- United States

- /

- Software

- /

- NasdaqCM:DJCO

Daily Journal Corporation (NASDAQ:DJCO) Is Going Strong But Fundamentals Appear To Be Mixed : Is There A Clear Direction For The Stock?

Daily Journal's (NASDAQ:DJCO) stock is up by a considerable 34% over the past three months. However, we decided to pay attention to the company's fundamentals which don't appear to give a clear sign about the company's financial health. In this article, we decided to focus on Daily Journal's ROE.

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. In simpler terms, it measures the profitability of a company in relation to shareholder's equity.

See our latest analysis for Daily Journal

How Do You Calculate Return On Equity?

Return on equity can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Daily Journal is:

9.7% = US$22m ÷ US$228m (Based on the trailing twelve months to March 2024).

The 'return' is the yearly profit. That means that for every $1 worth of shareholders' equity, the company generated $0.10 in profit.

Why Is ROE Important For Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

A Side By Side comparison of Daily Journal's Earnings Growth And 9.7% ROE

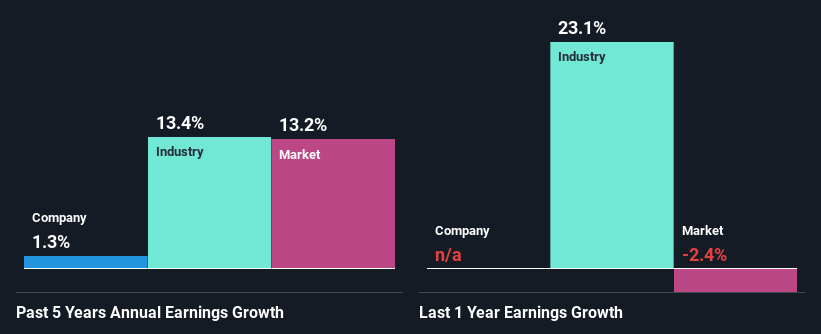

At first glance, Daily Journal's ROE doesn't look very promising. However, its ROE is similar to the industry average of 12%, so we won't completely dismiss the company. However, Daily Journal has seen a flattish net income growth over the past five years, which is not saying much. Bear in mind, the company's ROE is not very high. So that could also be one of the reasons behind the company's flat growth in earnings.

We then compared Daily Journal's net income growth with the industry and found that the company's growth figure is lower than the average industry growth rate of 13% in the same 5-year period, which is a bit concerning.

Earnings growth is a huge factor in stock valuation. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. Doing so will help them establish if the stock's future looks promising or ominous. One good indicator of expected earnings growth is the P/E ratio which determines the price the market is willing to pay for a stock based on its earnings prospects. So, you may want to check if Daily Journal is trading on a high P/E or a low P/E, relative to its industry.

Is Daily Journal Efficiently Re-investing Its Profits?

Daily Journal doesn't pay any regular dividends, which means that it is retaining all of its earnings. This makes us question why the company is retaining so much of its profits and still generating almost no growth? It looks like there might be some other reasons to explain the lack in that respect. For example, the business could be in decline.

Summary

On the whole, we feel that the performance shown by Daily Journal can be open to many interpretations. While the company does have a high rate of profit retention, its low rate of return is probably hampering its earnings growth. So far, we've only made a quick discussion around the company's earnings growth. To gain further insights into Daily Journal's past profit growth, check out this visualization of past earnings, revenue and cash flows.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:DJCO

Daily Journal

Daily Journal Corporation publishes newspapers and websites covering in California, Arizona, Utah, and Australia.

Flawless balance sheet with solid track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026