- United States

- /

- Software

- /

- NasdaqGS:GTLB

Will Shifts in Leadership and Revenue Outlook Reshape GitLab’s (GTLB) Long-Term Investment Thesis?

Reviewed by Sasha Jovanovic

- Last month, GitLab reported strong second-quarter results and announced the appointment of Simon Mundy as Chief Accounting Officer, following the resignation of Brian Robins on September 19, 2025.

- Despite demand growth and ongoing AI initiatives, investor concerns surfaced due to weaker third-quarter revenue guidance and leadership transitions.

- We’ll explore how investor concerns about GitLab’s revenue projections and executive changes might influence its long-term investment narrative.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

GitLab Investment Narrative Recap

To be a GitLab shareholder, you need to believe the company can translate its strong AI-driven platform innovation and enterprise expansion into sustained, profitable growth, despite clear competition and a transition-heavy management environment. The recent leadership changes, including a new Chief Accounting Officer and interim CFO, are important but appear to have limited immediate impact on GitLab’s biggest short-term driver, adoption of its hybrid AI-enhanced platform, while mildly adding to near-term uncertainty around revenue consistency.

The appointment of Simon Mundy as Chief Accounting Officer stands out, given his prior experience in tech accounting leadership. While continuity in financial oversight is critical amid GitLab’s platform evolution and new monetization models, this personnel change seems mainly procedural rather than disruptive to the company’s immediate product or growth catalysts.

However, investors should also be aware that despite recent technological progress, ongoing leadership turnover could still create…

Read the full narrative on GitLab (it's free!)

GitLab's narrative projects $1.4 billion revenue and $189.5 million earnings by 2028. This requires 21.6% yearly revenue growth and an increase in earnings of $176.5 million from $13.0 million currently.

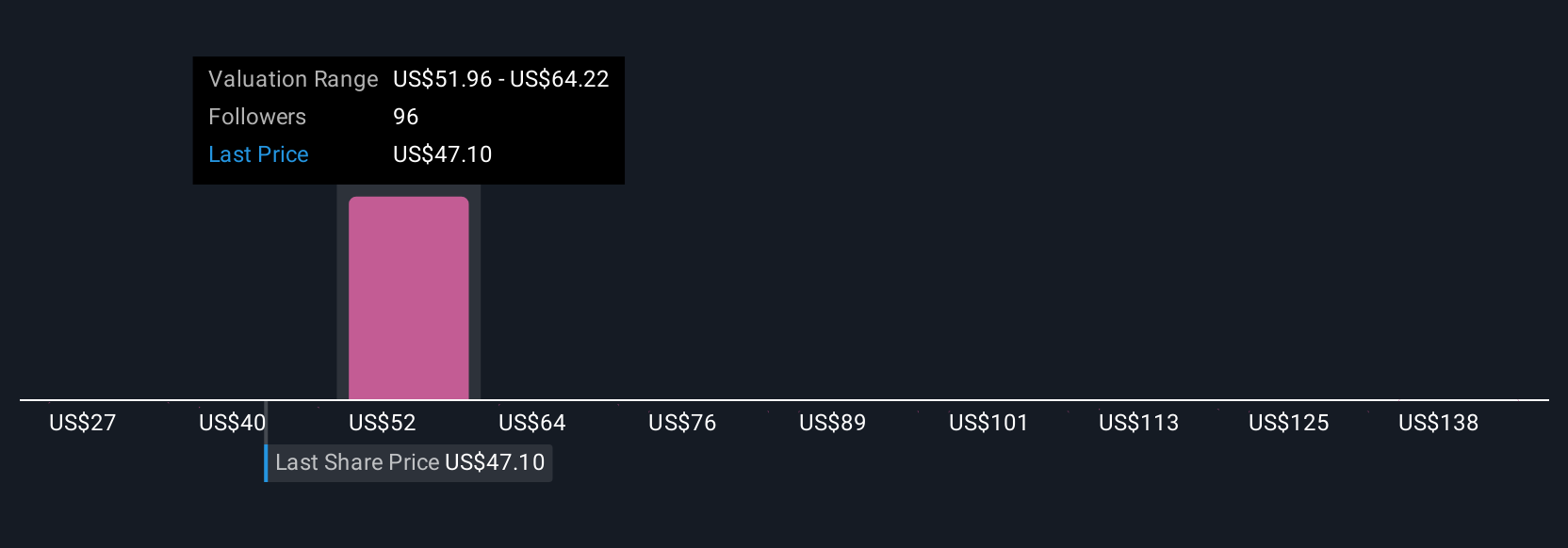

Uncover how GitLab's forecasts yield a $58.64 fair value, a 25% upside to its current price.

Exploring Other Perspectives

Fair value estimates from 23 Simply Wall St Community participants stretch from US$27.92 to US$150 per share, underscoring mixed expectations. Amid such wide-ranging outlooks, ongoing executive transitions continue to weigh on predictability of future growth, highlighting the importance of reviewing multiple viewpoints.

Explore 23 other fair value estimates on GitLab - why the stock might be worth 40% less than the current price!

Build Your Own GitLab Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your GitLab research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free GitLab research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate GitLab's overall financial health at a glance.

Ready For A Different Approach?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GTLB

GitLab

Develops software for the software development lifecycle in the United States, Europe, and the Asia Pacific.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives