- United States

- /

- IT

- /

- NasdaqCM:DTST

Here's Why We Think Data Storage Corporation's (NASDAQ:DTST) CEO Compensation Looks Fair

Performance at Data Storage Corporation (NASDAQ:DTST) has been rather uninspiring recently and shareholders may be wondering how CEO Chuck Piluso plans to fix this. One way they can exercise their influence on management is through voting on resolutions, such as executive remuneration at the next AGM, coming up on 16 November 2022. It has been shown that setting appropriate executive remuneration incentivises the management to act in the interests of shareholders. In our opinion, CEO compensation does not look excessive and we discuss why.

Check out the opportunities and risks within the US IT industry.

How Does Total Compensation For Chuck Piluso Compare With Other Companies In The Industry?

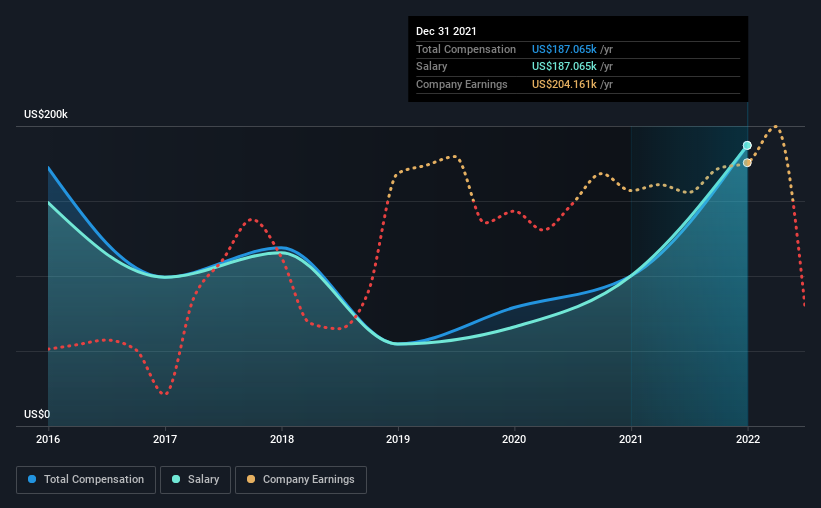

At the time of writing, our data shows that Data Storage Corporation has a market capitalization of US$13m, and reported total annual CEO compensation of US$187k for the year to December 2021. Notably, that's an increase of 87% over the year before. It is worth noting that the CEO compensation consists entirely of the salary, worth US$187k.

On comparing similar-sized companies in the industry with market capitalizations below US$200m, we found that the median total CEO compensation was US$897k. In other words, Data Storage pays its CEO lower than the industry median. Moreover, Chuck Piluso also holds US$1.7m worth of Data Storage stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | US$187k | US$100k | 100% |

| Other | - | - | - |

| Total Compensation | US$187k | US$100k | 100% |

Speaking on an industry level, nearly 10% of total compensation represents salary, while the remainder of 90% is other remuneration. At the company level, Data Storage pays Chuck Piluso solely through a salary, preferring to go down a conventional route. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

Data Storage Corporation's Growth

Data Storage Corporation's earnings per share (EPS) grew 4.3% per year over the last three years. It achieved revenue growth of 97% over the last year.

It's great to see that revenue growth is strong. With that in mind, the modestly improving EPS seems positive. We wouldn't say this is necessarily top notch growth, but it is certainly promising. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Data Storage Corporation Been A Good Investment?

Few Data Storage Corporation shareholders would feel satisfied with the return of -70% over three years. This suggests it would be unwise for the company to pay the CEO too generously.

To Conclude...

Data Storage pays CEO compensation exclusively through a salary, with non-salary compensation completely ignored. The fact that shareholders are sitting on a loss is certainly disheartening. Perhaps the poor price performance may have something to do with the the fact that earnings per share growth has not been performing as strongly either. In the upcoming AGM, shareholders should take this opportunity to raise these concerns with the board and revisit their investment thesis with regards to the company.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. That's why we did some digging and identified 2 warning signs for Data Storage that you should be aware of before investing.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:DTST

Data Storage

Provides enterprise cloud and business continuity solutions in the United States and internationally.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.