- United States

- /

- Software

- /

- NasdaqGS:IDCC

Why InterDigital (IDCC) Is Up 15.0% After New Samsung Deal and Raised 2025 Guidance

Reviewed by Simply Wall St

- In recent news, InterDigital announced a new patent license agreement with Samsung following the conclusion of a lengthy arbitration, alongside reporting its second-quarter 2025 financial results with sales of US$300.6 million and net income of US$180.57 million.

- The company also raised its annual revenue and earnings guidance, reflecting increased confidence in its business outlook after resolving key licensing disputes.

- We'll explore how the renewed partnership with Samsung and raised guidance could alter the outlined risks and opportunities in InterDigital's investment case.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

InterDigital Investment Narrative Recap

At its core, InterDigital’s investment case revolves around the company’s ability to secure and renew lucrative licensing agreements with global technology leaders. The conclusion of arbitration and fresh licensing deal with Samsung addresses the company’s main short-term catalyst, license renewals, as well as easing one of the most immediate risks previously outlined: uncertainty from ongoing legal disputes with key clients. As a result, the latest news meaningfully strengthens the near-term outlook by reducing headline risk and supporting upward guidance revisions.

The raised earnings and revenue guidance for 2025 is directly connected to the recent Samsung agreement, sending a clear signal to the market about management’s improved confidence in the company’s income stability and negotiating position. Such public revisions, especially when they follow a long-awaited client renewal, tend to resonate with analysts focused on recurring revenue and cash flow durability, key elements of the thesis for shareholders seeking resilience amid industry cycles.

However, in contrast to these positive signals, investors should be mindful of unresolved legal and licensing disputes elsewhere in the business that could still...

Read the full narrative on InterDigital (it's free!)

InterDigital's outlook forecasts $591.2 million in revenue and $158.7 million in earnings by 2028. This implies a 10.2% annual revenue decline and a $233.9 million decrease in earnings from the current $392.6 million.

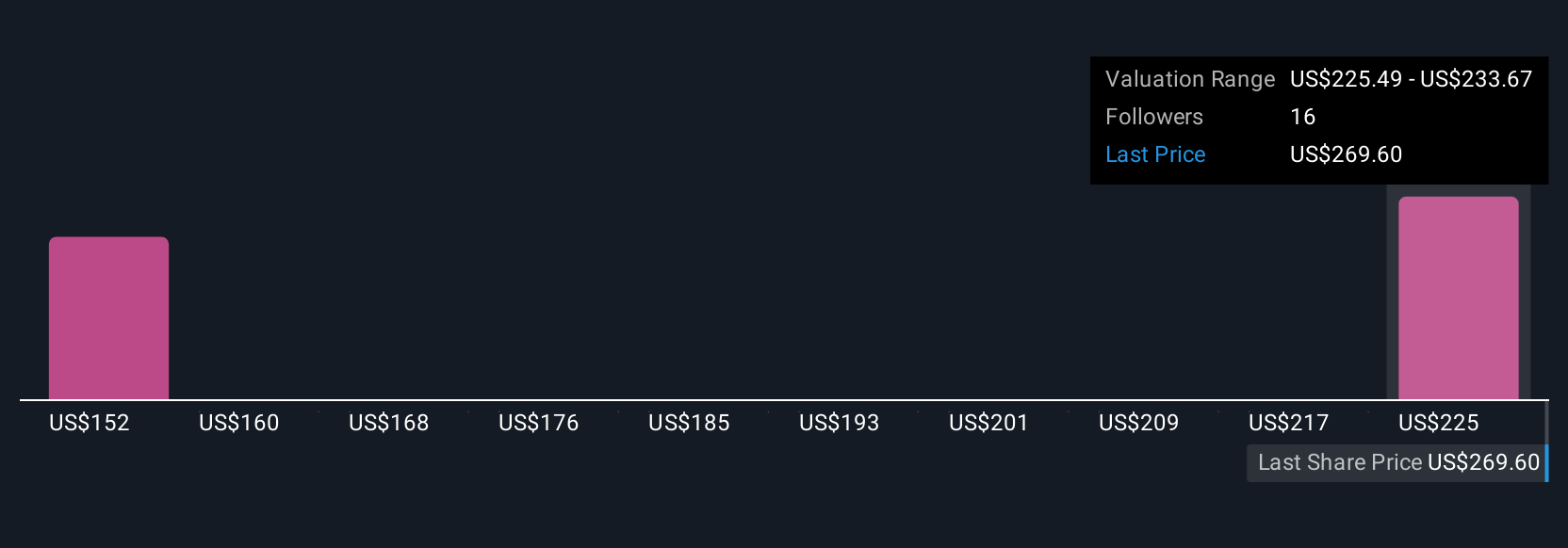

Uncover how InterDigital's forecasts yield a $233.67 fair value, a 10% downside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided fair value estimates for InterDigital ranging from US$110.39 to US$233.67, based on two different approaches. While some see strong upside, upcoming licensing negotiations and new agreements could continue to drive considerable debate about where the company’s performance, and valuation, may go next.

Explore 2 other fair value estimates on InterDigital - why the stock might be worth as much as $233.67!

Build Your Own InterDigital Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your InterDigital research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free InterDigital research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate InterDigital's overall financial health at a glance.

Ready For A Different Approach?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 24 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IDCC

InterDigital

Operates as a global research and development company focuses on wireless, visual, artificial intelligence (AI), and related technologies.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives