- United States

- /

- Software

- /

- NasdaqGM:FIVN

Has Five9's 43% Drop in 2025 Created a New Opportunity for Investors?

Reviewed by Bailey Pemberton

If you’ve been watching Five9 stock and wondering whether now is the right time to act, you’re definitely not alone. At first glance, the numbers might give you pause. Sure, the last week saw a small rebound of 4.7%, but let’s not sugarcoat it: the stock is down almost 16.3% this month, and a daunting 43.4% since the start of the year. Looking even further back reveals deeper losses, with Five9 off 23.7% over the past year and a staggering 84.0% over the last five years. It is easily enough to make even the most steadfast investor rethink their strategy.

Recent headlines have put a spotlight on the company’s evolving role in the cloud contact center space, as Five9 continues to invest in AI-powered solutions and land strategic partnerships with large enterprises. While these moves hint at strong long-term growth potential, the market still seems to be reassessing how much risk is on the table. Investors have taken notice, and many are waiting on the sidelines for clearer signs that optimism or pessimism is justified.

Despite the tough market sentiment, Five9 currently boasts a value score of 5 out of 6 under the latest valuation checks. In five major respects, it is considered undervalued. So, is the market missing something, or is there more pain ahead?

Let’s break down how Five9 stacks up across these valuation yardsticks. As you’ll see, there might be a more insightful way to approach this whole question at the end of our analysis.

Why Five9 is lagging behind its peers

Approach 1: Five9 Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future free cash flows and discounting them back to their present value. This method helps investors determine what a business is worth today, based on how much cash it is expected to generate in the future.

For Five9, analysts estimate current Free Cash Flow at $116.6 Million, with significant growth projected over the coming years. By 2029, free cash flow is expected to reach approximately $363 Million, according to available analyst data. While analyst estimates extend about five years out, Simply Wall St provides extrapolated forecasts beyond that to create a fuller long-term picture. All figures are reported in US dollars.

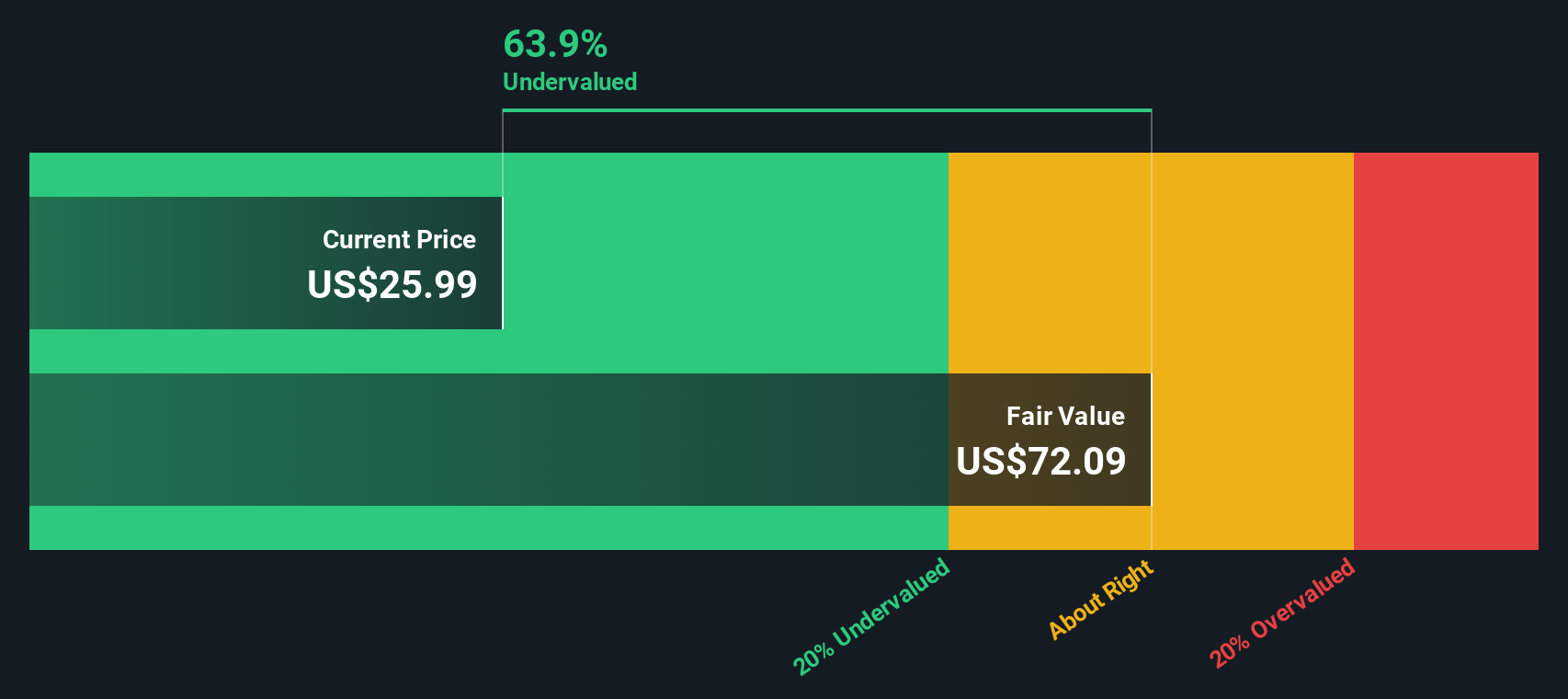

Based on this 2 Stage Free Cash Flow to Equity model, the DCF valuation places Five9's intrinsic value at $69.90 per share. This is notably higher than today’s share price, implying the stock is trading at a 67.3% discount to its estimated worth. In short, this methodology indicates the stock appears meaningfully undervalued relative to its future cash potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Five9 is undervalued by 67.3%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Five9 Price vs Sales

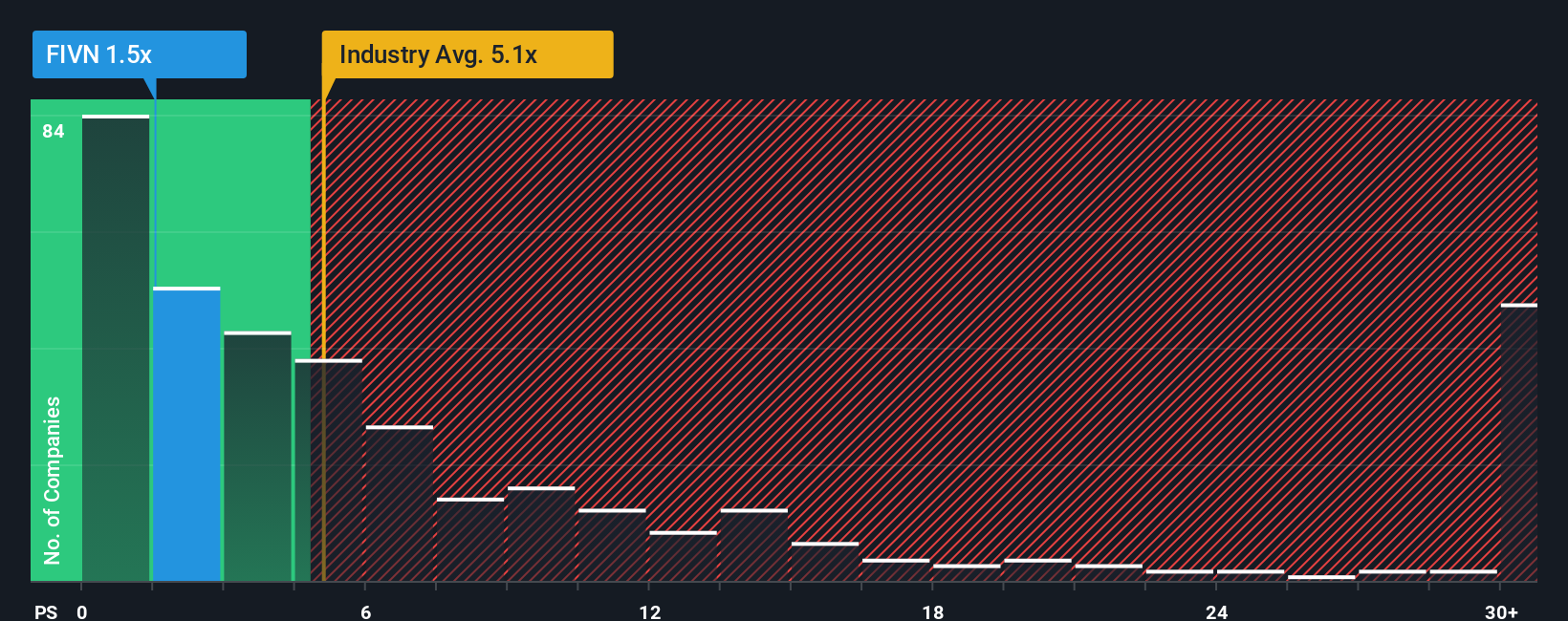

The Price-to-Sales (P/S) ratio is the preferred valuation metric here, and it is especially useful for assessing companies like Five9 that are growing rapidly but not yet consistently profitable. Unlike price-to-earnings, which can be distorted by thin or negative profits, the P/S ratio provides a clearer picture of how the market values every dollar of Five9’s revenue.

Growth expectations and risk play an important role in what makes a “normal” or “fair” P/S ratio. High-growth software companies typically command higher P/S multiples, since investors weigh the potential for future expansion and profitability against present risks and volatility.

Currently, Five9 trades at a P/S ratio of 1.60x. For context, similar peers average about 2.85x, and the broader software industry sits even higher at 5.26x. These comparisons suggest Five9 is valued at a marked discount to both its direct peers and the overall market segment.

The Fair Ratio, as calculated by Simply Wall St, refines this further. This proprietary metric goes beyond broad industry averages and peer comparisons, incorporating Five9’s unique characteristics such as growth rate, profit margins, risk, and scale. The Fair Ratio for Five9 is estimated at 2.87x, presenting a better gauge for what the stock should be worth in light of its fundamentals.

Comparing the Fair Ratio (2.87x) to Five9’s actual P/S (1.60x), the stock appears undervalued on a sales basis and is trading well below what its business metrics justify.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Five9 Narrative

Earlier, we mentioned there is a better way to think about value, so let’s introduce you to Narratives.

A Narrative is your personal investing story for Five9, combining your perspective about its business and future with your own numbers, like fair value, revenue, earnings, or margin forecasts.

Rather than relying solely on traditional metrics, Narratives help you connect what is happening at the company, such as AI adoption, market challenges, or leadership changes, directly to a financial forecast, which then generates a fair value for the stock.

Anyone can build and update a Narrative on Simply Wall St’s Community page, a tool used by millions of investors to share, debate, and refine their investment thinking in real time.

This approach makes it straightforward to decide when to buy or sell, since you can continuously compare your fair value with the latest market price, and Narratives are automatically refreshed with new earnings results or breaking news.

For example, some investors see Five9’s AI momentum and forecast strong growth, arriving at a fair value target as high as $59.00. Others focus on risks and set their estimates as low as $28.00. Your Narrative is entirely your own.

Do you think there's more to the story for Five9? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:FIVN

Five9

Provides intelligent cloud software for contact centers in the United States and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion