- United States

- /

- IT

- /

- NasdaqCM:GDYN

Shareholders in Grid Dynamics Holdings (NASDAQ:GDYN) have lost 61%, as stock drops 8.6% this past week

If you are building a properly diversified stock portfolio, the chances are some of your picks will perform badly. But long term Grid Dynamics Holdings, Inc. (NASDAQ:GDYN) shareholders have had a particularly rough ride in the last three year. Sadly for them, the share price is down 61% in that time. And the ride hasn't got any smoother in recent times over the last year, with the price 47% lower in that time. Furthermore, it's down 38% in about a quarter. That's not much fun for holders.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During five years of share price growth, Grid Dynamics Holdings moved from a loss to profitability. That would generally be considered a positive, so we are surprised to see the share price is down. So given the share price is down it's worth checking some other metrics too.

Revenue is actually up 8.5% over the three years, so the share price drop doesn't seem to hinge on revenue, either. It's probably worth investigating Grid Dynamics Holdings further; while we may be missing something on this analysis, there might also be an opportunity.

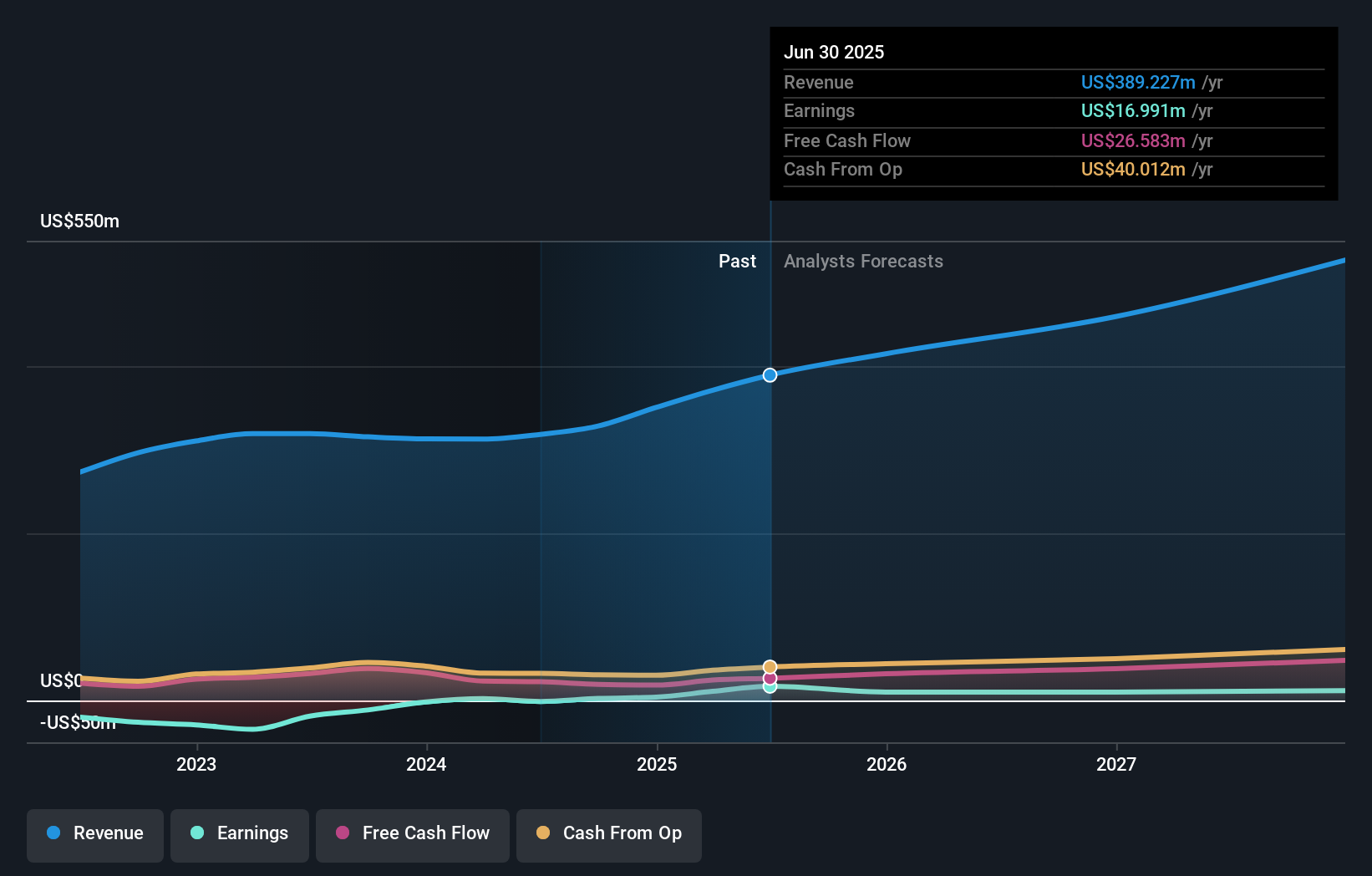

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

It is of course excellent to see how Grid Dynamics Holdings has grown profits over the years, but the future is more important for shareholders. If you are thinking of buying or selling Grid Dynamics Holdings stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

Grid Dynamics Holdings shareholders are down 47% for the year, but the market itself is up 21%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 0.7% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Grid Dynamics Holdings has 2 warning signs (and 1 which is concerning) we think you should know about.

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:GDYN

Grid Dynamics Holdings

Provides technology consulting, platform and product engineering, and analytics services in North America, Europe, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026