- United States

- /

- Software

- /

- NasdaqGS:GREE

Greenidge Generation Holdings Inc. (NASDAQ:GREE) Third-Quarter Results: Here's What Analysts Are Forecasting For Next Year

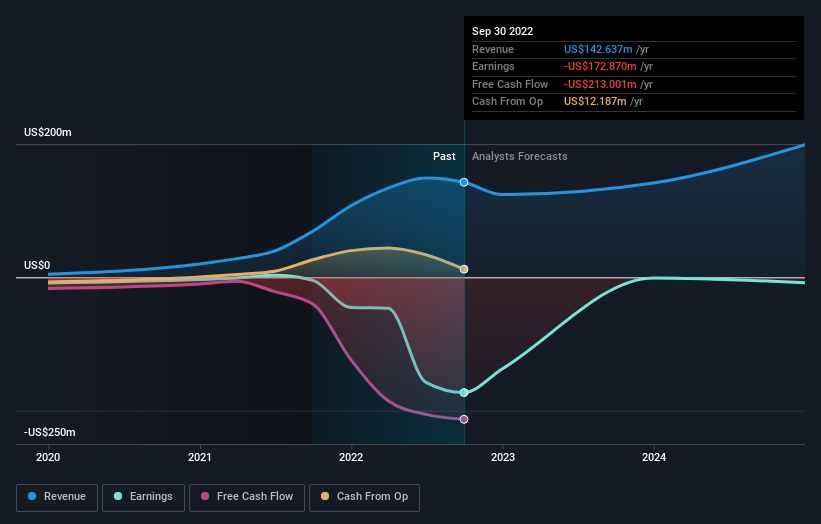

Investors in Greenidge Generation Holdings Inc. (NASDAQ:GREE) had a good week, as its shares rose 6.2% to close at US$0.69 following the release of its third-quarter results. Revenues came in at US$29m, in line with expectations, while statutory losses per share were substantially higher than expected, at US$0.55 per share. The analysts typically update their forecasts at each earnings report, and we can judge from their estimates whether their view of the company has changed or if there are any new concerns to be aware of. So we collected the latest post-earnings statutory consensus estimates to see what could be in store for next year.

View our latest analysis for Greenidge Generation Holdings

Following last week's earnings report, Greenidge Generation Holdings' two analysts are forecasting 2023 revenues to be US$141.5m, approximately in line with the last 12 months. Per-share statutory losses are expected to explode, reaching US$0.02 per share. In the lead-up to this report, the analysts had been modelling revenues of US$145.5m and earnings per share (EPS) of US$0.37 in 2023. The analysts have made an abrupt about-face on Greenidge Generation Holdings, administering a minor downgrade to to revenue forecasts and slashing the earnings outlook from a profit to loss.

There was no major change to the consensus price target of US$4.00, signalling that the business is performing roughly in line with expectations, despite lower earnings per share forecasts.

Taking a look at the bigger picture now, one of the ways we can understand these forecasts is to see how they compare to both past performance and industry growth estimates. We would highlight that sales are expected to reverse, with a forecast 0.7% annualised revenue decline to the end of 2023. That is a notable change from historical growth of 81% over the last three years. By contrast, our data suggests that other companies (with analyst coverage) in the same industry are forecast to see their revenue grow 13% annually for the foreseeable future. It's pretty clear that Greenidge Generation Holdings' revenues are expected to perform substantially worse than the wider industry.

The Bottom Line

The most important thing to take away is that the analysts are expecting Greenidge Generation Holdings to become unprofitable next year. On the negative side, they also downgraded their revenue estimates, and forecasts imply revenues will perform worse than the wider industry. The consensus price target held steady at US$4.00, with the latest estimates not enough to have an impact on their price targets.

Following on from that line of thought, we think that the long-term prospects of the business are much more relevant than next year's earnings. At least one analyst has provided forecasts out to 2024, which can be seen for free on our platform here.

It is also worth noting that we have found 5 warning signs for Greenidge Generation Holdings (2 can't be ignored!) that you need to take into consideration.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:GREE

Greenidge Generation Holdings

Operates as an integrated cryptocurrency datacenter and power generation company.

Medium-low risk and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026