- United States

- /

- Biotech

- /

- NasdaqGS:APLS

Exploring 3 High Growth Tech Stocks In The United States

Reviewed by Simply Wall St

Over the last 7 days, the United States market has experienced a 2.8% drop, yet it remains up by 24% over the past year with earnings forecasted to grow by 15% annually. In this context of fluctuating performance and promising growth prospects, identifying high growth tech stocks involves looking for companies that demonstrate strong innovation and adaptability in an evolving technological landscape.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 24.13% | 24.28% | ★★★★★★ |

| Ardelyx | 22.86% | 54.70% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Clene | 61.16% | 59.11% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.24% | 56.34% | ★★★★★★ |

| TG Therapeutics | 30.06% | 45.28% | ★★★★★★ |

| Blueprint Medicines | 22.63% | 55.38% | ★★★★★★ |

| Travere Therapeutics | 28.68% | 62.50% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 235 stocks from our US High Growth Tech and AI Stocks screener.

Let's review some notable picks from our screened stocks.

BitFuFu (NasdaqCM:FUFU)

Simply Wall St Growth Rating: ★★★★★☆

Overview: BitFuFu Inc. is a company based in Singapore that specializes in digital asset mining and cloud-mining services, with a market capitalization of approximately $806.37 million.

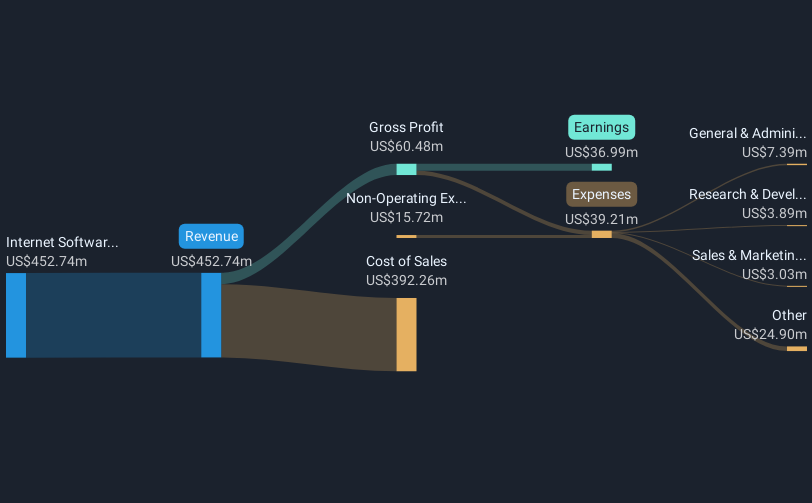

Operations: BitFuFu Inc. generates revenue primarily from its Internet Software & Services segment, amounting to $452.74 million. The company's focus on digital asset mining and cloud-mining services positions it within the tech-driven financial sector in Singapore.

BitFuFu stands out in the high-growth tech landscape, particularly through its aggressive earnings growth and strategic R&D investments. Over the past year, BitFuFu's earnings skyrocketed by 1119.2%, significantly outpacing the software industry's growth of 27.6%. This surge is backed by a robust forecast indicating an expected annual profit increase of 51%, dwarfing the US market average of 14.9%. Moreover, BitFuFu is enhancing user engagement and broadening its revenue streams as evidenced by recent upgrades to its digital platforms and introduction of flexible payment options in multiple digital currencies. These developments not only highlight BitFuFu’s commitment to innovation but also position it to capitalize on evolving market demands effectively.

Iovance Biotherapeutics (NasdaqGM:IOVA)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Iovance Biotherapeutics, Inc. is a commercial-stage biotechnology company focused on developing and commercializing cell therapies for metastatic melanoma and other solid tumor cancers in the United States, with a market cap of approximately $2.26 billion.

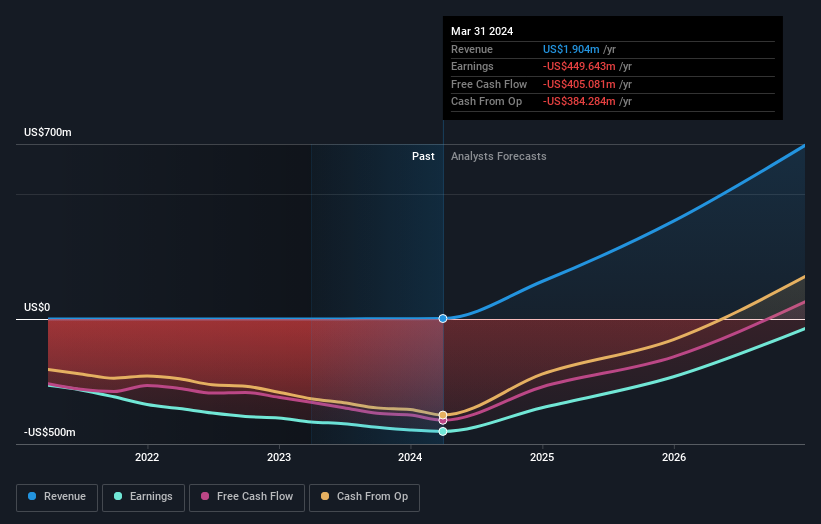

Operations: Iovance Biotherapeutics focuses on the development and commercialization of cell therapies, specifically utilizing autologous tumor infiltrating lymphocytes (TIL), generating $90.86 million in revenue from these activities.

Iovance Biotherapeutics is capturing attention with its robust pipeline and strategic leadership enhancements. Recently, the company reported a significant revenue jump to $58.56 million for Q3 2024 from just $0.469 million in the same quarter last year, reflecting an aggressive expansion trajectory. Furthermore, Iovance is poised for profitability within three years, with earnings expected to grow by 59.17% annually. The appointment of Dr. Raj Puri as Chief Regulatory Officer underscores their commitment to navigating complex regulatory landscapes effectively, potentially accelerating product approvals and market entry. This strategic positioning could significantly influence Iovance's role in biotech's competitive arena, particularly in innovative cancer treatments.

- Navigate through the intricacies of Iovance Biotherapeutics with our comprehensive health report here.

Evaluate Iovance Biotherapeutics' historical performance by accessing our past performance report.

Apellis Pharmaceuticals (NasdaqGS:APLS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Apellis Pharmaceuticals, Inc. is a commercial-stage biopharmaceutical company dedicated to discovering, developing, and commercializing therapeutic compounds that inhibit the complement system for treating autoimmune and inflammatory diseases, with a market cap of $3.97 billion.

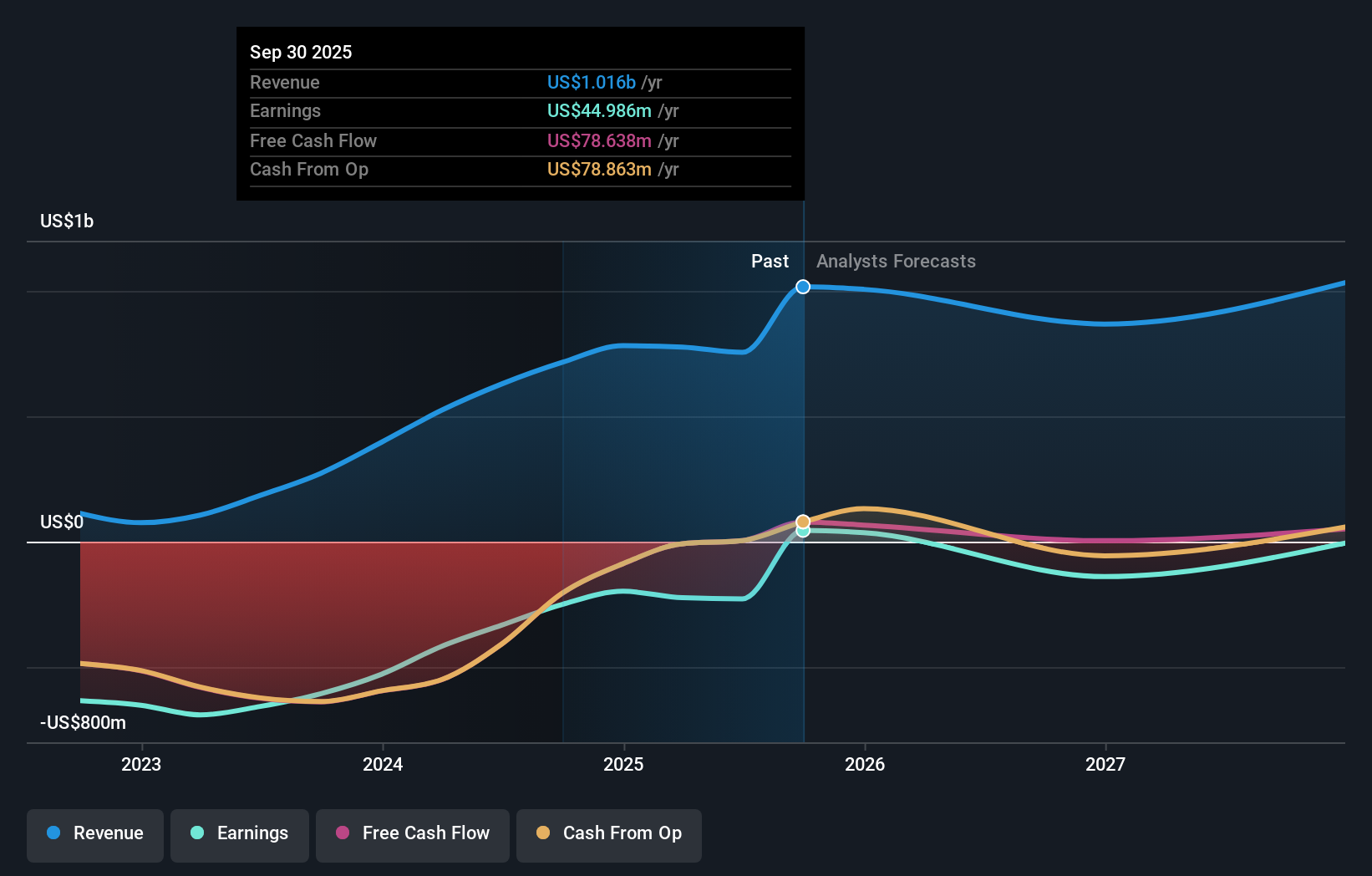

Operations: Apellis focuses on developing and commercializing proprietary therapeutics, generating revenue of $715.22 million through these activities.

Apellis Pharmaceuticals is navigating a transformative phase with promising clinical advancements and strategic presentations, signaling robust growth potential. In recent earnings, the company reported a significant revenue increase to $196.83 million in Q3 2024 from $110.4 million the previous year, alongside reducing its net loss substantially to $57.45 million from $140.24 million, reflecting effective management and operational efficiency. Highlighting its innovation in rare disease treatments, Apellis presented compelling data at multiple conferences, notably showing a 68% reduction in proteinuria with pegcetacoplan treatment during the ASN Kidney Week—a key indicator of its potential market impact in nephrology. These developments are pivotal as Apellis strides towards profitability forecasted within three years with an expected annual earnings growth of 59.79%.

- Take a closer look at Apellis Pharmaceuticals' potential here in our health report.

Assess Apellis Pharmaceuticals' past performance with our detailed historical performance reports.

Summing It All Up

- Take a closer look at our US High Growth Tech and AI Stocks list of 235 companies by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:APLS

Apellis Pharmaceuticals

A commercial-stage biopharmaceutical company, focuses on the discovery, development, and commercialization of therapeutic compounds through the inhibition of the complement system for autoimmune and inflammatory diseases.

Good value with reasonable growth potential.

Market Insights

Community Narratives