- United States

- /

- Software

- /

- NasdaqGS:FRSH

Will AI Upgrades to Freshservice Mark a Turning Point in Freshworks' (FRSH) Enterprise Strategy?

Reviewed by Sasha Jovanovic

- Freshworks Inc. recently introduced major AI-driven enhancements to its Freshservice IT management platform at its flagship Refresh event, showcasing features that enable faster issue resolution, smarter prevention, and improved employee experience through automation and real-time integrations.

- By targeting the costly and pervasive challenge of software complexity with both product innovation and a proprietary industry report, Freshworks is positioning itself as both a solution provider and thought leader addressing a critical concern for modern enterprises.

- We'll explore how Freshworks’ push to simplify enterprise IT through AI-powered Freshservice enhancements could influence its longer-term investment outlook.

Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

Freshworks Investment Narrative Recap

To believe in Freshworks as a shareholder today, you need to see long-term value in its ability to simplify enterprise IT with AI, grow its cloud-based platform, and expand customer adoption. The latest Freshservice AI enhancements may support Freshworks’ most important catalyst, widespread paid AI adoption and cross-sell into larger enterprise accounts, though execution and actual monetization in the near-term remain key watchpoints; meanwhile, competition from entrenched incumbents is still the biggest risk, and the product update does little to shift that balance.

Among recent announcements, the raised full-year 2025 revenue guidance to US$833.1 million to US$836.1 million stands out, as it supports confidence in near-term growth expectations even as Freshworks pushes forward with major product updates that target complexity for large business customers.

Yet, even with these positive signals, investors should not overlook the risk that...

Read the full narrative on Freshworks (it's free!)

Freshworks' narrative projects $1.1 billion in revenue and $145.1 million in earnings by 2028. This requires 12.3% yearly revenue growth and a $200 million increase in earnings from the current -$54.9 million.

Uncover how Freshworks' forecasts yield a $19.64 fair value, a 65% upside to its current price.

Exploring Other Perspectives

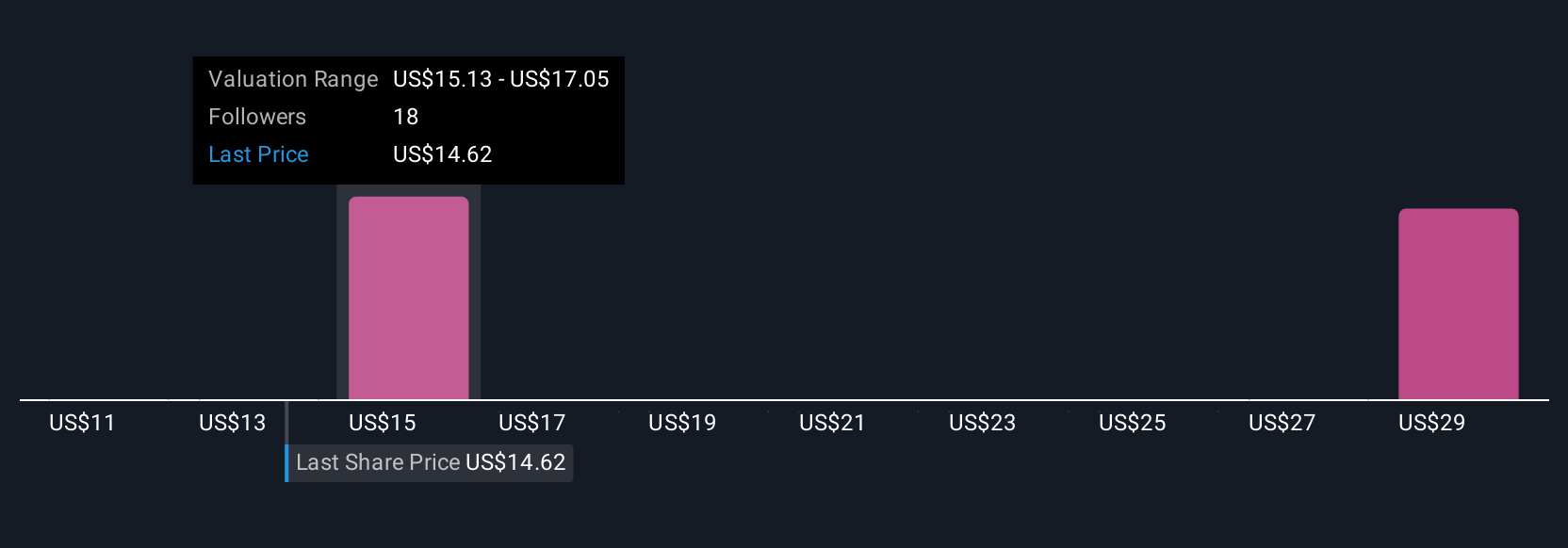

Five fair value estimates from the Simply Wall St Community range from US$15.12 to US$29.47 per share, with most clustering between US$15 and US$29. Some see rapid AI adoption across the Freshworks platform as a driver of future returns, but with competition intensifying, it’s wise to consider more than one viewpoint.

Explore 5 other fair value estimates on Freshworks - why the stock might be worth over 2x more than the current price!

Build Your Own Freshworks Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Freshworks research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Freshworks research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Freshworks' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our top stock finds are flying under the radar-for now. Get in early:

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FRSH

Freshworks

A software development company, provides software-as-a-service products in North America, Europe, the Middle East, Africa, Asia Pacific, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives