- United States

- /

- Software

- /

- NasdaqGS:FTNT

Fortinet (NasdaqGS:FTNT) Enhances Email Security With New AI-Powered Protection Features

Reviewed by Simply Wall St

Fortinet (NasdaqGS:FTNT) recently announced significant enhancements to its security portfolio, including the launch of the FortiMail Workspace Security suite, expanding its capabilities in email and collaboration tool security with AI-powered protection. Over the past week, the company's stock price moved slightly down by 1.78%. This minor decline coincides with a flat market trajectory. Although Fortinet's comprehensive security solutions may bolster its long-term prospects, the stock's recent movement mirrors broader market trends without any significant deviations, suggesting that the announcements added a level of weight to the stable market environment.

Buy, Hold or Sell Fortinet? View our complete analysis and fair value estimate and you decide.

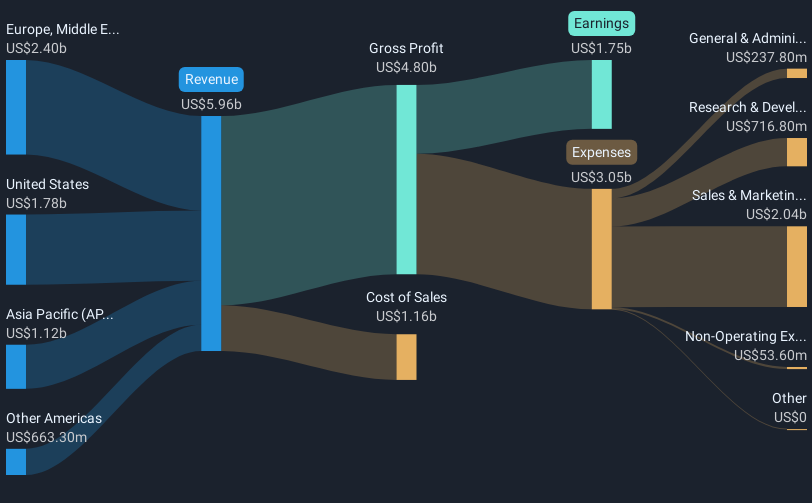

Fortinet's recent product enhancements, particularly the FortiMail Workspace Security suite, could influence financial projections by strengthening its foothold in email and collaboration security. This addition aligns with the company's focus on AI and Unified SASE, which are anticipated to boost revenue and margin growth. Over the past five years, Fortinet's total shareholder return has been very large, highlighting robust long-term performance. This positions the company favorably compared to the US market and has allowed it to outperform the US Software industry on a one-year basis.

In terms of analysts' projections, Fortinet's revenue is expected to grow by 14.2% annually over the next three years, with earnings potentially reaching US$2.3 billion by May 2028. However, the share price's recent decline of 1.78% amid stable market conditions keeps it within a minor 5.2% discount to the consensus price target of US$113.01. While this suggests the stock is fairly priced, the forecasts hinge on the successful rollout of Fortinet's new security solutions and the anticipated growth in its cybersecurity services.

Jump into the full analysis health report here for a deeper understanding of Fortinet.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FTNT

Fortinet

Provides cybersecurity and convergence of networking and security solutions worldwide.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion