- United States

- /

- Software

- /

- NasdaqGS:GLOO

Gloo Holdings (GLOO) Revenue Surge Deepens Losses, Testing High-Growth Bullish Narratives

Reviewed by Simply Wall St

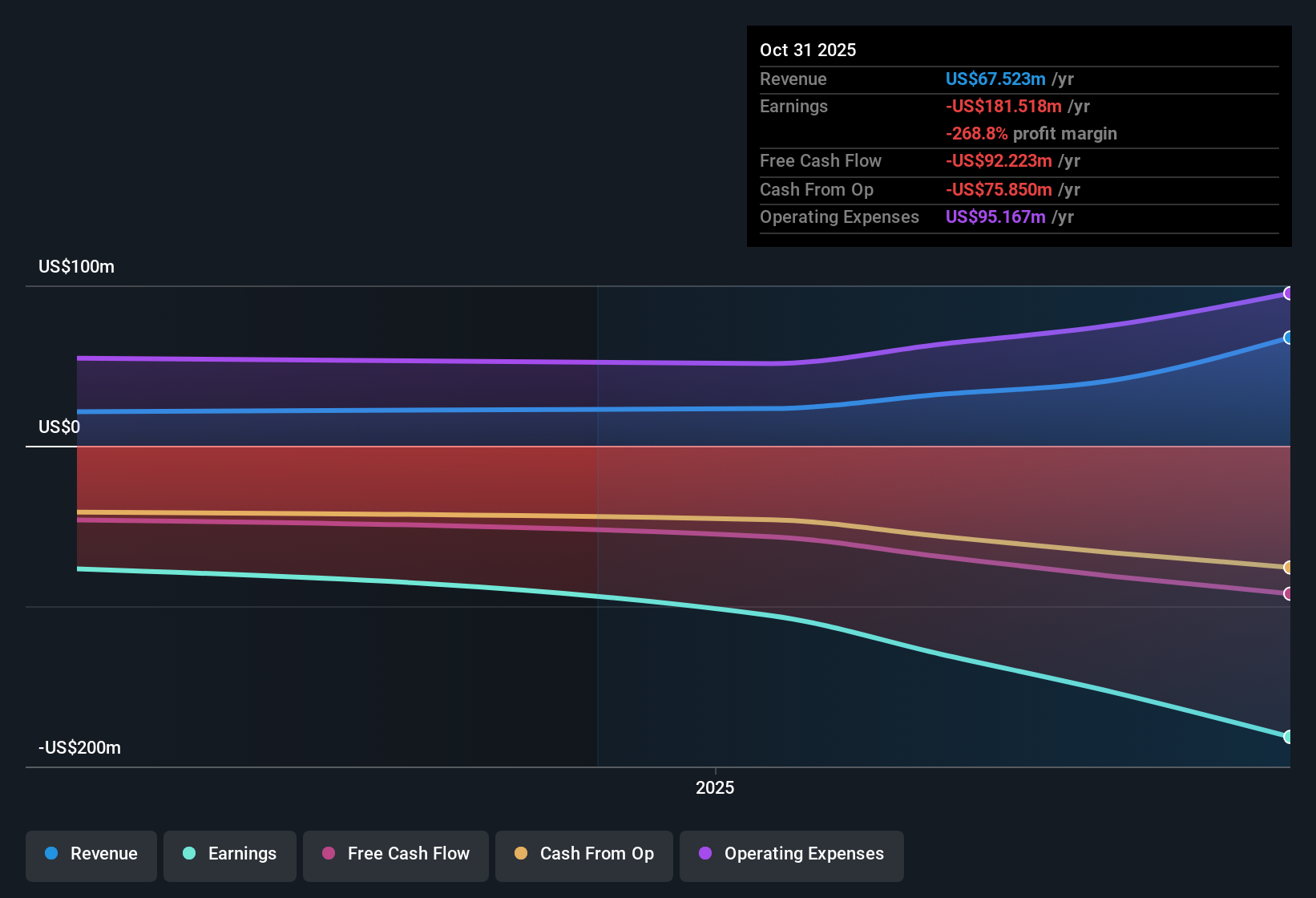

Gloo Holdings (GLOO) just posted its Q3 2026 numbers, with revenue of about $32.6 million, basic EPS of roughly -$4.59, and trailing 12 month revenue sitting near $67.5 million alongside a TTM EPS of about -$7.28. The company has seen quarterly revenue move from roughly $6.1 million in Q3 2025 to $32.6 million in Q3 2026, while quarterly EPS went from around -$1.75 to -$4.59. This sets the stage for a growth heavy story that still comes with meaningfully negative margins for shareholders to consider.

See our full analysis for Gloo Holdings.With the headline numbers on the table, the next step is to line them up against the most talked about narratives around Gloo, to see which stories the latest margins support and which ones they start to undercut.

Curious how numbers become stories that shape markets? Explore Community Narratives

197 percent revenue surge, losses still deepen

- Trailing 12 month revenue reached about $67.5 million, up from roughly $23.2 million a year earlier, while trailing net loss widened from about $106 million to around $172.7 million over the same period.

- What stands out for the bullish case that focuses on high growth is that revenue expanded about 197 percent year over year, yet net income stayed deeply negative at roughly negative $38 million in Q3 2026, so the growth story is strong but it has not translated into any visible margin improvement so far.

- Supporters pointing to forecast earnings growth of about 80 percent per year and a path to profitability within three years must weigh that against the steadily more negative trailing EPS, which moved from about negative $3.37 to roughly negative $7.28 over the last two years.

- This tension between rapid top line expansion and persistently large losses is exactly where future quarters will need to show whether scale can realistically carry the business toward the projected profitability timeline.

Rich 7.4x sales multiple despite ongoing losses

- Gloo trades at a price to sales multiple of about 7.4 times, compared with roughly 1.6 times for peers and around 4.9 times for the broader US software industry, even though trailing 12 month net income remains near negative $172.7 million.

- Critics who highlight valuation risk argue that paying a premium multiple over peers looks demanding while the company is still unprofitable, and the latest figures do show that despite TTM revenue of about $67.5 million, EPS over that period is approximately negative $7.28, so the market is valuing the stock well ahead of current profitability.

- The bearish narrative that the stock is expensive versus peers is numerically backed by the 7.4 times sales tag against a 1.6 times peer average, even though the shares trade below a DCF fair value of roughly $11.58.

- That combination, premium sales multiple but discounted versus DCF, means bears can still point directly to the gap between heavy current losses and the robust growth assumptions baked into long term valuation models.

Balance sheet strain and thin liquidity

- The latest analysis flags negative shareholders equity, less than one year of cash runway, and highly illiquid shares as key risks on top of the roughly $172.7 million trailing net loss.

- Skeptics focusing on financial stability see these balance sheet pressures as central to their cautious stance, since ongoing losses of tens of millions per quarter combined with under a year of cash coverage and thin trading volume concentrate attention on how management will fund the forecast growth and eventual profitability.

- The concern that funding needs could arise before profitability is reached is grounded in the trailing basic EPS of roughly negative $7.28 and the continued quarterly net losses, which together signal that internal cash generation is not yet supporting the scale up.

- With shares described as highly illiquid, any future capital raise or swing in sentiment could have an outsized impact on the stock price relative to larger, more liquid software names that carry similar growth ambitions but less pronounced balance sheet risk.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Gloo Holdings's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Gloo combines rapid top line expansion with deepening losses, high valuation multiples, negative equity and a thin cash runway, leaving financial resilience in question.

If those fragilities concern you, use our solid balance sheet and fundamentals stocks screener (1943 results) to quickly focus on companies built on stronger finances, healthier liquidity and balance sheets better suited to weather uncertainty.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GLOO

Gloo Holdings

Designs and develops a vertical technology platform for the faith and flourishing ecosystem.

High growth potential with low risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion