- United States

- /

- Software

- /

- NasdaqGS:GTLB

Assessing GitLab’s Value After Recent AI DevOps Partnerships and a 10% Share Price Drop

- Ever wondered if GitLab stock is a bargain or if the price still has room to climb? You are not alone, as plenty of investors are debating its true value right now.

- GitLab’s share price has had a wild ride lately, dropping 10.8% in the last week but still managing to eke out a 2.1% gain over the past month. However, it is down 19.2% year to date.

- Recently, news of accelerated AI-driven DevOps initiatives across the industry and fresh partnerships from major cloud providers have helped frame market expectations for GitLab. This has fueled both optimism and skepticism, making it clear why the stock price has seen heightened volatility as investors consider what this means for GitLab’s growth prospects.

- When it comes to how undervalued GitLab is, the company scores a 4 out of 6 on our valuation checklist. We will break down each valuation approach below, and the best way to judge its value story might just surprise you by the end of this article.

Find out why GitLab's -24.3% return over the last year is lagging behind its peers.

Approach 1: GitLab Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's fair value by projecting its future cash flows and then discounting those amounts back to their value in today's dollars. It is a cornerstone valuation method because it focuses on what the business is expected to actually generate over time, rather than market sentiment.

For GitLab, the company’s latest reported Free Cash Flow is $33.5 Million. Analysts estimate this figure will grow quickly, with projections for 2030 reaching $526.7 Million. In fact, analyst consensus provides forecasts for up to five years. Simply Wall St extrapolates the remaining years based on those forecasts. This points to strong expectations for future expansion and growth within the software sector.

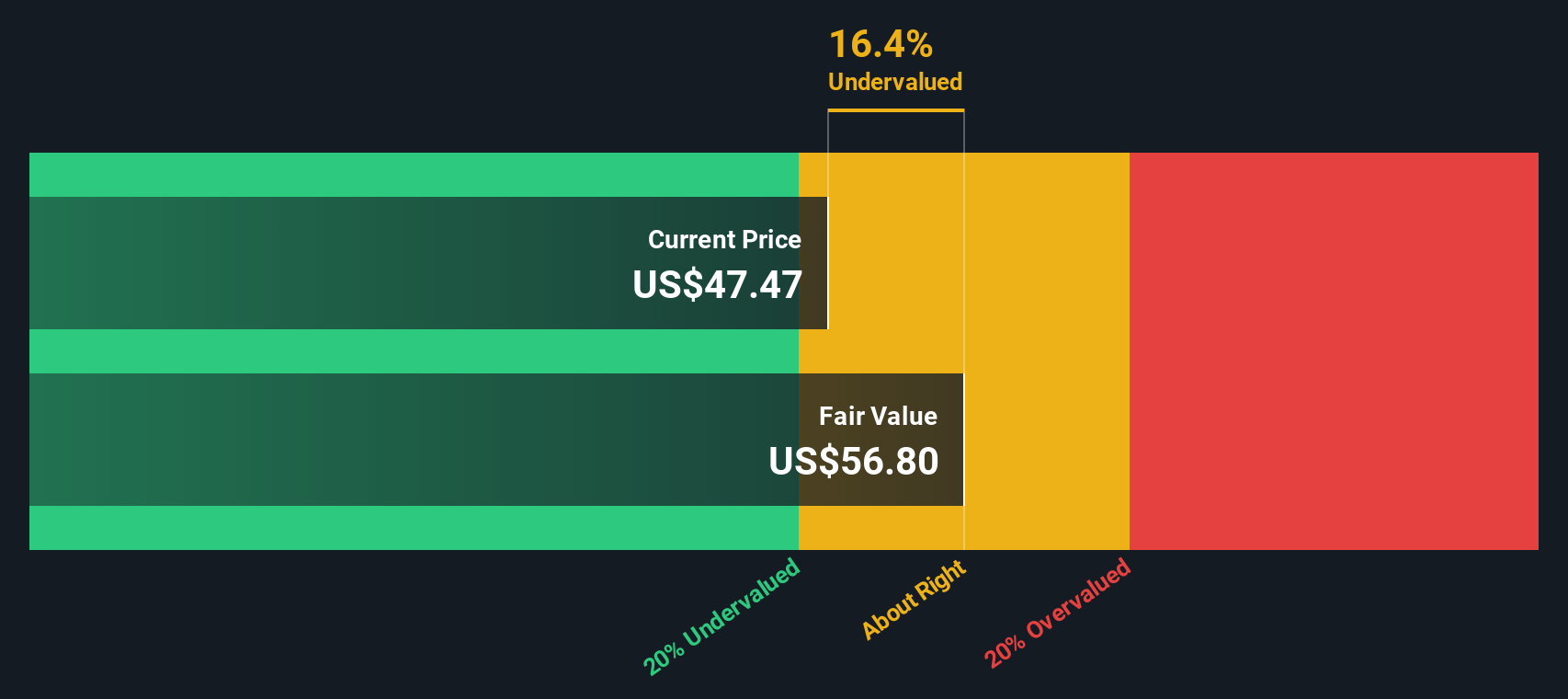

Using these forecasts, the DCF model suggests that GitLab’s intrinsic fair value per share is $58.40. With the share price currently trading about 22% below this computed value, the DCF model implies that the stock is notably undervalued by the market.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests GitLab is undervalued by 22.0%. Track this in your watchlist or portfolio, or discover 883 more undervalued stocks based on cash flows.

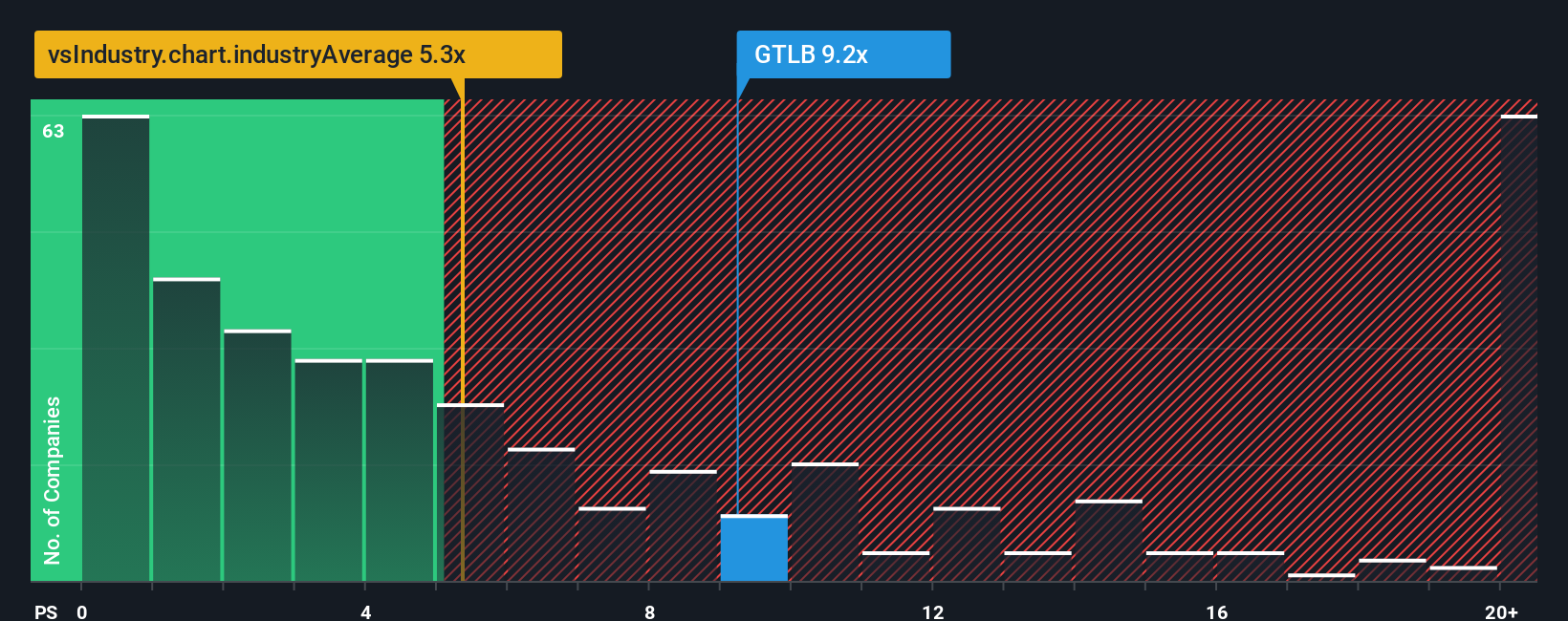

Approach 2: GitLab Price vs Sales

For fast-growing software companies that are not yet consistently profitable, the Price-to-Sales (PS) ratio is often the most relevant valuation yardstick. Unlike earnings-based ratios, PS lets us compare companies even if net profits are minimal or volatile. This makes it a popular metric across high-growth tech sectors.

The PS ratio is influenced by both growth expectations and risk levels. Higher projected sales growth or lower risk can justify a higher PS ratio. On the other hand, slower growth or more uncertainty typically calls for a lower one. Investors look for a balance that reflects where the company sits within its industry and how it compares to anticipated future performance.

GitLab is currently trading at a PS ratio of 8.85x, a bit higher than the average among its peers at 8.54x and nearly twice the Software industry average of 4.76x. However, Simply Wall St's proprietary "Fair Ratio" analysis sets GitLab's Fair PS at 9.72x. Unlike basic peer or industry averages, this Fair Ratio incorporates a tailored mix of factors including projected growth rates, profitability, risk profile, and market capitalization. This provides a more nuanced picture of what the valuation should be.

Given that GitLab’s current PS is just below its Fair Ratio, the stock appears to be modestly undervalued using this approach.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1403 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your GitLab Narrative

Earlier, we mentioned that there is an even better way to understand valuation. Let's introduce you to Narratives. A Narrative is a simple, accessible tool that lets you create your own story and perspective about GitLab. It helps ground your expectations and estimates for future revenue, earnings, and margins in a clear, forward-looking framework rather than just numbers alone.

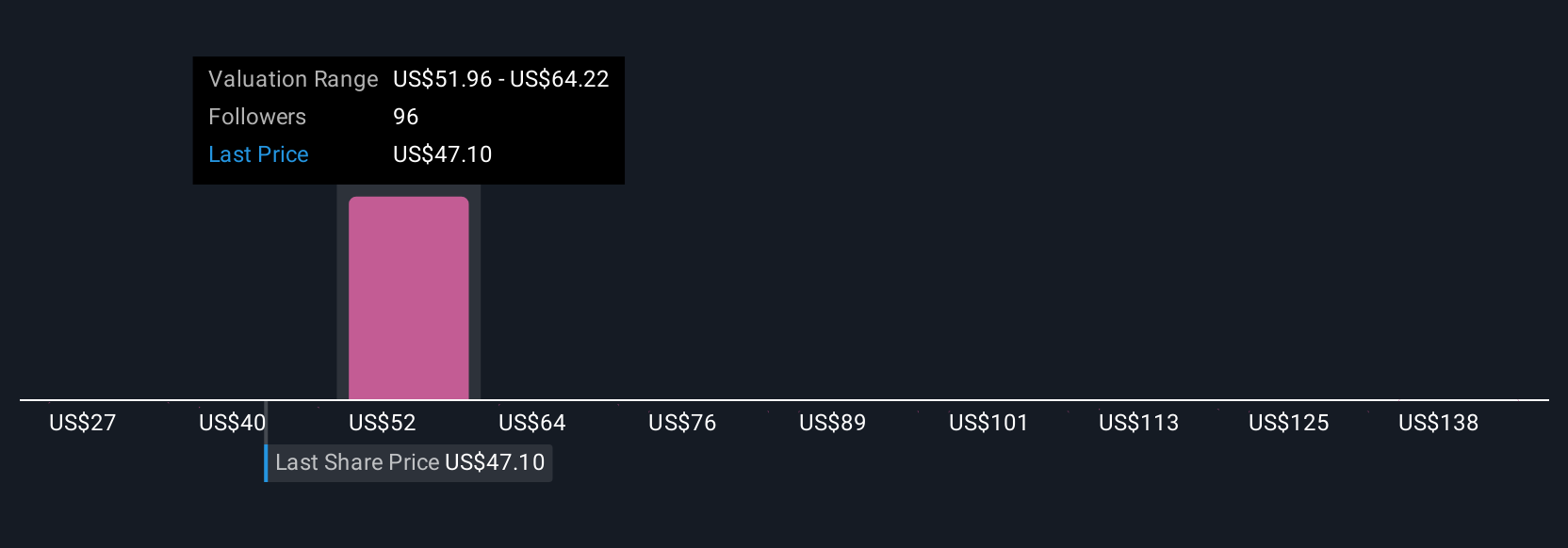

Narratives connect the dots between what a company is doing, your outlook on its growth or risks, and a personalized assessment of its fair value. On Simply Wall St's Community page, millions of investors use Narratives to express their viewpoints, whether they expect GitLab’s AI-driven expansion to propel its share price far higher or remain cautious amid competitive and execution risks.

By comparing your Narrative-based fair value with the current share price, you can make smarter and more informed decisions on when to buy or sell. The best part is that Narratives automatically update with new information, such as earnings or industry news, ensuring your investment thesis stays relevant.

For example, in the GitLab Community, one Narrative projects a bullish price target of $85, banking on rapid AI integration and market share gains. Another sees a fair value as low as $46, reflecting ongoing risks and fierce competition. This range empowers you to test your own assumptions and make decisions grounded in your unique perspective.

Do you think there's more to the story for GitLab? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GTLB

GitLab

Develops software for the software development lifecycle in the United States, Europe, and the Asia Pacific.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

EU#4 - Turning Heritage into the World’s Strongest Luxury Empire

The "Easy Money" Is Gone: Why Alphabet Is Now a "Show Me" Story

Recently Updated Narratives

EU#5 - From Industrial Giant to the Digital Operating System of the Real World

Norwegian Air Shuttle's revenue will grow by 73.56% and profitability will soar

Alphabet - A Fundamental and Historical Valuation

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

The "Sleeping Giant" Stumbles, Then Wakes Up

Trending Discussion

As a gamer, I would not touch this company now. They are hated by the community and have been releasing major flops on their AAA games during the last 5 years (for good reasons). It is true that the valuation is ridiculously low compared to what the licenses are worth, but if the trend continues the value of those will also decline. Management needs to almost make a 180° turnaround to get things right. I agree that a take-private deal before it is too late might be the best option for an investor entering today. We might also see a split sales of the different studios. It is a very risky play, but potentially with high reward.