- United States

- /

- IT

- /

- NasdaqGM:GDS

How Investors May Respond To GDS Holdings (GDS) $1.2B Equity Raise and Shanghai C-REIT IPO

Reviewed by Sasha Jovanovic

- GDS Holdings recently completed a US$1.2 billion Series B equity raise, led by major investors including SoftBank Vision Fund and Kenneth Griffin, and marked a key milestone with the successful IPO of its C-REIT on the Shanghai Stock Exchange.

- These moves have bolstered the company's financial resources for expansion and attracted constructive analyst commentary about its positioning in China’s data center market.

- We'll now explore how the sizeable equity raise may impact GDS Holdings' investment narrative and future growth outlook.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

GDS Holdings Investment Narrative Recap

To own shares in GDS Holdings, you need confidence that demand for advanced data center infrastructure in China and Asia will outpace the company’s persistent challenges with high leverage and modest profitability. The recent US$1.2 billion Series B equity raise supplies crucial growth capital, yet does not meaningfully ease the short-term risk tied to GDS’s elevated debt levels, which remain the biggest near-term concern as the company doubles down on expansion even while deleveraging is delayed.

Among recent announcements, GDS’s successful IPO of a data center C-REIT stands out as particularly relevant, as it illustrates the company’s ability to recycle capital and fund new growth while potentially improving its balance sheet. This C-REIT transaction, alongside the new equity raise, gives GDS more flexibility to invest in AI-ready capacity, an area analysts cite as a key revenue catalyst as the chip supply picture in China continues to improve.

However, it is important for investors to consider that, despite the fresh capital, GDS's reliance on frequent asset sales and high leverage means the risk of refinancing or earnings pressure has not disappeared...

Read the full narrative on GDS Holdings (it's free!)

GDS Holdings' narrative projects CN¥16.2 billion revenue and CN¥734.2 million earnings by 2028. This requires 14.1% yearly revenue growth and an increase in earnings of CN¥457 million from the current CN¥277.2 million.

Uncover how GDS Holdings' forecasts yield a $47.44 fair value, a 20% upside to its current price.

Exploring Other Perspectives

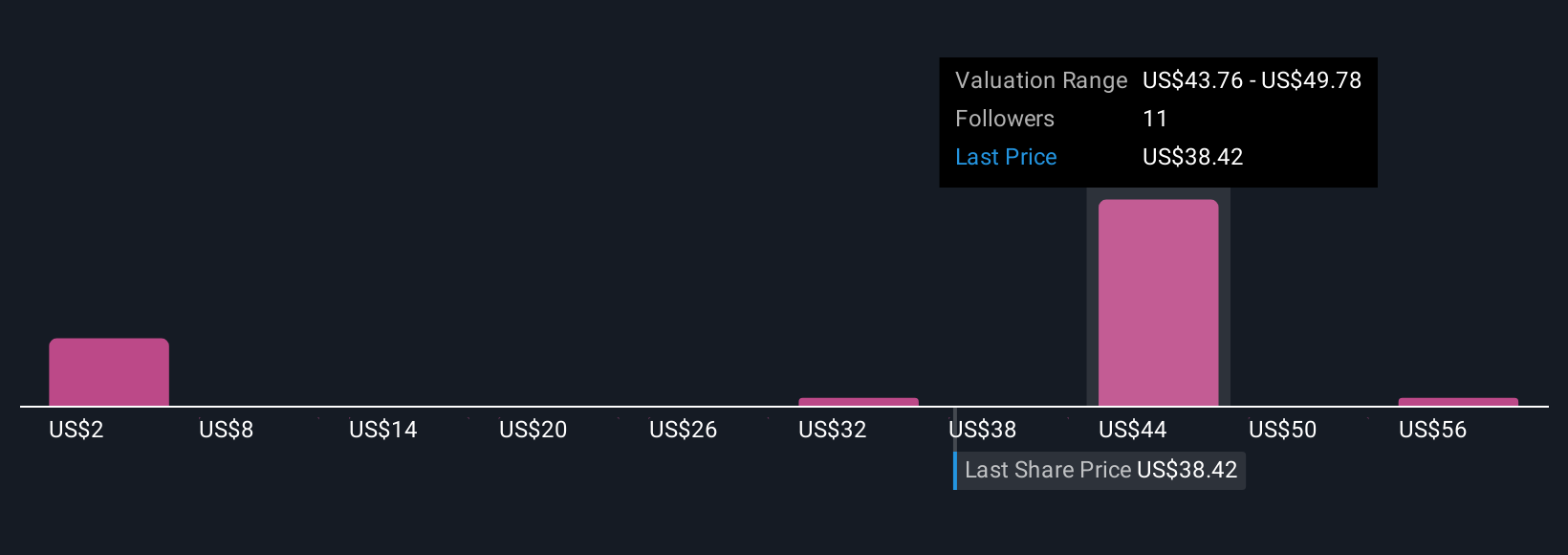

Simply Wall St Community fair value estimates for GDS Holdings range from just US$1.60 to US$61.83 across five analyses. With ongoing high leverage still in focus, this wide spectrum highlights that market participants see both significant promise and risk in the company's outlook.

Explore 5 other fair value estimates on GDS Holdings - why the stock might be worth as much as 56% more than the current price!

Build Your Own GDS Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your GDS Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free GDS Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate GDS Holdings' overall financial health at a glance.

No Opportunity In GDS Holdings?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:GDS

GDS Holdings

Develops and operates data centers in the People's Republic of China.

Moderate growth potential with questionable track record.

Similar Companies

Market Insights

Community Narratives