- United States

- /

- Software

- /

- NasdaqGM:FIVN

Five9 (FIVN): Assessing Value After Q3 Results, AI Growth, and $150 Million Share Buyback Announcement

Reviewed by Simply Wall St

Five9 (FIVN) just delivered its third-quarter earnings report, showcasing stronger financials, positive net income, and steady sales growth. The company also rolled out a $150 million share repurchase plan, which caught investors’ attention.

See our latest analysis for Five9.

Despite Five9’s encouraging Q3 results and the announcement of a $150 million share repurchase program, the stock’s momentum has been fading. The 90-day share price return is -22.31%, and the year-to-date decline is nearly 50%. The 1-year total shareholder return stands at -45.30%, reflecting persistent investor caution even as fundamentals improve and enterprise AI bookings accelerate.

If Five9’s turnaround story has your attention, now’s the moment to see what else the market offers by exploring fast growing stocks with high insider ownership.

With shares down sharply despite robust financials and a new buyback plan, investors are left to wonder: Is Five9 undervalued at current levels, or has the market already factored in its future growth potential?

Most Popular Narrative: 41.7% Undervalued

Five9’s most widely followed narrative points to a fair value of $34.76, which sits notably above the last close of $20.27. This suggests the market may be missing the company’s future upside. Let’s dig into the rationale that’s driving this optimistic view.

Five9’s accelerated adoption of AI-driven solutions, highlighted by 42% Enterprise AI revenue growth and a surge in AI bookings (representing over 20% of Enterprise new ACV), positions the company to benefit from increasing enterprise investment in AI and automation for customer experience. This supports higher recurring revenues and expanded net margins as AI products command premium pricing.

Curious how a sharp pivot to automation and some bold future earnings estimates set up this sizable undervaluation? The numbers behind these projections are not what you’d expect from a struggling tech stock. If you want to see how much future profit power is built into this narrative, don’t stop here.

Result: Fair Value of $34.76 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying competition and ongoing executive transitions could derail Five9’s turnaround. These factors may challenge its ability to sustain growth and restore investor confidence.

Find out about the key risks to this Five9 narrative.

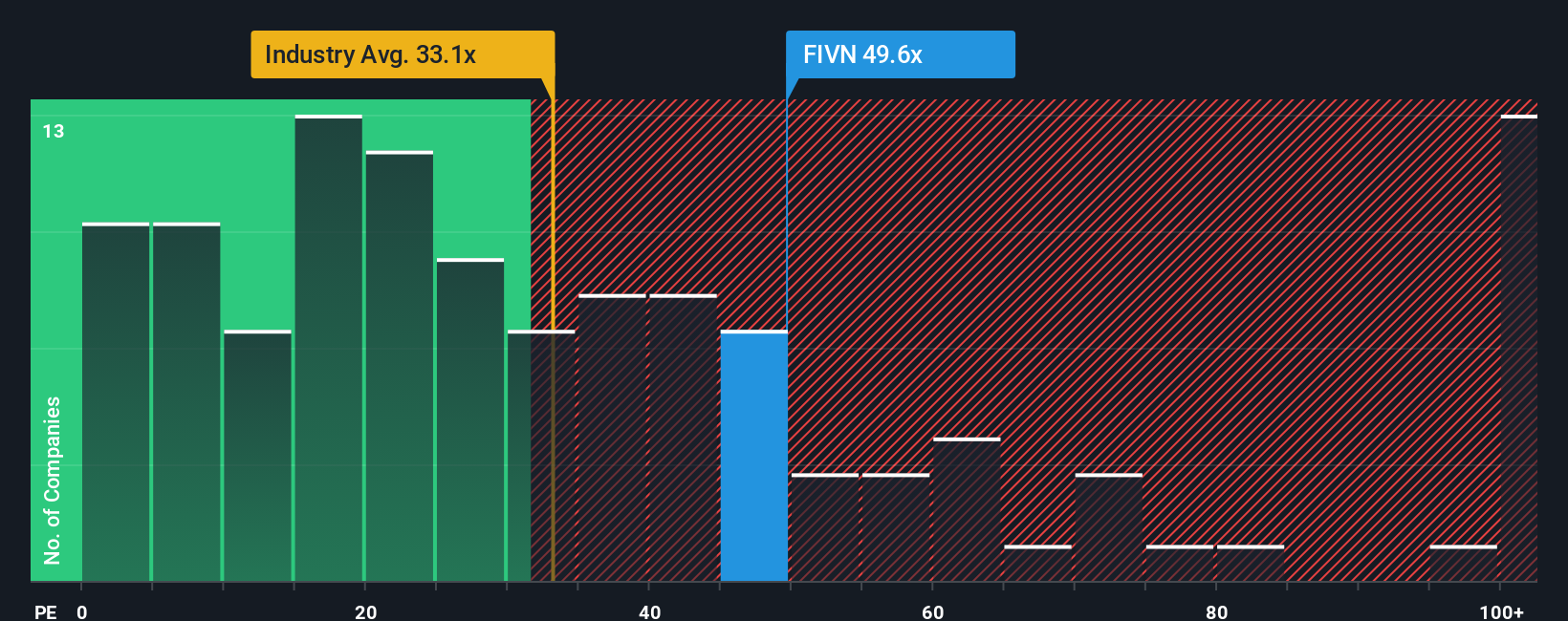

Another View: Multiples Tell a Different Story

Looking at Five9’s price-to-earnings ratio, we see a different verdict. The current ratio is 50.7 times, much higher than both the software industry average of 31.2 and the peer average of 32.8. Even compared to its fair ratio of 40.3, Five9 looks expensive. This gap suggests investors are paying up for future potential. However, if growth slows, it is uncertain how long that premium will persist.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Five9 Narrative

If you see things differently or want to take a hands-on approach to the data, you can craft your own story in just a few minutes. Do it your way.

A great starting point for your Five9 research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Ways to Grow Your Portfolio?

Step up your investing game by targeting tomorrow’s leaders and untapped opportunities. Use the Simply Wall Street Screener to ensure you’re not missing your next smart move.

- Catch the wave in artificial intelligence by spotting emerging companies through these 26 AI penny stocks, before they become household names.

- Build lasting wealth by targeting cash-generating businesses with healthy yields. Tap into these 16 dividend stocks with yields > 3% and find proven performers.

- Seize opportunities among mispriced businesses and hunt for value with these 906 undervalued stocks based on cash flows that could reward smart analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:FIVN

Five9

Provides intelligent cloud software for contact centers in the United States and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives