- United States

- /

- IT

- /

- NasdaqGM:GDS

GDS Holdings (NasdaqGM:GDS): Evaluating Valuation as AI Partnerships and Cloud Growth Spark Investor Optimism

Reviewed by Simply Wall St

If you’re watching GDS Holdings (NasdaqGM:GDS) after this week’s headlines, you’re not alone. The company’s stock has been energized by a wave of optimism, as China’s accelerating adoption of AI and surging demand for cloud capacity have vaulted data center operators like GDS into the spotlight. Fresh partnerships with industry giants, most notably Alibaba’s push to upgrade its cloud infrastructure, and GDS’s solid revenue guidance for 2025 have gotten investors paying close attention to what comes next.

Zooming out, this attention comes after a big run-up in share price over the past year, with momentum picking up sharply in the last quarter on the back of strong Q2 results and merger rumors. GDS managed to shrink its net loss while booking higher revenues. Alongside the AI boom and major customer moves, this has fueled a sense of renewed confidence in the stock. Sentiment around GDS has shifted, even as ongoing risks like leverage and margin pressures remain part of the conversation.

After this year’s impressive spike, is GDS Holdings priced for perfection, or is there still room for upside if growth surprises to the upside?

Most Popular Narrative: 19.5% Undervalued

The most widely watched narrative sees GDS Holdings as undervalued, with a fair value estimate nearly 20% above the current share price. Analysts highlight structural tailwinds and unique capital strategies as catalysts for continued growth.

The successful implementation of China's first data center ABS and C-REIT IPOs has pioneered a pathway for GDS to repeatedly recycle capital at cap rates and multiples well above the company's own market valuation. This allows the company to fund new growth while improving leverage and enhancing ROIC, supporting stronger net earnings over time.

What makes this optimistic valuation so compelling? There are bold expectations around growth in some eye-popping financial metrics and the possible payoff from embracing new business models. Curious what assumptions are driving this price target, and if a bet on GDS could mean catching the next major inflection point? The details behind these bullish projections may surprise you.

Result: Fair Value of $47.44 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent margin pressure and ongoing reliance on asset sales could weigh on GDS’s future growth. This may challenge the case for sustained outperformance.

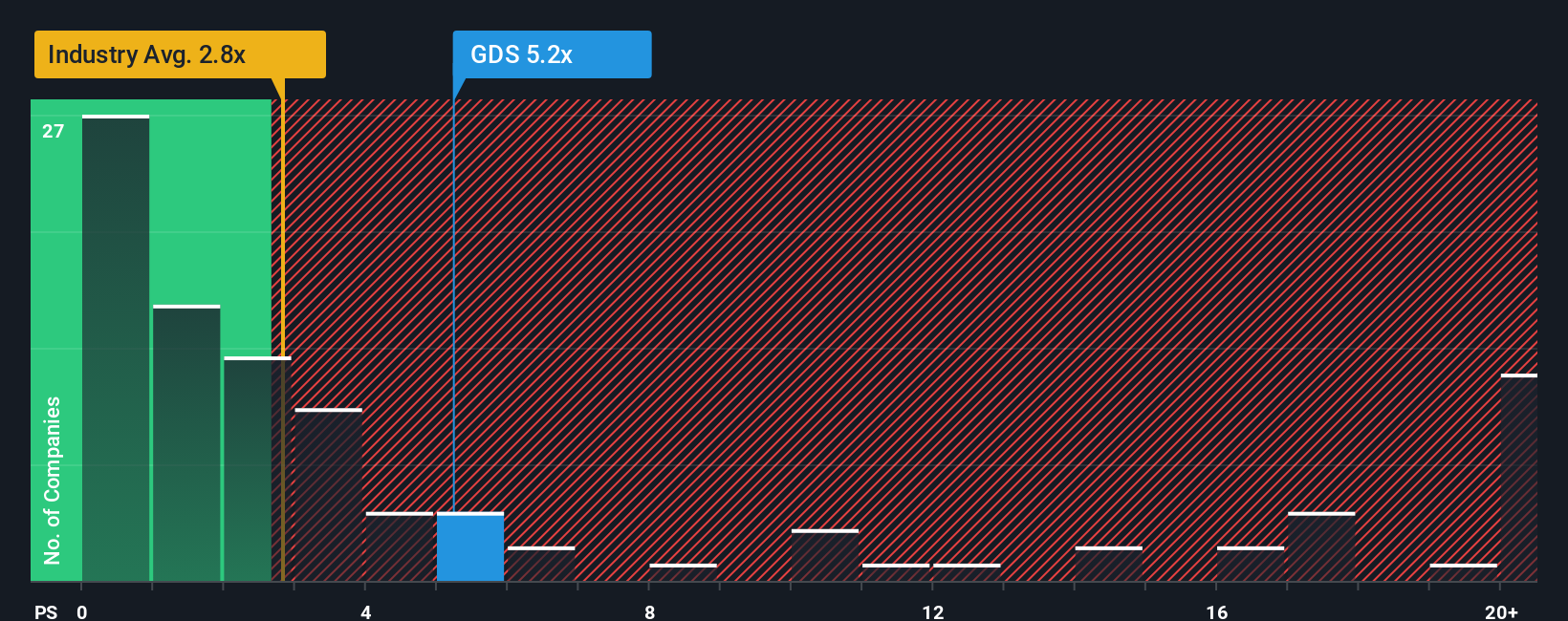

Find out about the key risks to this GDS Holdings narrative.Another View: Is GDS Expensive by Sales?

A second approach looks at how GDS is valued next to its industry based on sales. According to this measure, the stock appears expensive relative to sector standards. Does this challenge the bullish narrative, or is growth the key consideration?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding GDS Holdings to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own GDS Holdings Narrative

If you have a different perspective or want to dig into the numbers firsthand, it's easy to shape your own outlook in just a few minutes. Do it your way.

A great starting point for your GDS Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t miss out on some of the market’s most exciting trends and opportunities. Supercharge your investment research with these tailored stock lists and uncover ideas that could power your next winning move.

- Accelerate your portfolio growth by targeting emerging leaders in artificial intelligence with AI penny stocks, a selection of companies set to shape tomorrow’s tech landscape.

- Cushion your investments with reliable income by seeking out dividend stocks with yields > 3%, companies that consistently pay attractive yields above 3%.

- Get ahead of the curve by hunting for undervalued gems among undervalued stocks based on cash flows, which are identified based on their strong cash flows and potential for future upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:GDS

GDS Holdings

Develops and operates data centers in the People's Republic of China.

Moderate growth potential with questionable track record.

Similar Companies

Market Insights

Community Narratives