under US$200m, the reported median total CEO compensation was US$392k. This suggests that Mike Connors is paid more than the median for the industry. What's more, Mike Connors holds US$15m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

On an industry level, roughly 14% of total compensation represents salary and 86% is other remuneration. Information Services Group pays out 31% of remuneration in the form of a salary, significantly higher than the industry average. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

A Look at Information Services Group, Inc.'s Growth Numbers

Information Services Group, Inc.'s earnings per share (EPS) grew 71% per year over the last three years. Its revenue is down 7.4% over the previous year.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. While it would be good to see revenue growth, profits matter more in the end. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Information Services Group, Inc. Been A Good Investment?

With a three year total loss of 34% for the shareholders, Information Services Group, Inc. would certainly have some dissatisfied shareholders. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

To Conclude...

As we touched on above, Information Services Group, Inc. is currently paying its CEO higher than the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. But the company has impressed with its EPS growth, but shareholder returns — over the same period — have been disappointing. Although we'd stop short of calling it inappropriate, we think Mike is earning a very handsome sum.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. We've identified 1 warning sign for Information Services Group that investors should be aware of in a dynamic business environment.

Switching gears from Information Services Group, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

If you’re looking to trade Information Services Group, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NasdaqGM:III

Information Services Group

Operates as an artificial intelligence (AI) centered technology research and advisory company in the Americas, Europe, and the Asia Pacific.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

An Undervalued 3.3Moz Gold Project in Canada

SoFi Technologies: The Apex Aggregator and the Infrastructure of the Modern Financial System

CSL: The Dip Is the Opportunity

DHT Holdings, inc: Strait of Hormuz Risk Amidst US-Israel vs Iran Tensions Spikes VLCC Rates.

Recently Updated Narratives

A Company Preparing for the Future: Charles River Laboratories

The Birth of a High-Grade Canadian Gold Powerhouse

Fundamental Analysis on BNPL companies should be viewed differently for Valuation Metrics.

Popular Narratives

Nu holdings will continue to disrupt the South American banking market

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion