- United States

- /

- Software

- /

- NasdaqGS:DOCU

DocuSign (NasdaqGS:DOCU) Expands Buyback Plan And Reports Strong Earnings Growth

Reviewed by Simply Wall St

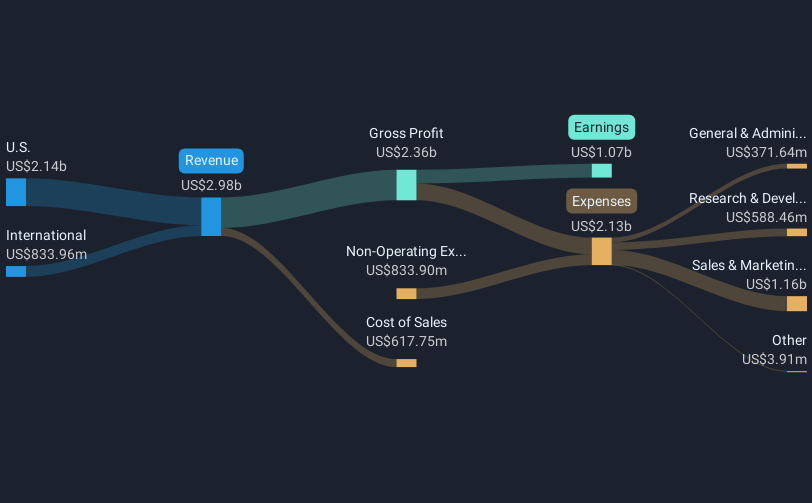

In the latest developments for DocuSign (NasdaqGS:DOCU), the company increased its equity buyback plan by $1 billion and posted first-quarter revenue growth to $763.65 million with net income reaching $72.09 million. Over the past quarter, its share price rose 16%, potentially influenced by the positive earnings announcement and the enhanced buyback program. This movement occurred against a backdrop of a broader market upswing and a strong May jobs report that buoyed investor confidence in overall economic health. Other factors, like an improving earnings environment, likely provided additional support to this upward momentum.

Be aware that DocuSign is showing 2 possible red flags in our investment analysis.

The recent news of DocuSign boosting its equity buyback plan by US$1 billion and reporting increased quarterly revenues could set a foundation for future growth by potentially boosting investor confidence and supporting share value. The company's shares have risen by 16% over the past quarter. However, considering a longer timeframe, the total return, including share price and dividends, was 70.15% over the past year. This performance surpasses both the US Software industry return of 21.9% and the broader US market return of 11% over the same period. The introduction of Intelligent Agreement Management, along with an enhanced focus on efficiency, presents multiple growth opportunities across various segments. However, the focus on AI and potential market adoption risks could temper the optimism surrounding revenue projections. Analysts have set a price target of US$91.74, approximately 11.0% higher than the current share price of US$81.65, suggesting that the market may not fully recognize DocuSign's potential despite forecasts of declining underlying business performance.

Examine DocuSign's past performance report to understand how it has performed in prior years.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DOCU

DocuSign

Provides electronic signature solution in the United States and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion