- United States

- /

- Software

- /

- NasdaqGM:FIVN

Five9 (FIVN): Reassessing Valuation After a Steep 12-Month Share Price Slide

Reviewed by Simply Wall St

Five9 (FIVN) has quietly slipped around 22% over the past 3 months and is down about 52% in the past year, even as revenue and earnings keep grinding higher in the background.

See our latest analysis for Five9.

That pattern fits a stock where sentiment is still cooling, with a weak year to date share price return and heavy three year and five year total shareholder return losses, despite recent operational progress.

If Five9’s slide has you reassessing your exposure to software and AI, it could be a good moment to explore high growth tech and AI stocks for other names with stronger momentum and fundamentals.

With shares now trading at roughly a one third discount to analyst targets despite solid double digit revenue and earnings growth, is Five9 a contrarian buy, or is the market rightly skeptical about its long term AI upside?

Most Popular Narrative Narrative: 40.0% Undervalued

Compared with Five9’s last close at $20.42, the most followed narrative pegs fair value much higher, implying the market is heavily discounting its future earnings power.

Ongoing large customer wins and multi year contract expansions that emphasize Five9 as a single, comprehensive CX platform for both core and AI solutions demonstrate sustained demand for scalable, cloud native contact center offerings, supporting continued enterprise revenue growth and improved dollar based net retention rates.

Curious how modest revenue growth assumptions, sharply rising margins, and a premium future earnings multiple combine to justify this gap? Want to see the full blueprint behind that fair value call?

Result: Fair Value of $34.05 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying competition and leadership transitions could derail Five9’s AI growth narrative, pressuring margins and undermining confidence in its long term earnings power.

Find out about the key risks to this Five9 narrative.

Another Take on Valuation

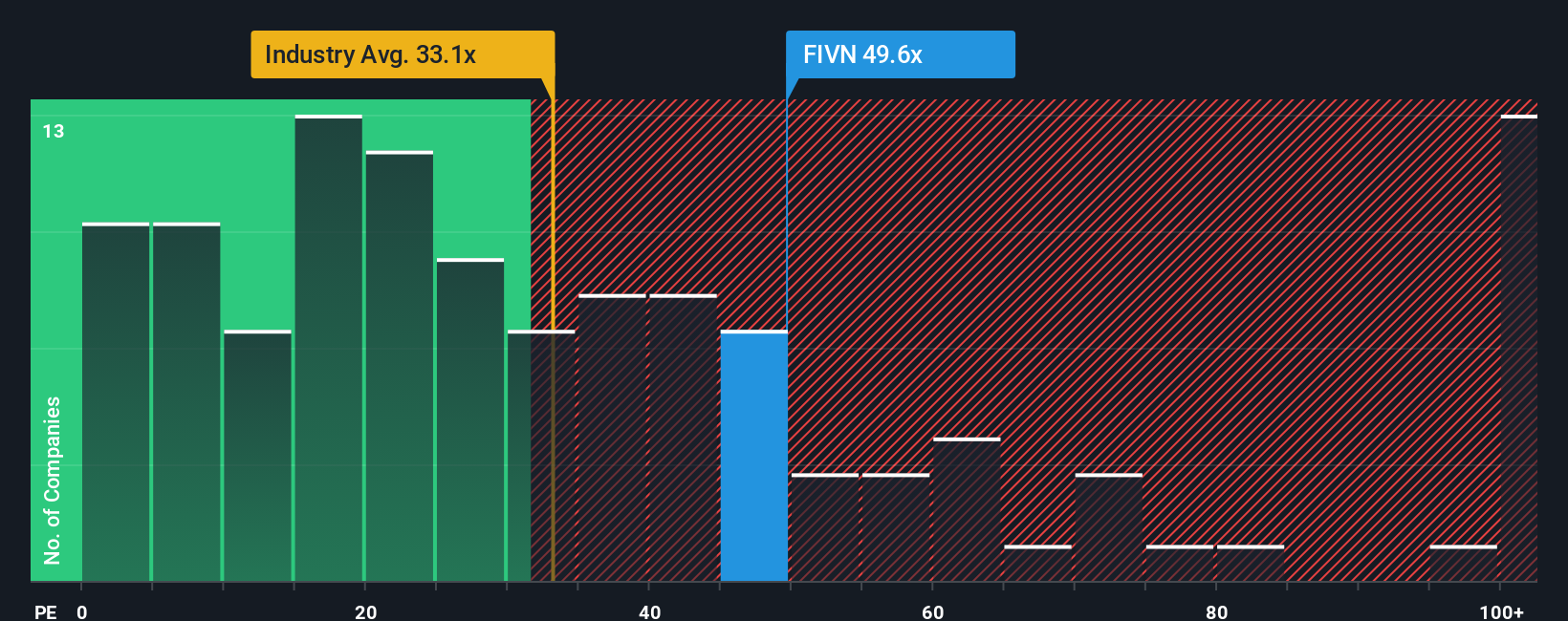

While our fair value work suggests Five9 is undervalued, the current price to earnings ratio of 51.1 times tells a very different story. It is far richer than the US Software average of 32.3 times and above a fair ratio of 38.2 times, which points to real downside risk if sentiment sours further.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Five9 Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalized view in just a few minutes: Do it your way.

A great starting point for your Five9 research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next money making idea?

Use the Simply Wall St screener to uncover focused, data backed opportunities beyond Five9, so you are not left watching others capture the upside first.

- Target potential multibaggers early by scanning these 3635 penny stocks with strong financials that already back their tiny share prices with real financial strength.

- Ride the next wave of automation by zeroing in on these 24 AI penny stocks positioned at the crossroads of software, data, and intelligent infrastructure.

- Lock in better entry points by filtering for these 902 undervalued stocks based on cash flows where cash flow strength and mispriced expectations create room for upside reratings.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:FIVN

Five9

Provides intelligent cloud software for contact centers in the United States and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion