- United States

- /

- Software

- /

- NasdaqGS:DOCU

Is DocuSign’s Share Price Attractive After Recent Earnings and Guidance Update in 2025?

Reviewed by Bailey Pemberton

Wondering what to do with your DocuSign shares, or thinking about adding them to your watchlist? It’s understandable. DocuSign has become one of those stocks everyone seems to have a strong opinion about, especially lately. While tech overall has seen its share of volatility, DocuSign’s chart is a story of sharp swings: over the past year, it’s up 4.6%. Zoom out to three years and you’ll see a confident 57% return. Of course, anyone who bought in five years ago might be scratching their head, as the stock is still down over 70% from its highs. Recent months haven’t been easy either, with a drop of 3% in just the last week and nearly 12.4% over the past month.

So, what’s driving all this fluctuation? The way the digital agreement market keeps evolving is a big piece of the puzzle. There’s renewed optimism that secure e-signature solutions like DocuSign’s are here to stay, with accelerating tech adoption across industries. At the same time, some investors are refocusing on how much they’re willing to pay for growth, especially with the macro winds shifting and competition never too far behind.

Digging into the numbers, DocuSign currently scores a 3 when it comes to valuation. That’s 3 out of 6 key checks suggesting the company is undervalued right now. What does that actually mean in practice, and is there more to the story than just a scorecard? In the next section, we’ll unpack what goes into those valuation approaches and, before we’re done, I’ll show you a smarter way to think about DocuSign’s real worth.

Why DocuSign is lagging behind its peers

Approach 1: DocuSign Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model works by projecting a company’s future free cash flows and then calculating what those are worth today, given the risk and time value of money. In DocuSign’s case, this means taking the cash the business is expected to generate in years ahead, then ‘discounting’ those numbers back to current values using a realistic rate.

For the most recent period, DocuSign reported Free Cash Flow of $938.4 million. Analyst projections suggest modest growth over the first five years, with FCF expected to reach $951.4 million in 2026. These estimates, provided by various analysts, are then extended for future years by following a steady growth rate. By 2030, the model projects Free Cash Flow will rise to $1.19 billion, based on extrapolated figures in USD.

When all these projected cash flows are combined and discounted back, the model arrives at an intrinsic value of $98.35 per share. This is about 28.9% above the current share price, which suggests the stock is significantly undervalued based on its long-term cash-generating potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests DocuSign is undervalued by 28.9%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: DocuSign Price vs Earnings

For profitable companies like DocuSign, the price-to-earnings (PE) ratio remains one of the most widely used valuation metrics. It provides a quick way to gauge how much investors are willing to pay for each dollar of company earnings, which can be especially illuminating when the business is consistently in the black.

What counts as a “fair” PE ratio depends a lot on expectations. Companies with higher growth prospects or lower perceived risks often trade at a higher multiple, while those facing headwinds or volatility get discounted. Benchmarking DocuSign’s PE of 50.1x against the Software industry average of 35.6x and a peer average of 47.9x shows that the market is pricing in a premium, likely expecting continued profitability and growth relative to many rivals.

But there is more nuance to a company’s story than what simple peer or industry comparisons can reveal. That is where Simply Wall St’s “Fair Ratio” comes in. This proprietary metric weighs in not just the company’s sector and profit margins, but also factors like its earnings growth, risks, and even the market cap, aiming for a more tailored sense of value. For DocuSign, the Fair Ratio clocks in at 34.0x, notably below the current 50.1x. This suggests that, given DocuSign’s specific circumstances, the stock is trading above what might be justified by fundamentals alone, even in the context of industry optimism.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your DocuSign Narrative

Earlier, we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is the personal story you use to explain DocuSign’s business prospects behind the numbers. It connects your outlook on its future revenue, earnings, and margins to a fair value you believe in. Narratives help you make investment decisions by clearly tying together a company’s story, a transparent financial forecast, and a fair value calculation, so you can compare it to the current price.

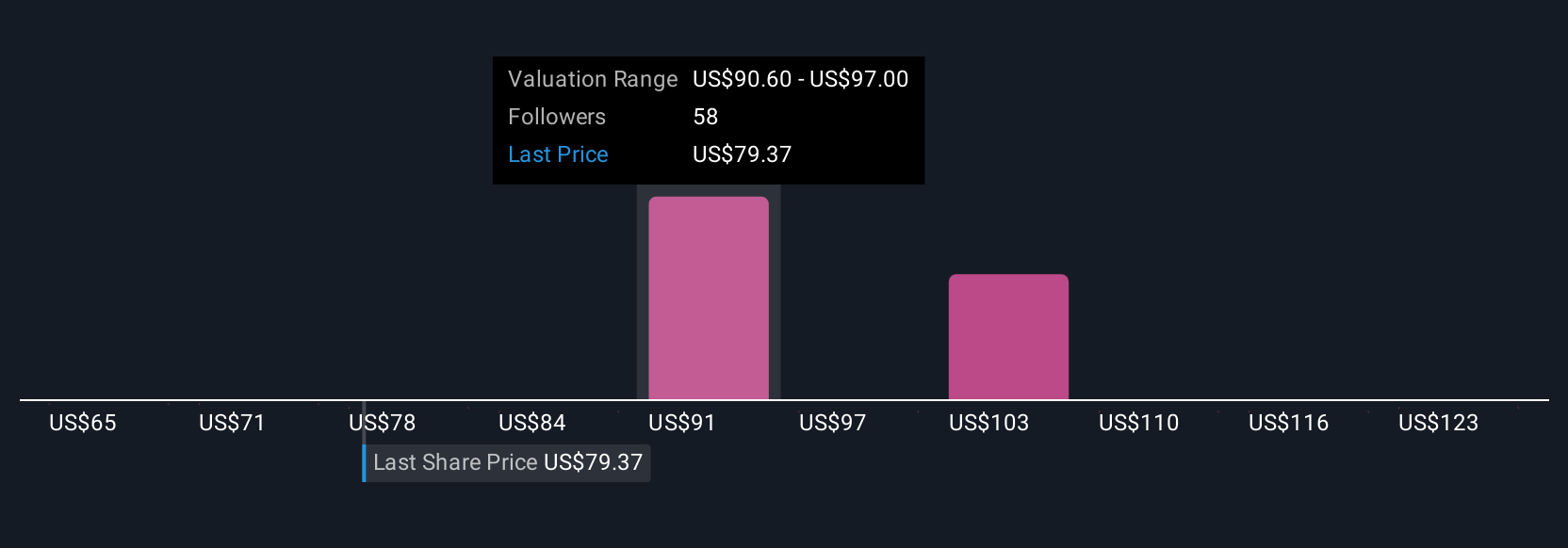

Narratives are easy to create or follow on Simply Wall St’s Community page, making tools once reserved for professionals accessible to everyone. They update automatically whenever there is new information, such as earnings or major news, so you always have the latest context for your investing decisions. For example, one investor might see DocuSign expanding rapidly into new global markets, projecting margins to rise and valuing shares at $124. Another investor, worried about competition and market saturation, could arrive at a much lower fair value of $77. Narratives put these perspectives side by side, empowering you to choose the story and strategy that fits you best.

Do you think there's more to the story for DocuSign? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DOCU

DocuSign

Provides electronic signature solution in the United States and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.