- United States

- /

- Software

- /

- NasdaqCM:GVP

GSE Systems, Inc. (NASDAQ:GVP) Soars 67% But It's A Story Of Risk Vs Reward

GSE Systems, Inc. (NASDAQ:GVP) shareholders are no doubt pleased to see that the share price has bounced 67% in the last month, although it is still struggling to make up recently lost ground. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 74% share price drop in the last twelve months.

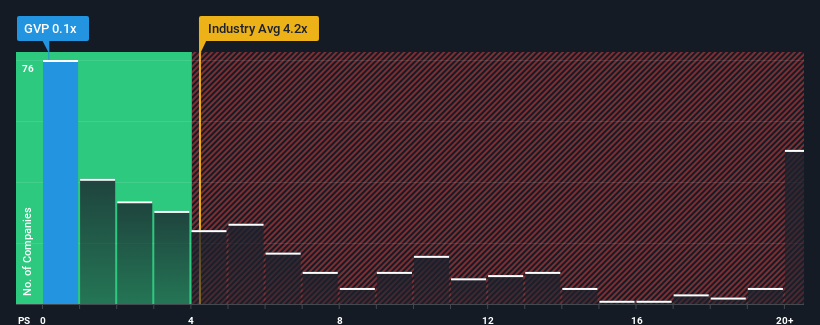

In spite of the firm bounce in price, GSE Systems may still be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.1x, since almost half of all companies in the Software industry in the United States have P/S ratios greater than 4.2x and even P/S higher than 12x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

Check out our latest analysis for GSE Systems

What Does GSE Systems' P/S Mean For Shareholders?

GSE Systems hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Keen to find out how analysts think GSE Systems' future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For GSE Systems?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like GSE Systems' to be considered reasonable.

Retrospectively, the last year delivered a frustrating 10% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 27% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 15% each year during the coming three years according to the one analyst following the company. With the industry predicted to deliver 15% growth per year, the company is positioned for a comparable revenue result.

With this in consideration, we find it intriguing that GSE Systems' P/S is lagging behind its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

What We Can Learn From GSE Systems' P/S?

GSE Systems' recent share price jump still sees fails to bring its P/S alongside the industry median. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

It looks to us like the P/S figures for GSE Systems remain low despite growth that is expected to be in line with other companies in the industry. The low P/S could be an indication that the revenue growth estimates are being questioned by the market. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

There are also other vital risk factors to consider and we've discovered 5 warning signs for GSE Systems (3 are potentially serious!) that you should be aware of before investing here.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:GVP

GSE Systems

Engages in the provision of professional and technical engineering services, staffing services, and simulation software to clients in the power and process industries in the United States, Asia, Europe, and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026