- United States

- /

- Software

- /

- NasdaqGS:DOCU

DocuSign (NasdaqGS:DOCU) Jumps 14% This Week Following US$83 Million Net Income Announcement

Reviewed by Simply Wall St

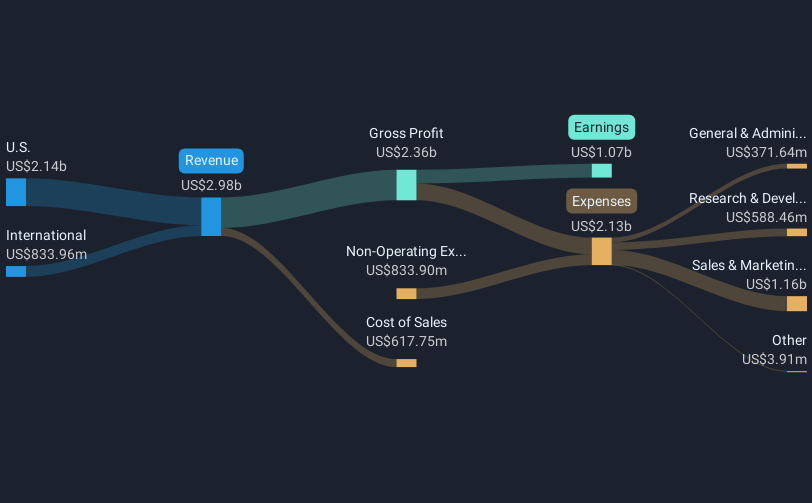

DocuSign (NasdaqGS:DOCU) experienced a significant price move of 14% over the last week. This surge follows the company’s recent announcement of robust fourth-quarter earnings, with revenue climbing to $776 million and net income jumping to $83 million. Positive earnings guidance for the upcoming fiscal year and the ongoing success of its share buyback program may have further fueled investor optimism. Meanwhile, the U.S. stock market experienced a general upswing, rebounding as the Federal Reserve held interest rates steady. These favorable earnings and broader market trends likely aided the notable increase in DocuSign's stock performance.

We've spotted 3 risks for DocuSign you should be aware of, and 2 of them shouldn't be ignored.

Over the past year, DocuSign's total shareholder return was 44.99%, significantly outperforming both the US market, which returned 7.6%, and the US Software industry, which saw a decline of 1.6%. This impressive performance coincided with strategic initiatives and strong earnings. The launch of DocuSign's Intelligent Agreement Management, which garnered strong market adoption, played a crucial role in expanding revenue, especially in SMB and mid-market segments. Additionally, international expansion and operational efficiencies helped boost margins and earnings consistently during the year.

DocuSign's robust share buyback program was a key factor enhancing shareholder value. By March 2025, DocuSign had repurchased over 15 million shares, representing 7.5%, for US$892 million. Moreover, the company's earnings announcements throughout the year reflected consecutive increases in both revenue and net income, further instilling investor confidence. For instance, Q2 net income surged to US$888.21 million compared to the previous period, underpinning the remarkable annual return.

Evaluate DocuSign's historical performance by accessing our past performance report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade DocuSign, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DOCU

DocuSign

Provides electronic signature solution in the United States and internationally.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives