- United States

- /

- Software

- /

- NasdaqGS:FTNT

Will Fortinet’s (FTNT) Quantum-Safe Push Reinforce Its Long-Term Cybersecurity Leadership?

Reviewed by Simply Wall St

- In late July 2025, Fortinet announced expanded innovations in its FortiOS platform to bolster protection against quantum-computing threats, incorporating quantum-safe encryption, hybrid key management, and a streamlined interface for administrators managing sensitive information.

- This move underscores Fortinet's continued emphasis on future-proofing its security solutions, particularly for organizations requiring advanced protection against emerging cyber risks from quantum computing.

- We'll explore how the integration of quantum-safe encryption capabilities could influence confidence in Fortinet's long-term cybersecurity growth narrative.

We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Fortinet Investment Narrative Recap

To hold Fortinet stock, an investor needs to believe in the company’s ability to continually innovate and expand its cybersecurity offerings while executing on near-term catalysts such as customer upsell from hardware refresh cycles and cross-selling SASE solutions. The recent announcement of quantum-safe encryption within FortiOS further strengthens Fortinet’s long-term security narrative, but its impact on immediate hardware upgrade sales and customer retention appears minor compared to ongoing challenges with cross-selling and regulatory headwinds.

Among recent announcements, the launch of the FortiGate 700G series is especially relevant. Like the quantum-safe updates in FortiOS, this next-generation firewall, which is also designed for emerging cryptographic standards, reflects consistent product innovation that supports Fortinet’s core adaptive security and upgrade cycle catalysts.

But while these advances push the business forward, investors still need to be mindful of the execution risks embedded in Fortinet’s ambitious Unified SASE transition, as...

Read the full narrative on Fortinet (it's free!)

Fortinet's narrative projects $9.0 billion in revenue and $2.3 billion in earnings by 2028. This requires 13.6% yearly revenue growth and a $0.4 billion increase in earnings from the current $1.9 billion.

Uncover how Fortinet's forecasts yield a $109.88 fair value, a 11% upside to its current price.

Exploring Other Perspectives

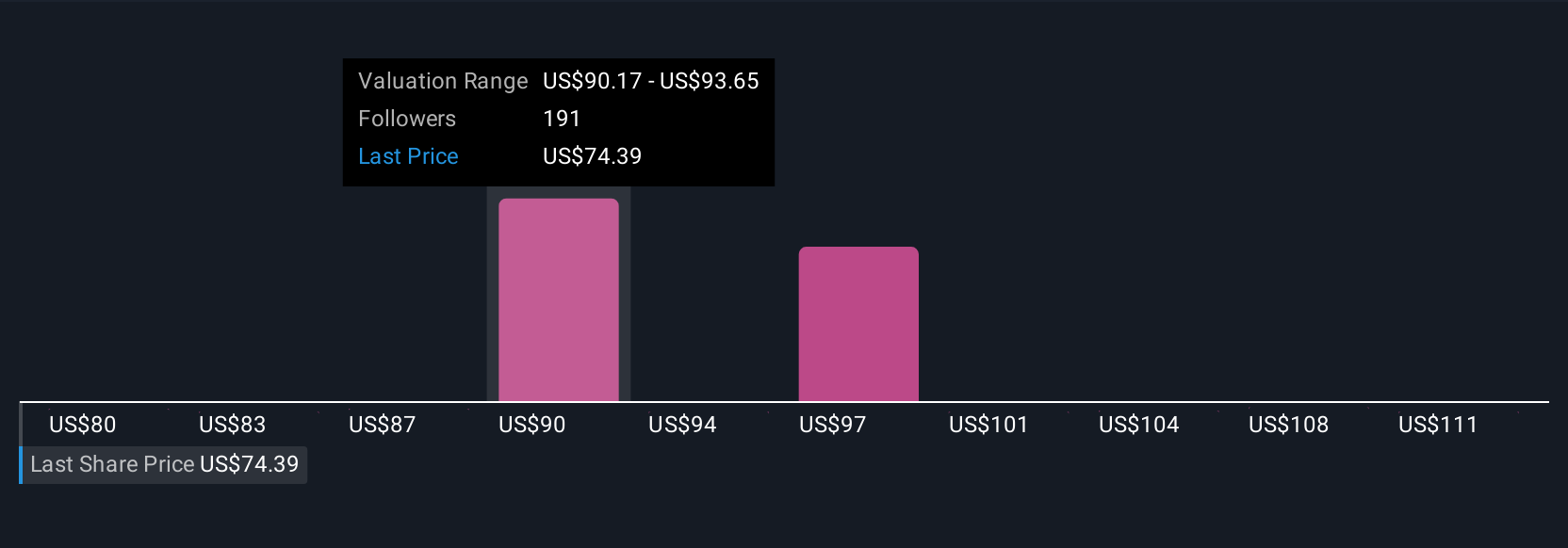

Twenty-one members of the Simply Wall St Community estimate Fortinet’s fair value between US$79.73 and US$116.43 per share. With quantum-safe encryption updates reinforcing Fortinet’s security value proposition, you can compare multiple opinions to see how views on growth and risk widely differ.

Explore 21 other fair value estimates on Fortinet - why the stock might be worth as much as 18% more than the current price!

Build Your Own Fortinet Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Fortinet research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Fortinet research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Fortinet's overall financial health at a glance.

Looking For Alternative Opportunities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Rare earth metals are the new gold rush. Find out which 25 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FTNT

Fortinet

Provides cybersecurity and convergence of networking and security solutions worldwide.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives