- United States

- /

- Software

- /

- NasdaqGS:FTNT

Is Increased Legal Scrutiny Reshaping the Investment Narrative for Fortinet (FTNT)?

Reviewed by Sasha Jovanovic

- In the past week, multiple law firms announced class action lawsuits against Fortinet, alleging the company overstated its business performance and misrepresented the progress of its FortiGate firewall refresh cycle between November 2024 and August 2025.

- The news comes as Fortinet is also collaborating with Crime Stoppers International on a global Cybercrime Bounty program, further highlighting the company's public-private partnerships in the cybersecurity sector.

- We’ll explore how these legal developments may impact Fortinet’s investment narrative, especially amid heightened scrutiny of its financial disclosures.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Fortinet Investment Narrative Recap

Owning Fortinet means believing in the need for scalable cybersecurity solutions amid ongoing digital transformation and threats. The recent class action lawsuits alleging misrepresentation of FortiGate upgrade momentum introduce headline risk, but at this stage do not appear to alter the most important near-term catalyst: continued hardware firewall refreshes that support revenue growth. However, if legal scrutiny impacts customer confidence or financial disclosures, that could become more meaningful to the business’s outlook.

Among recent company announcements, Fortinet’s launch of the global Cybercrime Bounty program with Crime Stoppers International stands out. This initiative aligns with Fortinet’s multi-sector partnership approach, enhancing its credibility and positioning as a cybersecurity leader, a supporting factor for confidence in upgrade cycles and wider platform adoption.

Yet, it is important to remember that while the refresh cycle is providing a near-term boost, there is ongoing uncertainty around the pace of...

Read the full narrative on Fortinet (it's free!)

Fortinet's narrative projects $9.2 billion revenue and $2.4 billion earnings by 2028. This requires 13.1% yearly revenue growth and a $0.5 billion earnings increase from $1.9 billion.

Uncover how Fortinet's forecasts yield a $87.45 fair value, a 10% upside to its current price.

Exploring Other Perspectives

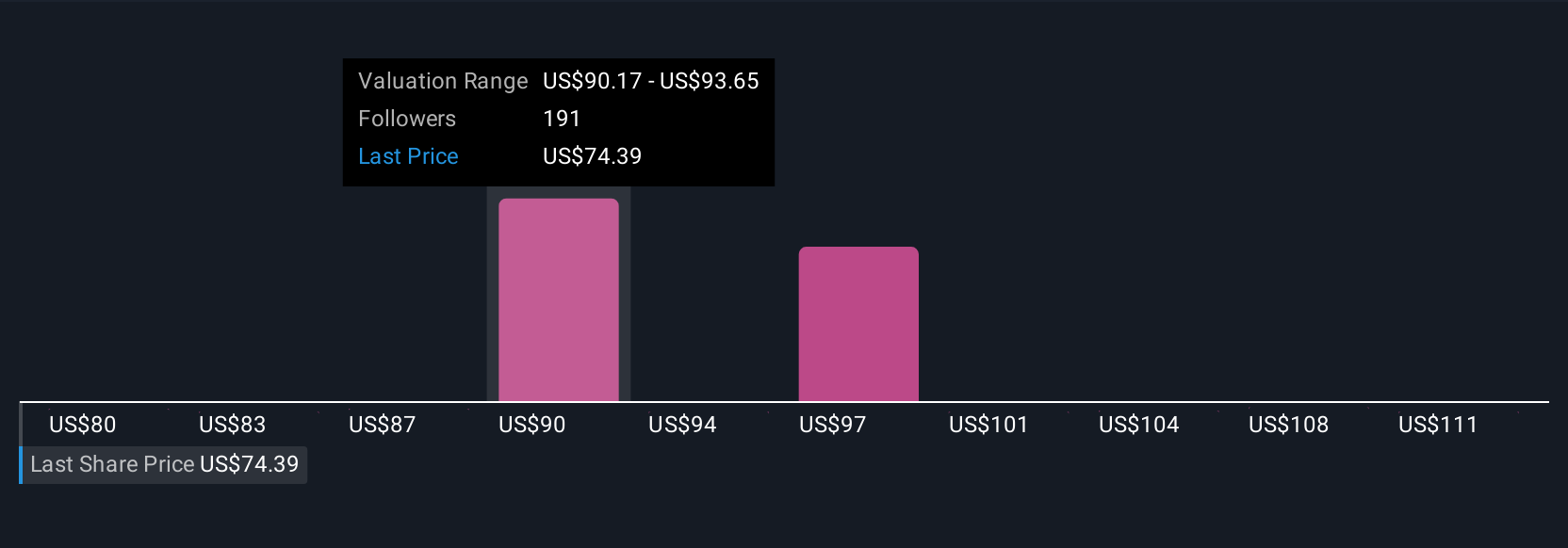

Twenty-five fair value estimates from the Simply Wall St Community range between US$82.99 and US$110.39 per share. While the community sees upside potential, recent legal actions highlight the importance of scrutinizing financial disclosures and business momentum, offering several viewpoints for you to weigh.

Explore 25 other fair value estimates on Fortinet - why the stock might be worth just $82.99!

Build Your Own Fortinet Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Fortinet research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Fortinet research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Fortinet's overall financial health at a glance.

Want Some Alternatives?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FTNT

Fortinet

Provides cybersecurity and convergence of networking and security solutions worldwide.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success