- United States

- /

- Diversified Financial

- /

- NasdaqCM:RVYL

GreenBox POS' (NASDAQ:GBOX) growing losses don't faze investors as the stock rallies 28% this past week

It might be of some concern to shareholders to see the GreenBox POS (NASDAQ:GBOX) share price down 28% in the last month. But that doesn't undermine the rather lovely longer-term return, if you measure over the last three years. In fact, the share price is up a full 264% compared to three years ago. To some, the recent share price pullback wouldn't be surprising after such a good run. The fundamental business performance will ultimately dictate whether the top is in, or if this is a stellar buying opportunity.

After a strong gain in the past week, it's worth seeing if longer term returns have been driven by improving fundamentals.

See our latest analysis for GreenBox POS

GreenBox POS isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last 3 years GreenBox POS saw its revenue grow at 49% per year. That's much better than most loss-making companies. Along the way, the share price gained 54% per year, a solid pop by our standards. But it does seem like the market is paying attention to strong revenue growth. Nonetheless, we'd say GreenBox POS is still worth investigating - successful businesses can often keep growing for long periods.

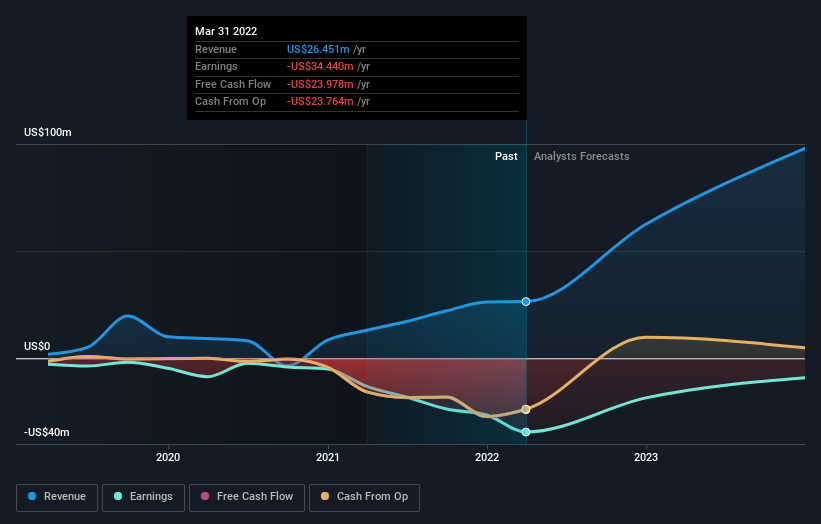

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. So it makes a lot of sense to check out what analysts think GreenBox POS will earn in the future (free profit forecasts).

A Different Perspective

The last twelve months weren't great for GreenBox POS shares, which performed worse than the market, costing holders 76%. The market shed around 10%, no doubt weighing on the stock price. Fortunately the longer term story is brighter, with total returns averaging about 54% per year over three years. The recent sell-off could be an opportunity if the business remains sound, so it may be worth checking the fundamental data for signs of a long-term growth trend. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with GreenBox POS (at least 1 which is potentially serious) , and understanding them should be part of your investment process.

We will like GreenBox POS better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:RVYL

Ryvyl

A financial technology company, develops software platforms and tools that focuses on providing payment acceptance and disbursement capabilities in North America, Europe, and Asia.

Moderate risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026