- United States

- /

- Software

- /

- NasdaqGS:DOCU

Can DocuSign's (DOCU) Trusted Brand Withstand the Rise of AI Rivals Like DocuGPT?

Reviewed by Sasha Jovanovic

- OpenAI launched DocuGPT, an AI-powered contract management tool, prompting investor concerns about increased competition for DocuSign and its position in the digital agreement space.

- Industry analysts note that while DocuSign's longstanding customer trust and security credentials may offset some risks, the emergence of advanced AI-driven alternatives could shape client preferences and future market growth.

- We'll explore how the challenge posed by DocuGPT may impact DocuSign's investment outlook and long-term market positioning.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

DocuSign Investment Narrative Recap

To believe in DocuSign as a shareholder, you need conviction that the company’s trusted brand, established customer base, and secure workflow platform will remain essential as organizations digitize more agreement processes. The arrival of OpenAI’s DocuGPT ramps up competitive risk and investor anxiety in the short term, particularly around pricing power and customer retention. However, this challenge does not appear to materially affect DocuSign’s most immediate catalyst: expanded AI-powered agreement management and sustained enterprise adoption, although competitive pressures now loom as the biggest risk to watch.

The recently announced integration with DossDocs stands out, streamlining time-sensitive document delivery for lenders using DocuSign’s secure e-signature network. This partnership highlights DocuSign’s ongoing efforts to reinforce its position as the default digital trust layer across regulated industries, a key factor supporting near-term revenue growth opportunities that could offset competitive headwinds. But while workflow integrations remain a strength, new entrants leveraging advanced AI will continue raising the bar for what customers expect.

By contrast, the pace and scale of competitive disruption, especially from well-capitalized AI-first rivals, are critical issues investors should not ignore...

Read the full narrative on DocuSign (it's free!)

DocuSign's outlook anticipates $3.8 billion in revenue and $359.8 million in earnings by 2028. This scenario is based on a 7.3% yearly revenue growth rate and a $78.8 million increase in earnings from the current $281.0 million level.

Uncover how DocuSign's forecasts yield a $93.16 fair value, a 34% upside to its current price.

Exploring Other Perspectives

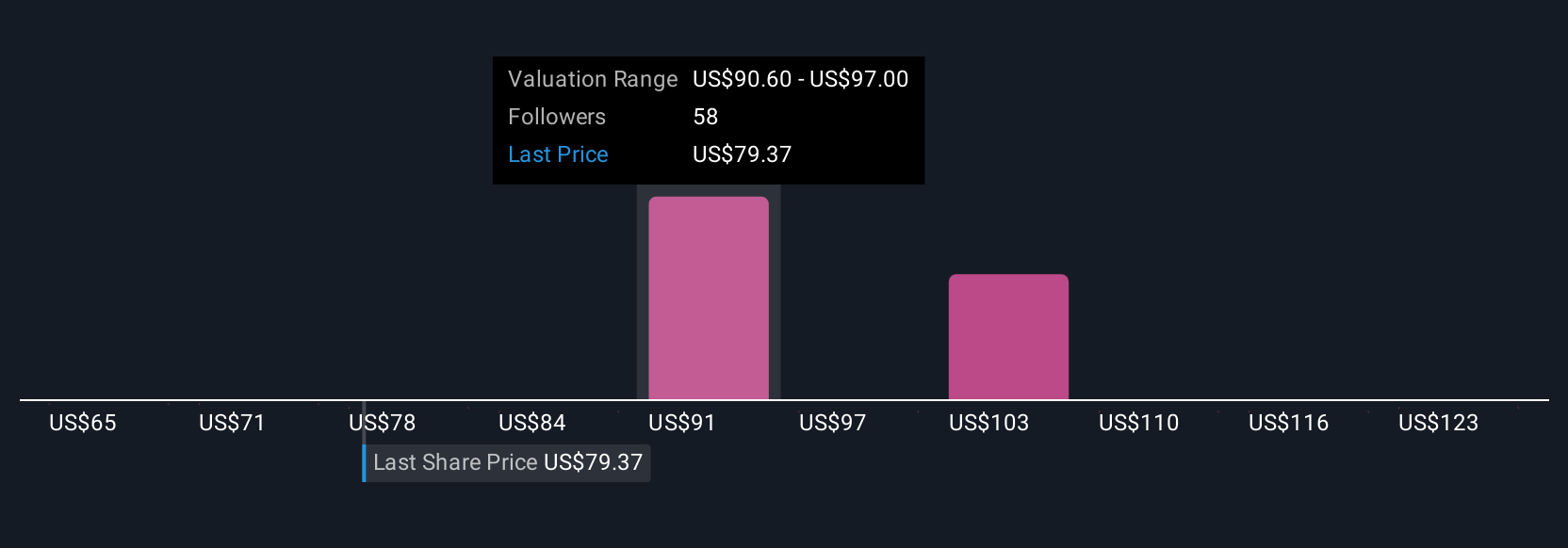

Six community members at Simply Wall St estimate DocuSign’s fair value between US$77 and US$118, with several pricing well above current market levels. However, many remain alert to competition eroding DocuSign’s pricing power and margins, underscoring the wide differences in opinion across investors.

Explore 6 other fair value estimates on DocuSign - why the stock might be worth as much as 69% more than the current price!

Build Your Own DocuSign Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your DocuSign research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free DocuSign research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate DocuSign's overall financial health at a glance.

Contemplating Other Strategies?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 32 companies in the world exploring or producing it. Find the list for free.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DOCU

DocuSign

Provides electronic signature solution in the United States and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives