- United States

- /

- Software

- /

- NasdaqCM:GRRR

Gorilla Technology Group (NasdaqCM:GRRR): Valuation Check as CVR Holders Gain Access to Price Protection Shares

Reviewed by Simply Wall St

Gorilla Technology Group (GRRR) just kicked off a new chapter for its SPAC-era investors by issuing a CVR Payment Notice that lets qualifying CVR holders claim forfeited ordinary shares now reclassified as Price Protection Shares.

See our latest analysis for Gorilla Technology Group.

The CVR announcement lands after a volatile spell for Gorilla, with a 10.8% 1 day share price return and 19.3% 7 day share price return contrasting sharply with a weak year to date share price return. At the same time, the 1 year total shareholder return of 163.0% highlights how powerful the recent rebound has been despite a still deeply negative 3 year total shareholder return.

If this kind of sharp sentiment shift has your attention, it could be a good time to broaden your search and discover fast growing stocks with high insider ownership.

With revenue and earnings surging but the share price still far below analyst targets, the rebound in Gorilla looks dramatic yet incomplete. This raises a key question for investors: Is this a genuine buying opportunity, or is future growth already priced in?

Most Popular Narrative Narrative: 58% Undervalued

With Gorilla Technology Group last closing at $15.49 against a narrative fair value of $36.50, the valuation gap is striking and grounded in aggressive growth assumptions.

Ongoing transition from lumpy, milestone-driven project revenue to predictable, long-term recurring revenue contracts, coupled with an improving product/service mix and normalization of gross margins (targeting 40%), is expected to deliver greater earnings visibility, higher net margins, and steadier cash flows over the next several years.

Curious how a loss making, recently diluted business still lands such a rich upside case? The secret mix involves rapid top line growth, sharp margin expansion, and a future earnings multiple that undercuts typical software peers yet still drives a much higher fair value.

Result: Fair Value of $36.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy dependence on large government contracts and ongoing shareholder dilution from equity raises could quickly undermine the bullish growth narrative.

Find out about the key risks to this Gorilla Technology Group narrative.

Another View: What Sales Multiples Are Saying

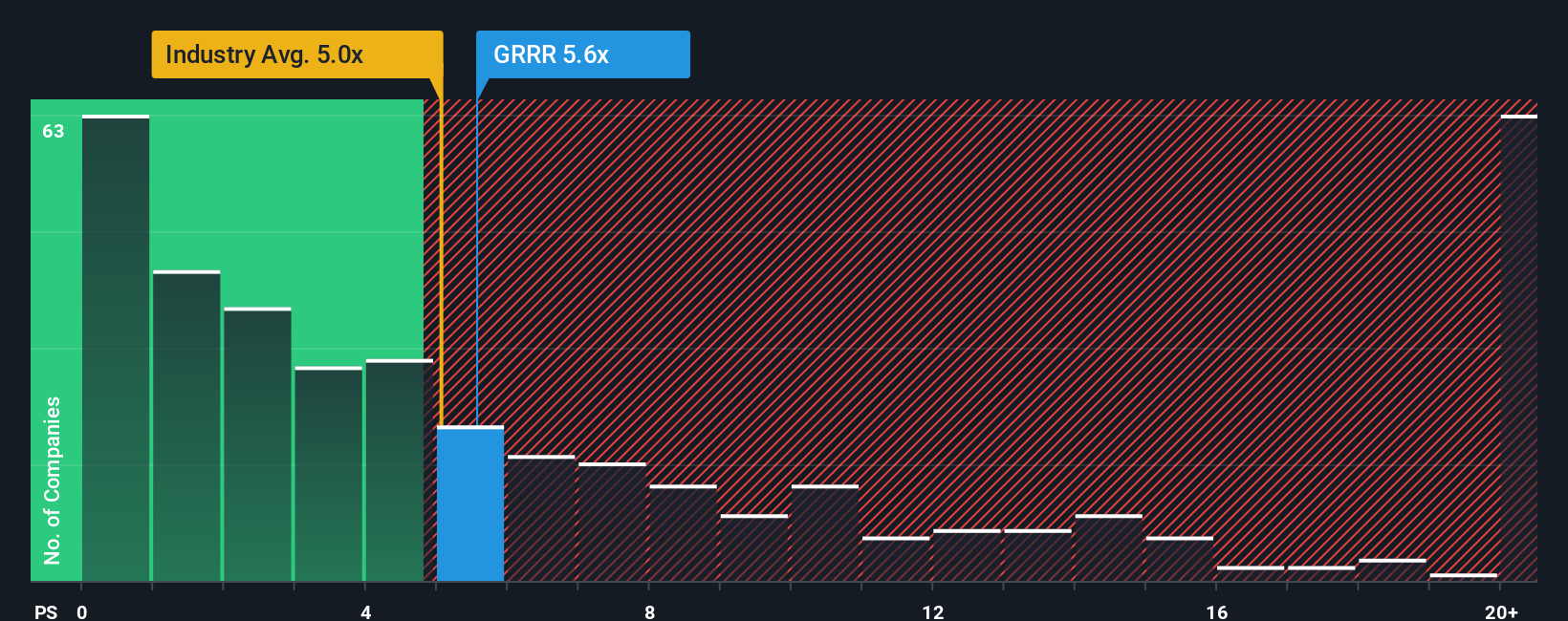

Those bullish fair value estimates sit uneasily beside today’s sales based view. Gorilla trades on 4.5 times sales, only slightly below the US software average of 5 times and just under peers at 4.4 times, while its fair ratio is a higher 5.9 times, hinting at both upside and execution risk.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Gorilla Technology Group Narrative

If you see the story differently or want to test your own assumptions directly against the numbers, you can build a personalized narrative in minutes: Do it your way.

A great starting point for your Gorilla Technology Group research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before Gorilla’s story moves on without you, you may wish to consider your next opportunity now by using focused screeners that surface high conviction ideas most investors overlook.

- Target potential bargains by scanning these 908 undervalued stocks based on cash flows that trade below their cash flow potential and could rerate sharply as the market catches up.

- Explore the AI theme by reviewing these 26 AI penny stocks positioned at the heart of data, automation, and next generation software demand.

- Strengthen your income strategy by pinpointing these 15 dividend stocks with yields > 3% that combine attractive yields with solid underlying fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:GRRR

Gorilla Technology Group

Provides solutions in security, network, business intelligence, and Internet of Things (IoT) technology in Taiwan and the United Kingdom.

High growth potential with adequate balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026