- United States

- /

- Software

- /

- NasdaqGS:FTNT

Is Fortinet Fairly Priced After Recent Strategic Partnerships and Modest Stock Gains?

Reviewed by Bailey Pemberton

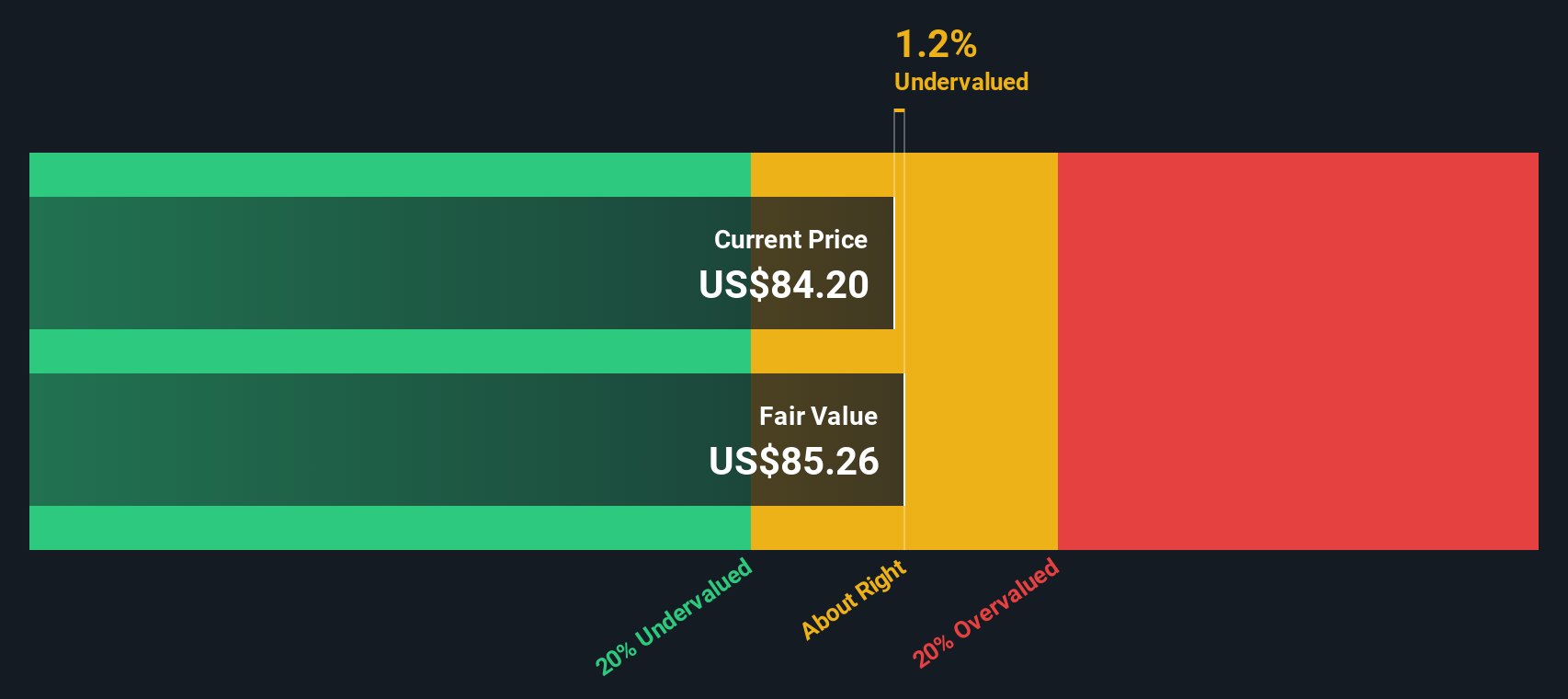

Trying to decide whether to hold onto Fortinet stock, scoop up more shares, or step aside for now? You’re not alone. This is a company that’s been front and center for tech-minded investors and those keeping an eye on the cybersecurity landscape. Recently, Fortinet’s share price hasn’t exactly skyrocketed, but the moves have been quietly intriguing. Over the past week, we’ve seen a mild uptick of 0.5%. Zooming out, the company posted a steady 1.2% rise over the last month, and the past year brought a modest 5.6% gain. That short-term bounce follows some headline-making strategic partnerships, as well as increased attention in the industry as organizations ramp up digital security spending. Still, it’s impossible to ignore that year-to-date, Fortinet is down 10.0%. There’s a story here about evolving expectations, changing risk profiles, and maybe, for the savvy investor, the potential for growth hiding in plain sight.

Whether you’ve been enjoying the impressive 285.6% return over five years or only just started tracking Fortinet’s moves, you might be wondering what the company’s real value is today. Based on a systematic value check, Fortinet lands a valuation score of 3 out of 6, meaning it’s considered undervalued in half of the key categories analysts use to judge a stock. In the next section, we’ll break down those six checks to see what’s driving that score. Stay tuned for an even more insightful angle on value that isn’t always captured by the numbers alone.

Why Fortinet is lagging behind its peers

Approach 1: Fortinet Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to today’s dollars. This provides a sense of what the business is truly worth right now. This method looks beyond what is happening in the market today and aims to uncover value grounded in fundamental business performance.

For Fortinet, the current Free Cash Flow stands at approximately $2.05 billion. Analyst forecasts suggest that free cash flow could grow to about $3.54 billion by 2029, though estimates are only directly available for the next five years. Beyond that period, the numbers are extrapolated, drawing on observed trends and industry expectations. These projections help form a clearer picture of the company’s potential future earnings power.

Using this approach, Fortinet’s fair value per share is calculated at $85.19. The DCF model indicates the stock is 0.1% overvalued compared to its intrinsic value, so Fortinet’s present share price is almost exactly in line with what long-term cash flows would justify.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out Fortinet's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

Approach 2: Fortinet Price vs Earnings

For profitable companies like Fortinet, the Price-to-Earnings (PE) ratio is a popular and widely trusted way to gauge valuation. This metric reflects how much investors are willing to pay for every dollar of current earnings, making it especially useful for businesses with established profits and clear paths for growth.

A company’s “fair” PE ratio is influenced by factors such as expected future earnings growth, its risk profile, and how stable or cyclical its business is. Higher growth prospects and lower perceived risk typically justify a higher PE multiple. Slower growth or industry headwinds can push it lower.

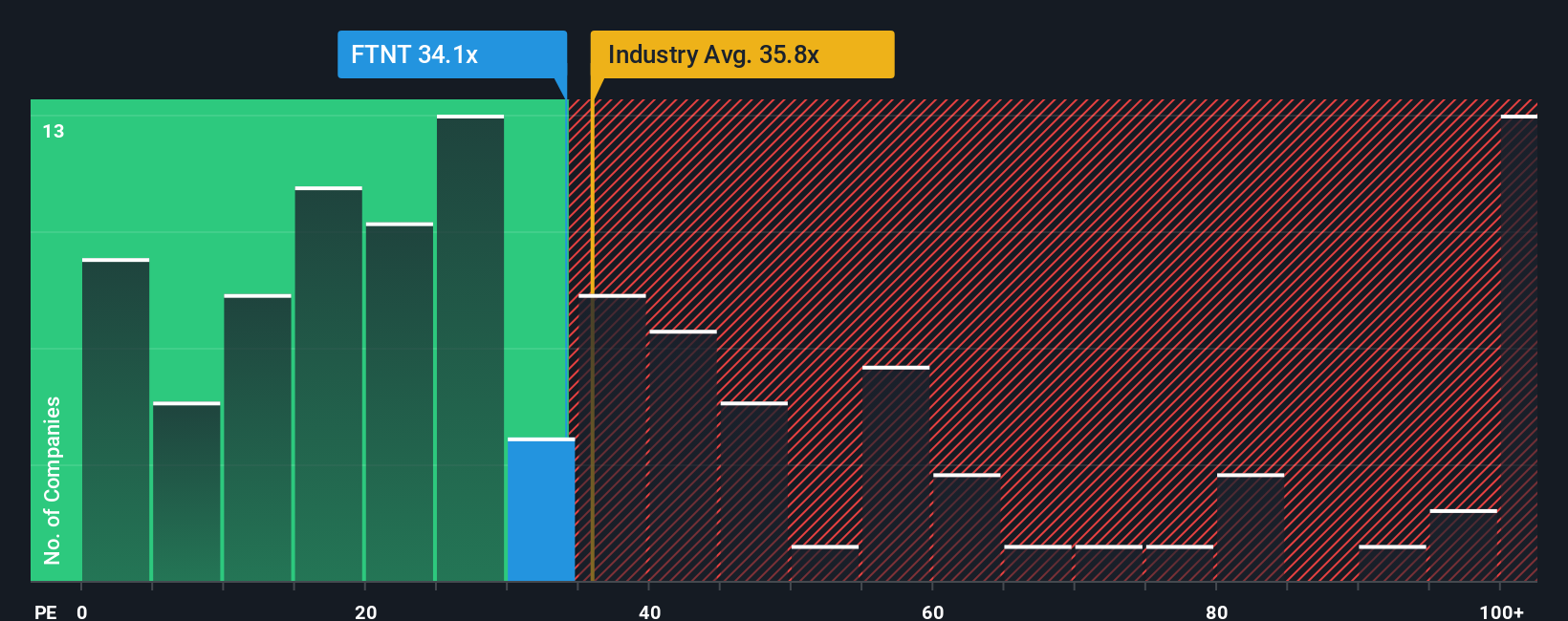

Fortinet currently trades at a PE ratio of 33.7x. That figure is nearly identical to the software industry average of 33.9x and notably below the peer group average of 75.3x. While these benchmarks offer important context, they do not always reflect a company’s unique qualities and circumstances.

This is where the Simply Wall St "Fair Ratio" comes in. This proprietary metric weighs not only Fortinet’s earnings growth and profit margins, but also its industry dynamics, market cap, and key risk factors. The fair PE ratio calculated for Fortinet is 35.9x. Because this fair value incorporates a wider set of relevant considerations than just peer or industry averages, it provides a more reliable picture of what the company deserves to trade at today.

On the numbers, Fortinet’s current PE ratio of 33.7x is almost exactly in line with its Fair Ratio of 35.9x. This suggests that the stock is valued ABOUT RIGHT relative to its fundamentals and prospects.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Fortinet Narrative

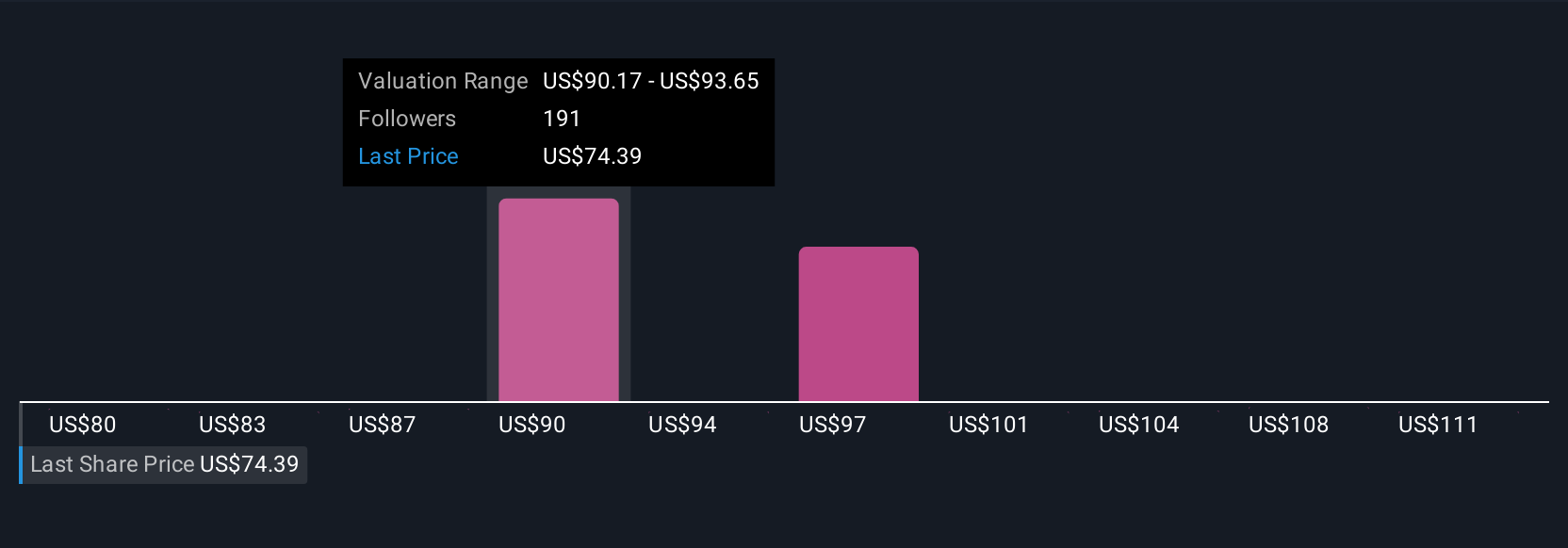

Earlier, we hinted at an even better way to understand a company’s value, so let’s introduce Narratives, a tool that lets you connect the story you believe about Fortinet to a concrete financial forecast and a fair value estimate.

In simple terms, a Narrative is your personal perspective on a company, defining not just how you see its future growth, profitability, and risks, but how those expectations shape what you believe the stock is really worth today. Unlike static numbers, Narratives put your assumptions about revenue, margins, and fair value front and center, anchoring your investment decisions to a story that you control.

On Simply Wall St’s Community page, used by millions of investors, Narratives are a quick, accessible way to write, share, and compare your outlook for Fortinet with those of others. You can clearly see whether your fair value estimate is above or below the current share price, helping you decide when buying or selling might make sense for your goals.

Best of all, Narratives update automatically when news breaks, earnings are released, or key trends shift, so your story always stays relevant. For example, some investors see Fortinet fairly valued at $67, focusing on hardware margin pressure, while others believe it could be worth as much as $120, banking on emerging platform expansion. This proves there is more than one way to value this business.

Do you think there's more to the story for Fortinet? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FTNT

Fortinet

Provides cybersecurity and convergence of networking and security solutions worldwide.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives