- United States

- /

- Software

- /

- NasdaqGS:FRSH

What Freshworks (FRSH)'s AI-Driven Q1 Outperformance Means For Shareholders

Reviewed by Simply Wall St

- Freshworks recently reported first-quarter 2025 financial results that surpassed analyst expectations, showcasing significant progress in integrating artificial intelligence across its software products.

- Analyst projections now suggest Freshworks’ AI-driven annual recurring revenue could increase fivefold over the next three years, highlighting the scale of anticipated growth from AI initiatives.

- We'll explore how Freshworks' rapid AI adoption and outperformance could influence the company's investment narrative and future trajectory.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Freshworks Investment Narrative Recap

To be a shareholder in Freshworks today, you need to believe that its fast-moving AI integration can fundamentally transform its growth outlook, drive meaningful recurring revenue, and carve out an edge against larger software competitors. The company’s strong first-quarter 2025 results and analyst forecast for fivefold AI-driven revenue growth are encouraging, but the most important near-term catalyst, rapid AI feature adoption, remains closely tied to execution risk, particularly against more established peers. This news reinforces the positive sentiment, but execution challenges are still front and center.

Among recent developments, Freshworks’ launch of the next generation Freddy Agentic AI platform is closely tied to this narrative. Enhancing automation and customer experience, this product stands as a key driver for increased AI monetization, directly supporting management’s ambitions for sustained revenue growth from AI initiatives.

On the other hand, investors should be aware that, despite the recent momentum, the true impact of AI monetization is still uncertain as...

Read the full narrative on Freshworks (it's free!)

Freshworks' outlook anticipates $1.1 billion in revenue and $145.1 million in earnings by 2028. This scenario assumes annual revenue growth of 12.3% and an earnings increase of $200 million from current earnings of -$54.9 million.

Uncover how Freshworks' forecasts yield a $20.23 fair value, a 57% upside to its current price.

Exploring Other Perspectives

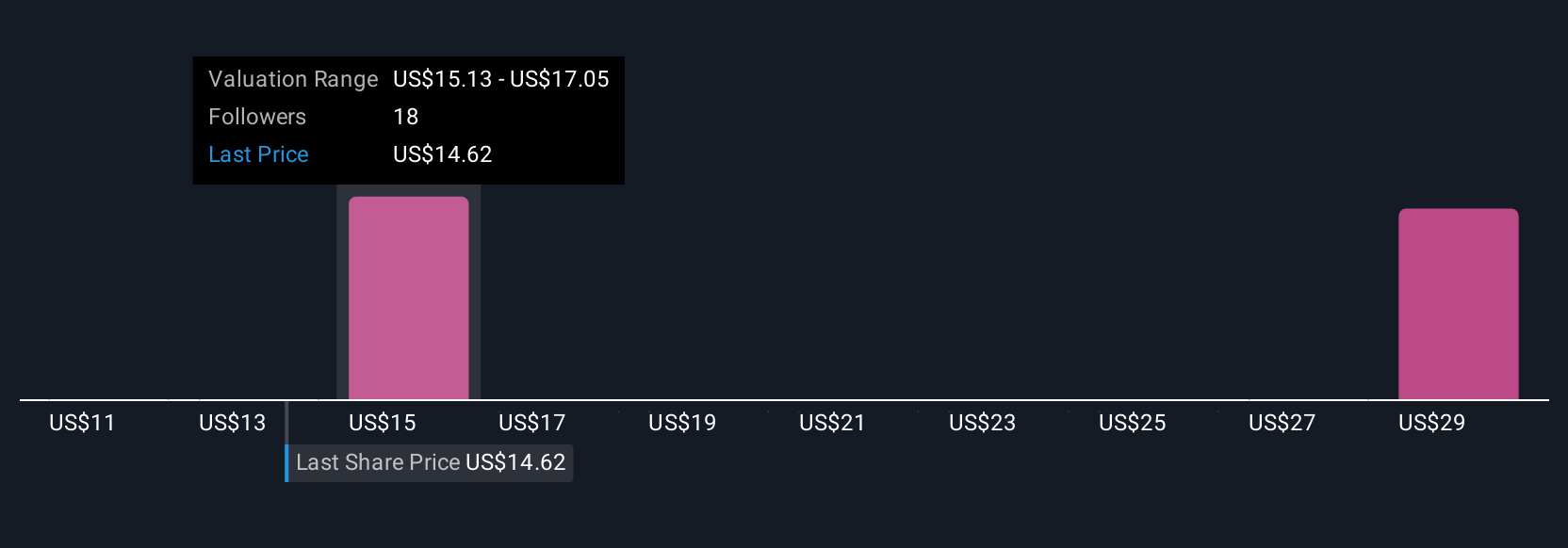

Four fair value estimates from the Simply Wall St Community range from US$15.12 to US$28.29, highlighting a wide spread of individual outlooks. As you consider these varied valuations, remember that the company’s future still hinges on successfully scaling AI monetization amid heavy competition, your view on this may shape your perspective on Freshworks’ upside.

Explore 4 other fair value estimates on Freshworks - why the stock might be worth over 2x more than the current price!

Build Your Own Freshworks Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Freshworks research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Freshworks research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Freshworks' overall financial health at a glance.

No Opportunity In Freshworks?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 30 companies in the world exploring or producing it. Find the list for free.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FRSH

Freshworks

A software development company, provides software-as-a-service products in North America, Europe, the Middle East, Africa, Asia Pacific, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion