- United States

- /

- Software

- /

- NasdaqGS:IDCC

A Look at InterDigital (IDCC) Valuation Following Analyst Upgrade and Strong Sector Outperformance

Reviewed by Simply Wall St

InterDigital (IDCC) is drawing investor attention following its recent upgrade to a Buy ranking, a change that reflects a stronger earnings outlook. The company’s shares have also outpaced both sector and industry peers so far this year.

See our latest analysis for InterDigital.

Momentum has been building for InterDigital, with its share price climbing nearly 78% year-to-date and a stellar 93% total shareholder return over the past year. This performance has outperformed both sector and industry groups. Recent insider sales have not slowed investor enthusiasm, as strong results and improved sentiment continue to drive gains.

If you’re interested in spotting more companies on the move, now is a great time to broaden your horizons and discover fast growing stocks with high insider ownership

But after such a rapid run-up and bullish analyst attention, does InterDigital still offer hidden value for investors? Or have markets already accounted for every bit of its future growth potential?

Most Popular Narrative: 15.4% Undervalued

With InterDigital closing at $348.44 and the narrative’s fair value set at $412, the narrative indicates more upside potential ahead. This is driven by multi-year growth assumptions and a wave of new licensing agreements.

The company is making rapid progress expanding into Consumer Electronics and IoT markets, as shown by a recent HP agreement (now over 50% of the PC market under license) and a 175% increase in CE and IoT program revenue in Q2. This points to successful diversification and a growing addressable market, supporting topline growth and reducing cyclicality.

Curious about what powers this valuation? The narrative is based on ambitious recurring revenue forecasts and shrinking future margins. The key point is the projections for profit and earnings per share that stand out against industry trends. Want the full breakdown? See which bold growth assumptions are behind that fair value calculation.

Result: Fair Value of $412 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, if key new markets underperform or regulatory hurdles materialize, InterDigital's growth trajectory and valuation narrative could encounter significant challenges.

Find out about the key risks to this InterDigital narrative.

Another View: Multiples Suggest Room for Caution

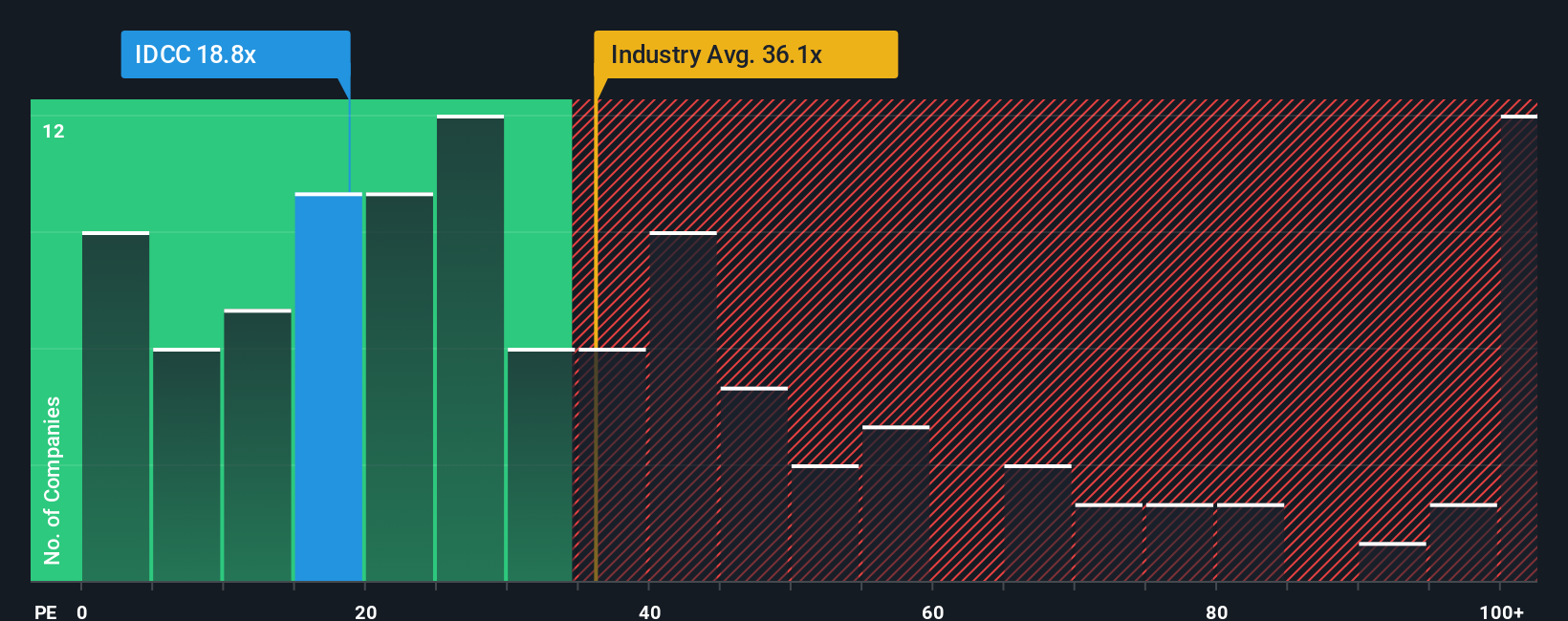

While the narrative points to undervaluation based on growth assumptions, InterDigital currently trades at a price-to-earnings ratio of 18.1x, noticeably lower than the US Software industry’s average of 31.2x and peer average of 27.3x. However, this is above its fair ratio of 15.6x, suggesting the market could price in more risk or temper its enthusiasm over time. Does this mean there is still a margin of safety, or has optimism already been priced in?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out InterDigital for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 887 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own InterDigital Narrative

If you see the story differently or want to dive deeper into the numbers, you can craft your own narrative in just a few minutes. Do it your way

A great starting point for your InterDigital research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don't let your next winning opportunity slip past you. Act now and access unique stock picks you might otherwise miss using the Simply Wall Street Screener.

- Spot undervalued gems poised for a rebound by evaluating these 887 undervalued stocks based on cash flows, which have strong cash flow potential and attractive entry points.

- Tap into the booming AI sector with these 25 AI penny stocks to uncover businesses powering innovation in data intelligence and automation.

- Capture steady passive income by browsing these 16 dividend stocks with yields > 3%, offering reliable yields above 3% and robust financial pedigrees.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IDCC

InterDigital

Operates as a global research and development company focuses on wireless, visual, artificial intelligence (AI), and related technologies.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives