- United States

- /

- Software

- /

- NasdaqGS:IDCC

InterDigital (IDCC): Evaluating Valuation After Major U.S. Government Contract and New Spectrum Technology Collaboration

InterDigital (IDCC) has been tapped by the U.S. Department of War to lead a government-backed project, bringing its advanced expertise in dynamic spectrum sharing and AI-powered wireless technologies to a new collaboration with DeepSig and Skylark Wireless.

See our latest analysis for InterDigital.

This government-backed contract comes as InterDigital enjoys strong momentum, with a 12% share price return over the past month and a remarkable 140% total shareholder return over the last year. The recent upswing signals growing market confidence in the company’s potential, especially as high-profile partnerships and fresh innovations continue to put InterDigital in the spotlight.

If this breakthrough has sparked your curiosity, the next logical step is to discover other high-growth tech and AI innovators. See the full list for free: See the full list for free.

With the stock posting standout gains and a major government contract in hand, the big question is whether there is still room for further upside or if all the good news is already reflected in the current price.

Most Popular Narrative: 11.6% Overvalued

With InterDigital’s last closing price sitting above the narrative’s fair value estimate, market optimism has pushed the stock beyond what this widely followed perspective considers justified. This sets up an intriguing exploration into why the narrative sees risk at these levels and what is driving the calculations behind the scenes.

The recent 67% uplift in the Samsung license and an all-time high annualized recurring revenue, driven by multi-year agreements with major OEMs, have set highly optimistic expectations for continued outsized growth in future contract renewals, potentially inflating valuation multiples and overstating sustainable revenue trajectory.

Want to know what bold forecasts power this premium valuation? The narrative hints at exponential contract gains and daring profit assumptions, but the precise numbers are kept just out of reach. Ready to discover what really fuels these elevated price targets?

Result: Fair Value of $328.75 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, robust smartphone licensing deals and successful expansion into IoT could deliver more stable growth than current forecasts suggest, which may challenge prevailing caution.

Find out about the key risks to this InterDigital narrative.

Another View: Multiples Tell a Different Story

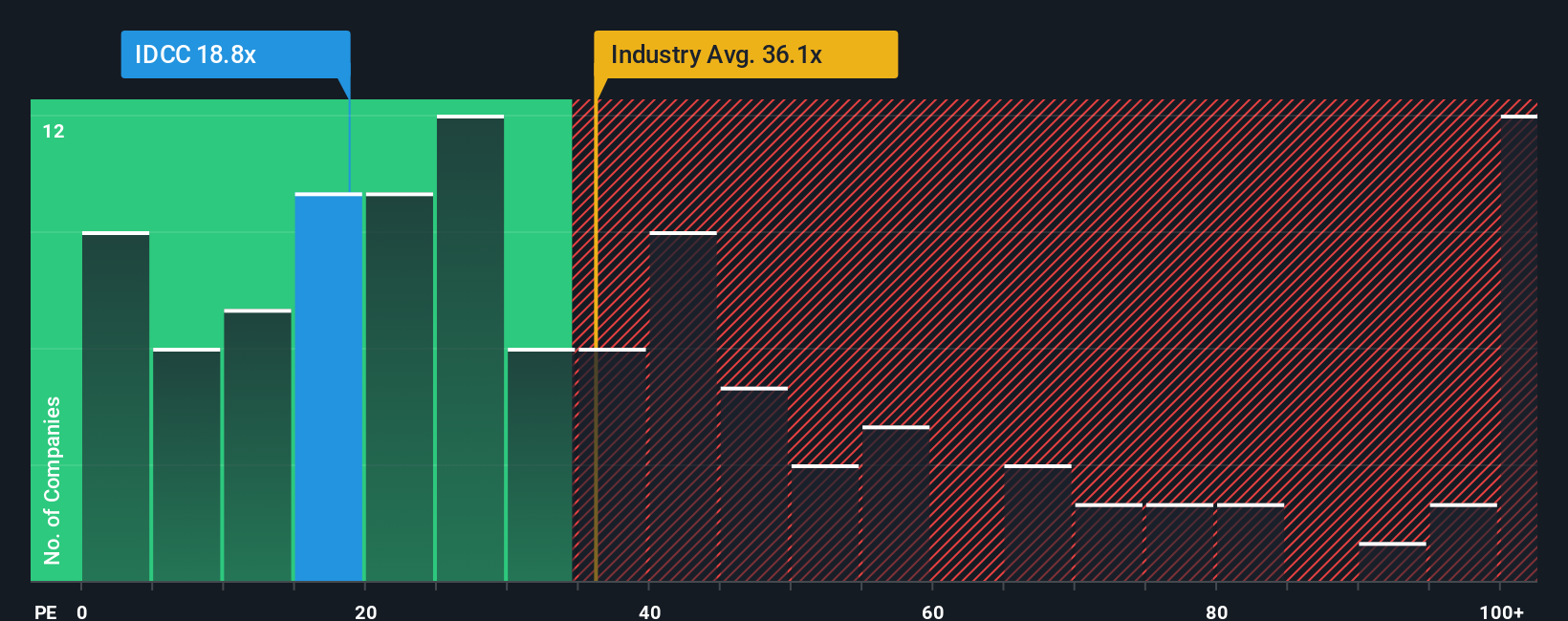

While the narrative values InterDigital as overvalued, a closer look at its price-to-earnings ratio paints a more nuanced picture. At 20.4x, the company trades well below both the US Software industry average (34.9x) and its peer group average (39.8x). However, this is still above the fair ratio of 15x that the market could eventually align with. Does this gap imply less risk than the narrative suggests, or is there still downside if the market reprices expectations?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own InterDigital Narrative

Prefer a different angle? Dive into the numbers yourself and craft your own take. Building a personalized view of InterDigital’s story takes just a few minutes. Do it your way

A great starting point for your InterDigital research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t let great opportunities slip by. Level up your investing game in minutes by targeting stocks with potential that many others haven’t yet noticed. Use the power of tailored screeners and get a jump on tomorrow’s winners. Why settle for ordinary when you can invest with an edge?

- Capture high yields by reviewing these 18 dividend stocks with yields > 3% and see which companies consistently reward shareholders with robust, above-average payouts.

- Focus on innovation leaders running the artificial intelligence race with these 24 AI penny stocks helping you filter for firms poised to dominate new markets.

- Position yourself ahead of trends by scanning these 26 quantum computing stocks for companies pioneering quantum breakthroughs that could reshape industries faster than anyone expects.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IDCC

InterDigital

Operates as a global research and development company focuses on wireless, visual, artificial intelligence (AI), and related technologies.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

EU#4 - Turning Heritage into the World’s Strongest Luxury Empire

The "Easy Money" Is Gone: Why Alphabet Is Now a "Show Me" Story

Recently Updated Narratives

Future PE of 12.8x Shines Bright for FactSet Growth

BIPC: A strategic player in the energy crisis, a hybrid of Utility and Digital REIT.

Quintessential serial acquirer

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

The "Sleeping Giant" Stumbles, Then Wakes Up

Trending Discussion

As a gamer, I would not touch this company now. They are hated by the community and have been releasing major flops on their AAA games during the last 5 years (for good reasons). It is true that the valuation is ridiculously low compared to what the licenses are worth, but if the trend continues the value of those will also decline. Management needs to almost make a 180° turnaround to get things right. I agree that a take-private deal before it is too late might be the best option for an investor entering today. We might also see a split sales of the different studios. It is a very risky play, but potentially with high reward.