- United States

- /

- Software

- /

- NasdaqGS:GTLB

Is GitLab Now a Value Opportunity After Recent Slide and DevSecOps AI Expansion?

- Wondering if GitLab is quietly turning into a value opportunity after a rough stretch on the market? This piece will help you decide whether the current price makes sense or not.

- GitLab has bounced 6.9% over the last week even after sliding 15.0% over the past month and sitting roughly 23.0% down year to date and 34.8% lower over the past year, which is exactly the kind of volatility that can hide mispricing.

- Recent headlines have focused on GitLab's push to deepen its DevSecOps platform and expand AI driven features across the software delivery lifecycle, reinforcing its role as a core productivity tool for developers. At the same time, ongoing chatter about consolidation in enterprise software and spending discipline among large customers has kept investors debating how durable that growth runway really is.

- On our framework, GitLab scores a 4 out of 6 on undervaluation checks, suggesting pockets of value but also areas where the market may be more cautious. Next we will break down the different valuation approaches and then circle back to an even more insightful way to think about what this stock is truly worth.

Find out why GitLab's -34.8% return over the last year is lagging behind its peers.

Approach 1: GitLab Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company is worth by projecting its future cash flows and then discounting those back to a single value in today’s dollars. For GitLab, the model uses its latest twelve month Free Cash Flow of about $33.5 million as a starting point and then layers on analyst expectations and longer term extrapolations.

Analysts see GitLab’s Free Cash Flow climbing into the low hundreds of millions over the next few years, with projections reaching roughly $204.6 million by 2026 and about $512.2 million by 2030. Beyond those analyst estimates, Simply Wall St extends the forecasts using a 2 Stage Free Cash Flow to Equity approach to capture a tapering but still meaningful growth trajectory.

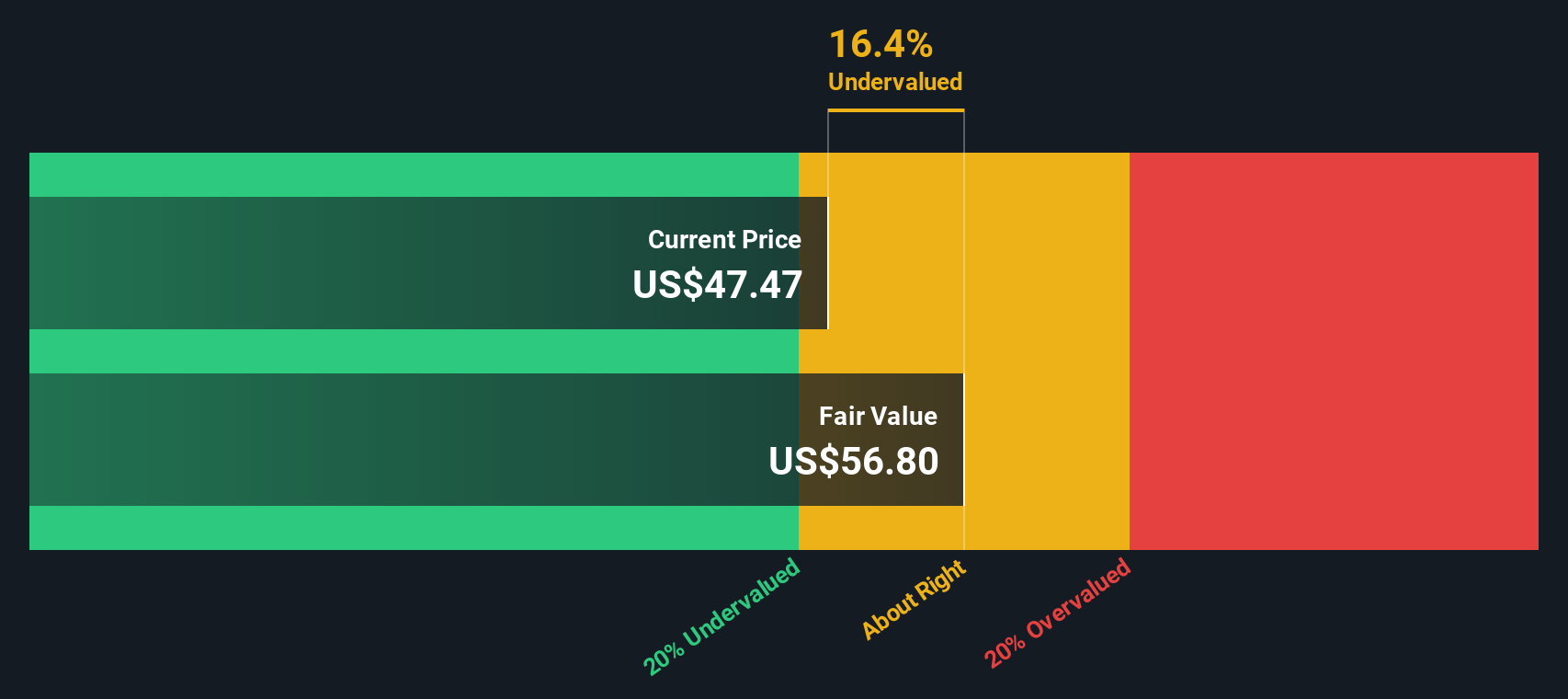

When all those projected cash flows are discounted back, the model arrives at an intrinsic value of about $57.06 per share, which implies the stock is trading at roughly a 24.0% discount to its estimated worth. On this view, GitLab appears materially undervalued today based on this cash flow model.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests GitLab is undervalued by 24.0%. Track this in your watchlist or portfolio, or discover 925 more undervalued stocks based on cash flows.

Approach 2: GitLab Price vs Sales

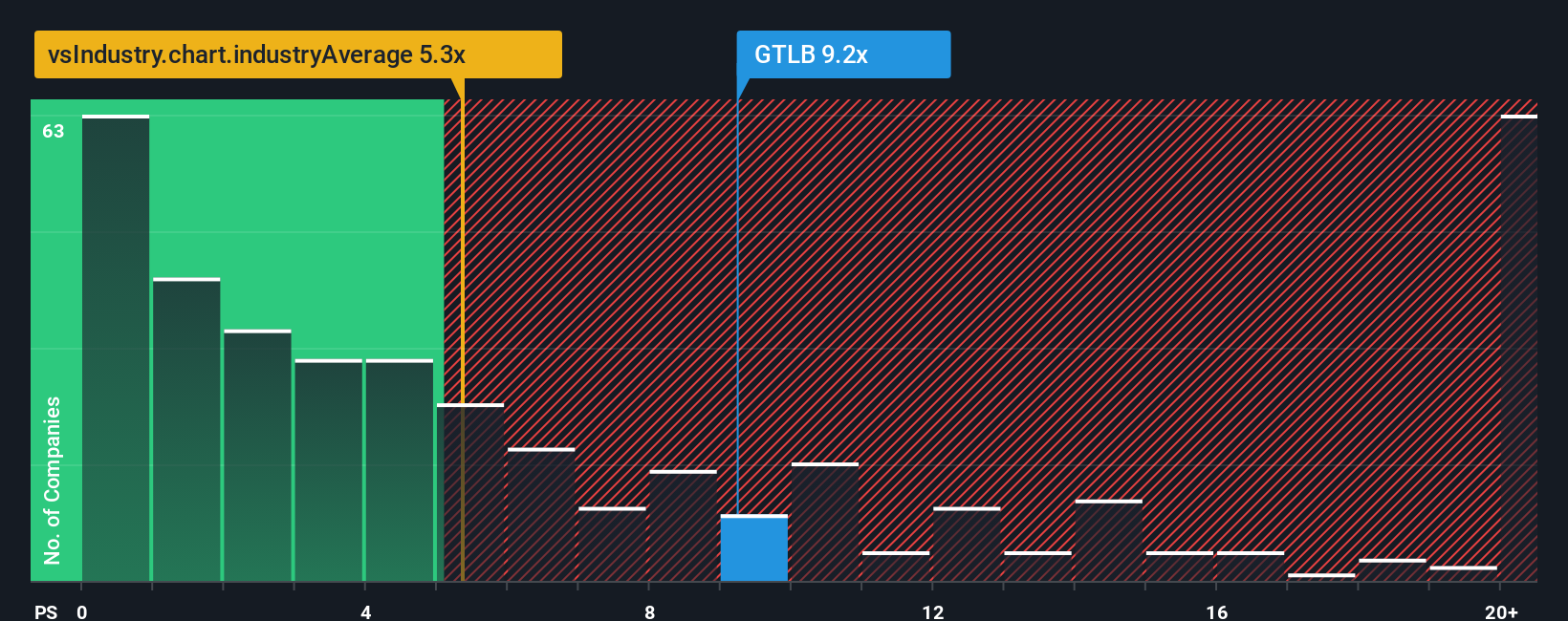

For a company like GitLab that is still building toward mature profitability, the price to sales multiple is a practical way to assess value because it anchors the valuation to current revenue while the bottom line is still being reinvested for growth.

In general, higher expected growth and lower perceived risk justify a richer multiple, while slower growth or more uncertainty should pull that multiple down. GitLab currently trades on a price to sales ratio of about 8.4x, which is notably above the broader Software industry average of roughly 4.8x and slightly above a peer group average of around 8.1x.

Simply Wall St bridges this gap with its Fair Ratio, a proprietary estimate of what GitLab’s price to sales multiple should be given its growth outlook, risk profile, margins, size and industry context. That Fair Ratio sits at about 8.7x, modestly higher than where the stock trades today. This suggests the market is not fully reflecting GitLab’s fundamentals, even after accounting for sector specific nuances that simple peer or industry comparisons can miss.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1441 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your GitLab Narrative

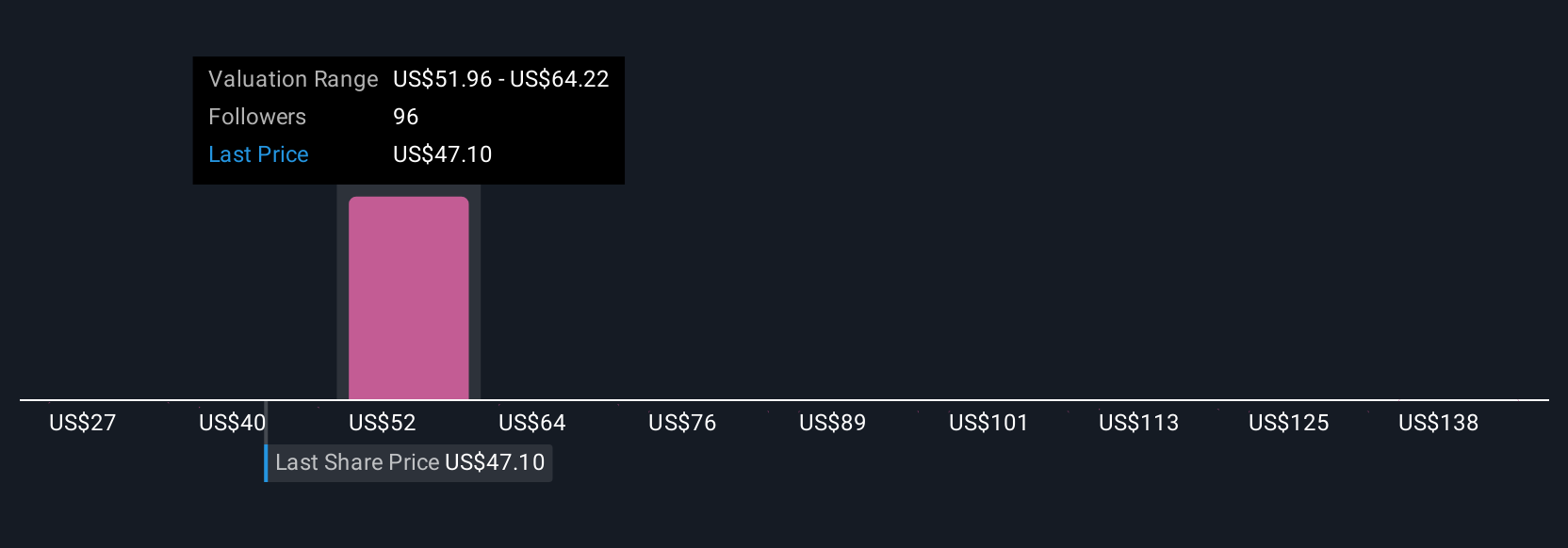

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, an intuitive tool on Simply Wall St’s Community page that lets you describe your view of GitLab’s story in plain language. It translates that into assumptions for revenue, earnings and margins, and automatically links those assumptions to a full financial forecast, a Fair Value estimate and clear buy or sell signals by comparing that Fair Value with today’s share price. All of this then updates dynamically when new information like earnings or takeover headlines arrive. You can see, for example, how one investor might build an optimistic GitLab Narrative around accelerating AI adoption, cloud migration and a potential acquisition that justifies a Fair Value closer to the bullish 85 dollars price target. Another might focus on competitive pressure, execution risk and slower customer growth to anchor a more conservative Narrative around 46 dollars. This gives you a structured, side by side view of how different stories lead to different numbers and helps you choose the path that fits your own expectations.

Do you think there's more to the story for GitLab? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GTLB

GitLab

Develops software for the software development lifecycle in the United States, Europe, and the Asia Pacific.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

EU#4 - Turning Heritage into the World’s Strongest Luxury Empire

The "Easy Money" Is Gone: Why Alphabet Is Now a "Show Me" Story

Recently Updated Narratives

Norwegian Air Shuttle's revenue will grow by 73.56% and profitability will soar

Alphabet - A Fundamental and Historical Valuation

The Compound Effect: From Acquisition to Integration

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

The "Sleeping Giant" Stumbles, Then Wakes Up

Trending Discussion