- United States

- /

- Software

- /

- NasdaqGS:FTNT

Fortinet (FTNT): Exploring Current Valuation After Recent Share Price Fluctuations

Fortinet (FTNT) continues to draw attention as investors revisit its recent performance in the cybersecurity sector. After a steady climb over the past year, the stock’s trajectory offers some interesting points for those watching technology equities.

See our latest analysis for Fortinet.

This year has seen Fortinet's share price dance through ups and downs, with short-term momentum hesitating a bit as its 90-day share price return dropped 12.3%. Meanwhile, the 1-year total shareholder return still clocks in at 9.7%, hinting at lingering long-term confidence from investors despite recent soft patches.

If recent volatility has you thinking about where growth and leadership might come next in tech, consider taking a closer look at See the full list for free..

So the question for investors now is whether Fortinet is trading below its true potential or if the recent numbers signal that future growth is already well-reflected in the share price. Is there still a buying opportunity here, or is everything priced in?

Most Popular Narrative: 12.7% Undervalued

According to user BlackJesus, Fortinet's fair value sits well above its recent closing price of $86.43, suggesting the stock could be overlooked by the market at its current levels. This perspective reframes Fortinet as a uniquely efficient operator in its sector and questions whether investors are truly appreciating the company's underlying strengths.

Its trailing-twelve-month (TTM) profit margin stands at an impressive 30.6%. This level of profitability is a direct result of its organic growth model, which avoids the heavy non-cash charges associated with large acquisitions.

Curious what powers Fortinet’s standout fair value? The key is a punchy combination of razor-sharp operating margins and disciplined organic growth that rivals can’t easily replicate. Which assumptions do the narrative’s numbers lean on most? Tap into the full story to see how high profitability and proprietary technology factor into the calculation.

Result: Fair Value of $99.03 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks such as Fortinet’s hardware focus and past product security issues could challenge the bullish outlook if they have an impact on future results.

Find out about the key risks to this Fortinet narrative.

Another View: SWS DCF Model Perspective

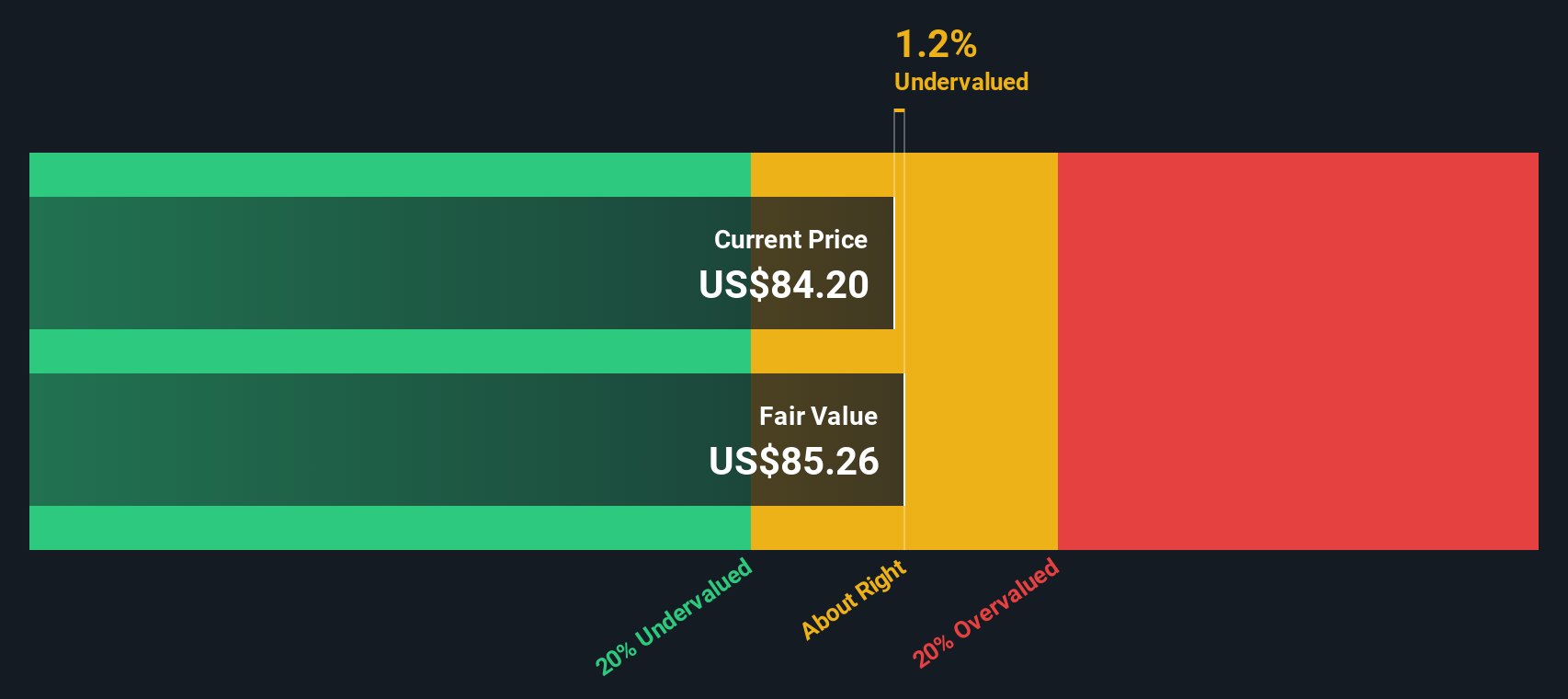

Taking a step back from multiples, the SWS DCF model values Fortinet at $85.09, just below its last trade of $86.43. This suggests Fortinet is currently priced a little higher than what the model considers fair, hinting it might be closer to fully valued. Does this mean the market is already factoring in Fortinet’s strengths, or do the numbers miss something only fundamentals show?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Fortinet for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 840 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Fortinet Narrative

If the current take does not reflect your own view, why not investigate the numbers yourself and craft a different story in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Fortinet.

Looking for more investment ideas?

Expand your portfolio opportunities. Don’t let the next big market mover pass you by when these exciting segments could shape your returns and open up new growth avenues.

- Unlock high-growth potential by tapping into these 26 AI penny stocks, which are transforming industries with artificial intelligence and next-generation automation.

- Capture regular income while building wealth with these 22 dividend stocks with yields > 3%, connecting you to companies rewarding their shareholders with solid yields above 3%.

- Tap into future breakthroughs by checking out these 28 quantum computing stocks, where quantum computing leaders are moving beyond conventional tech frontiers.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FTNT

Fortinet

Provides cybersecurity and convergence of networking and security solutions worldwide.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

An Undervalued 3.3Moz Gold Project in Canada

Coca-Cola’s Enduring Moat in a Health-Conscious World: Steady Compounder Poised for 5-10% Annual Returns Through Emerging Market Dominance

Xero: Growth Was Priced In — Execution Is Not

Nu holdings will continue to disrupt the South American banking market

Recently Updated Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

My long-term take on Nike: A global sports brand with steady growth potential but margin challenges to solve.

QuantumScape: A Mispriced Deep‑Tech Inflection Point With Multi‑Billion‑Dollar Optionality

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks