- United States

- /

- Software

- /

- NasdaqCM:GRRR

Market Might Still Lack Some Conviction On Gorilla Technology Group Inc. (NASDAQ:GRRR) Even After 68% Share Price Boost

Gorilla Technology Group Inc. (NASDAQ:GRRR) shareholders would be excited to see that the share price has had a great month, posting a 68% gain and recovering from prior weakness. But the last month did very little to improve the 88% share price decline over the last year.

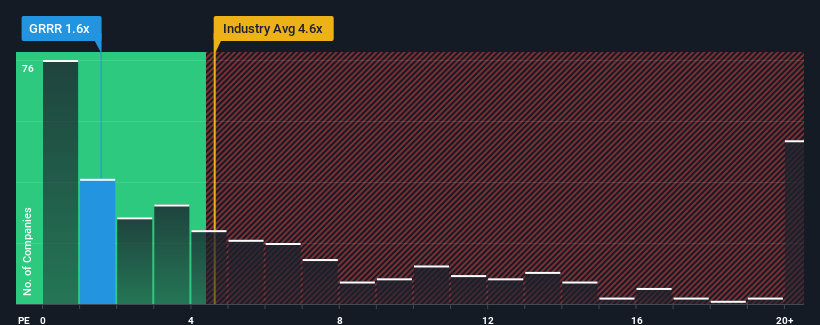

Even after such a large jump in price, Gorilla Technology Group may still look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 1.6x, considering almost half of all companies in the Software industry in the United States have P/S ratios greater than 4.6x and even P/S higher than 12x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

View our latest analysis for Gorilla Technology Group

How Has Gorilla Technology Group Performed Recently?

With revenue growth that's superior to most other companies of late, Gorilla Technology Group has been doing relatively well. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Keen to find out how analysts think Gorilla Technology Group's future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For Gorilla Technology Group?

In order to justify its P/S ratio, Gorilla Technology Group would need to produce anemic growth that's substantially trailing the industry.

Taking a look back first, we see that the company grew revenue by an impressive 31% last year. Still, revenue has fallen 7.8% in total from three years ago, which is quite disappointing. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to climb by 93% during the coming year according to the three analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 15%, which is noticeably less attractive.

With this in consideration, we find it intriguing that Gorilla Technology Group's P/S sits behind most of its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What We Can Learn From Gorilla Technology Group's P/S?

Even after such a strong price move, Gorilla Technology Group's P/S still trails the rest of the industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

A look at Gorilla Technology Group's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

There are also other vital risk factors to consider and we've discovered 5 warning signs for Gorilla Technology Group (2 are potentially serious!) that you should be aware of before investing here.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:GRRR

Gorilla Technology Group

Provides solutions in security, network, business intelligence, and Internet of Things (IoT) technology in Taiwan and the United Kingdom.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Near zero debt, Japan centric focus provides future growth

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.