- United States

- /

- Software

- /

- NasdaqCM:GRRR

Gorilla Technology Group (NasdaqCM:GRRR) Climbs 30% In Last Month

Reviewed by Simply Wall St

Gorilla Technology Group (NasdaqCM:GRRR) witnessed a notable price movement with a 30% increase in the past month. This gain contrasts broader market trends, which saw a 2% rise, potentially reflecting specific catalysts unique to the company. While the market was buoyed by positive trade discussions between the U.S. and China and robust tech sector performance, Gorilla's price movement may have also been influenced by internal developments, though specifics weren't provided. Such movements could show investor optimism, possibly due to developments not detailed here but nevertheless impacting investor sentiment favorably.

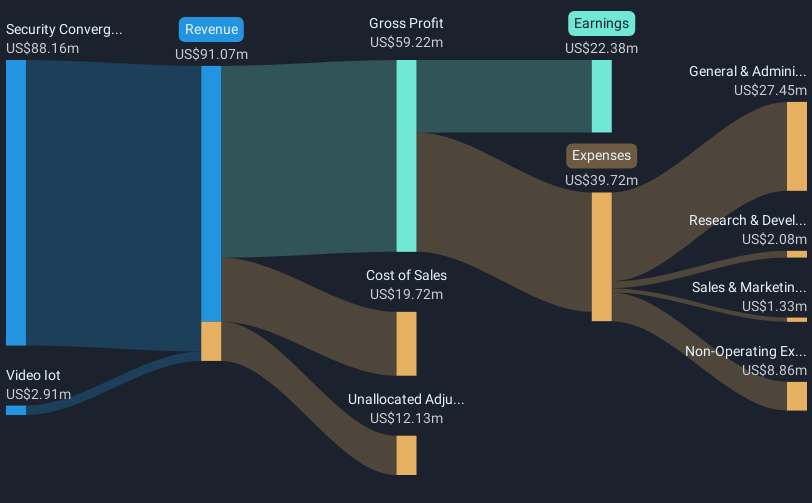

The recent surge in Gorilla Technology Group's share price marks a jarring contrast to broader market trends. While the market saw a modest 2% rise, Gorilla's substantial 244.87% total return over the past year highlights significant investor confidence. This movement, notably driven by potential catalysts for the company, suggests that the market might have picked up on internal developments related to its strategic narrative of global expansion and AI initiatives.

The company's share price evolution reflects not only short-term optimism but also longer-term prospects rooted in significant revenue and earnings potential. With substantial signed contracts and a $4.6 billion project pipeline, the likelihood of increased revenue streams appears strong, despite current earnings standing at a $64.79 million loss. However, such optimism must be balanced with potential geopolitical and economic vulnerabilities, particularly given its revenue reliance on Egypt.

From a valuation perspective, Gorilla's current share price of $17.8 juxtaposes a consensus analyst price target of $31.0, resulting in a 42.6% discount. The recent positive price movement might close this gap if revenue and earnings align with future expectations. Lastly, when examining Gorilla's performance against the US Software industry and market indices, the company's exceptional growth starkly outpaces both, with industry returns at 21.6% and market returns at 11.6% over the past year, suggesting that Gorilla's strategic focus may indeed be yielding results, at least in the eyes of investors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:GRRR

Gorilla Technology Group

Provides solutions in security, network, business intelligence, and Internet of Things (IoT) technology in Taiwan and the United Kingdom.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives