- United States

- /

- Software

- /

- NasdaqGS:DDOG

Is Datadog’s Valuation Attractive After Takeover Talks for GitLab in 2025?

Thinking about what to do with Datadog stock right now? You are not alone. Whether you have been following the company for years or just got it on your radar, recent price moves have definitely caught the market’s attention. In the past week, Datadog’s share price slipped by 7.9%, but zoom out a bit and you will see a more upbeat story. Shares are up a solid 12.3% over the last 30 days, and if you had bought and held for a year, you would be sitting on a 19.8% return. Over three and five years, Datadog’s gains have been even more impressive, at 83.6% and 52.8% respectively.

So, what is driving this mix of volatility and sustained growth? Part of the buzz comes from reports that Datadog is exploring M&A moves, such as the rumored takeovers of GitLab and cybersecurity upstart Upwind. When a company goes shopping for acquisitions, it is usually a sign that they feel confident about their prospects, but it can also dial up investors’ risk radar. The market seemed to reward Datadog’s big beats and raised expectations with a higher price target from major analysts. Short-term worries, however, still pop up after speculative headlines.

Amid the noise, valuation questions are at the center of every investor’s decision. Right now, Datadog scores a 2 out of 6 on a standard undervaluation checklist. This means it appears undervalued according to just two typical measures. As you will see next, the usual methods are only part of the story when it comes to understanding Datadog’s value. Let’s break down the main ways analysts assess valuation, and then talk about a smarter angle to evaluate where Datadog truly stands.

Datadog scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Datadog Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is designed to estimate a company's true worth by projecting its future cash flows and then discounting them back to their present value. This approach helps investors visualize what Datadog’s future earnings are really worth in today’s dollars.

For Datadog, analysts estimate the current Free Cash Flow (FCF) at $860.5 million. Looking ahead, projections suggest that the FCF could reach about $2.81 billion by 2029. While analyst estimates only extend five years into the future, longer-term forecasts are extrapolated to provide a full picture. These fast-growing cash flows underline why Datadog’s growth narrative has caught so much attention.

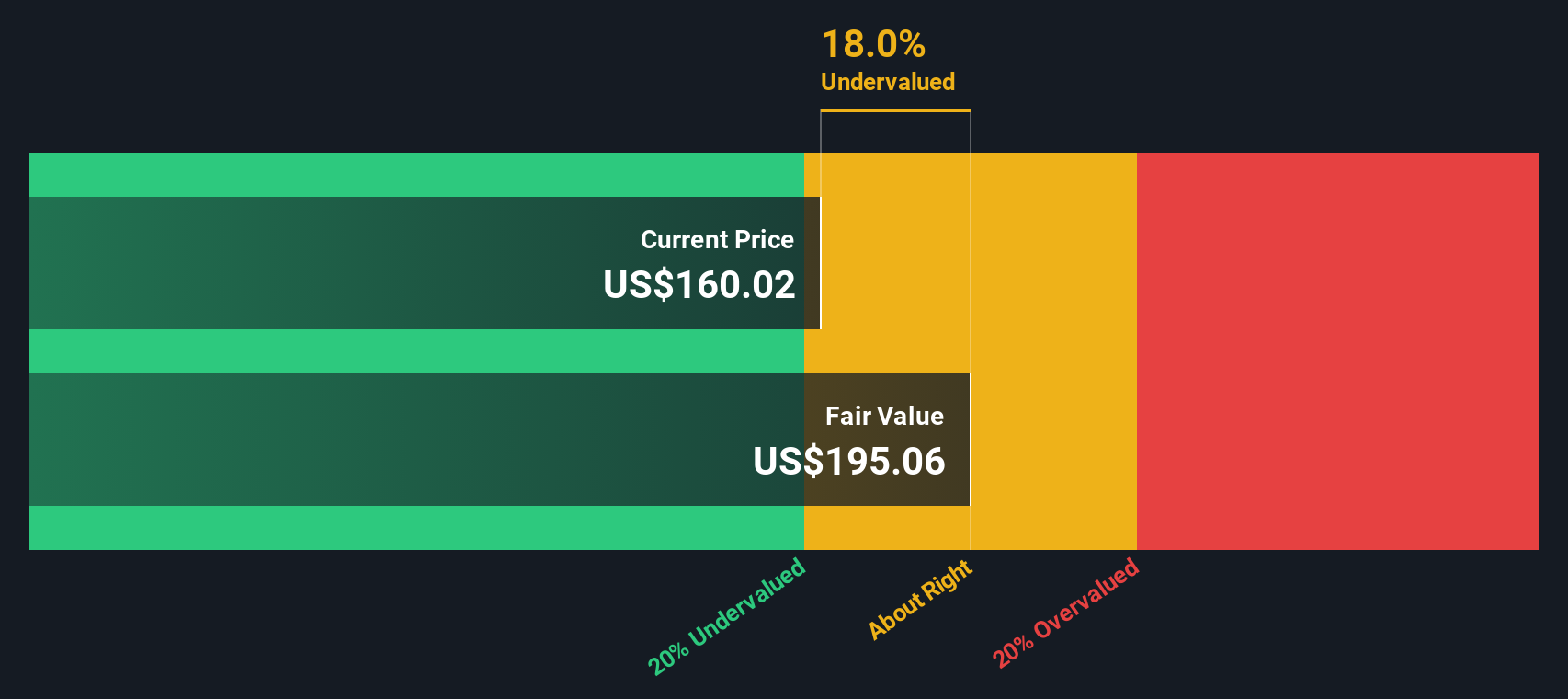

According to the DCF analysis, Datadog’s fair value is estimated at $194.86 per share. This is roughly 22.4% higher than where the stock is currently trading. This suggests the company is undervalued by a comfortable margin.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Datadog is undervalued by 22.4%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Datadog Price vs Sales

The Price-to-Sales (P/S) ratio is widely used for valuing high-growth, profitable companies like Datadog. Since Datadog reinvests heavily for expansion and is building market leadership, earnings can understate its business momentum. This makes the P/S ratio a more meaningful benchmark for both growth and profitability.

Growth expectations and risk appetite both play a big role in what investors see as a “fair” multiple. Higher growth companies with solid prospects can justify higher ratios, while increased risk or slowing momentum usually calls for a discount.

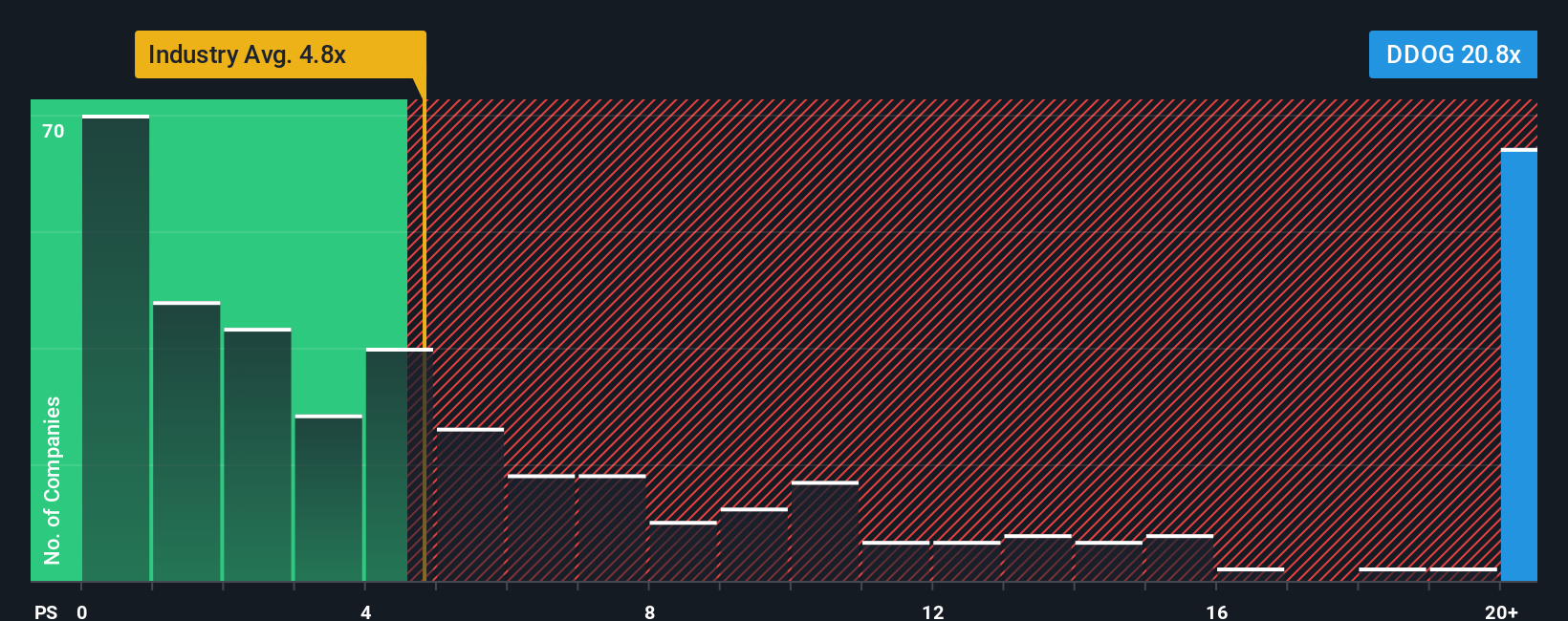

Right now, Datadog is trading at a P/S ratio of 17.5x. To put this in context, the average P/S in the Software industry is 4.9x and Datadog’s peers trade at around 7.8x. This makes Datadog’s current multiple significantly higher than both industry and peer averages.

Simply Wall St’s proprietary “Fair Ratio” model takes things further by considering Datadog’s profit margins, growth forecast, risks, and its specific market position. This customized fair P/S for Datadog is set at 14.7x, which is higher than the broad industry but still somewhat below Datadog’s current valuation. Using the Fair Ratio, which is tailored to the company’s strengths and risks, gives a much clearer sense of value than simple peer or industry comparisons.

Comparing the actual P/S of 17.5x to the Fair Ratio of 14.7x, shares appear to be trading above what would be considered reasonable by this analysis.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Datadog Narrative

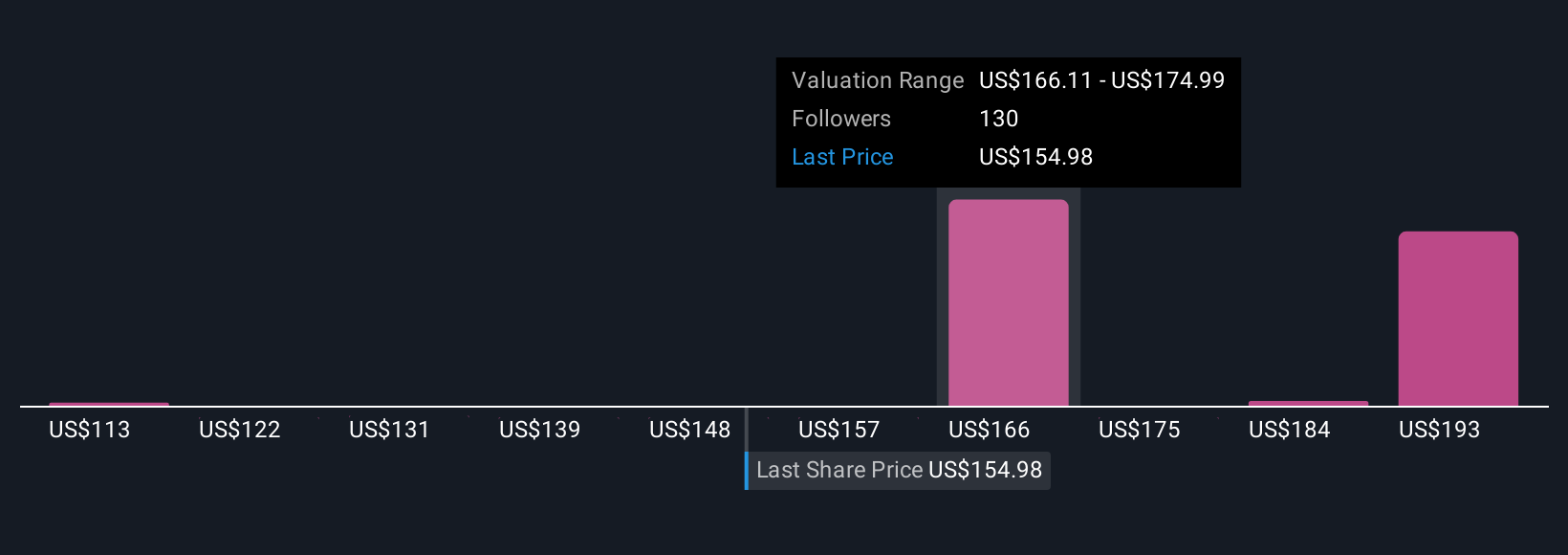

Earlier, we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply your perspective on the company’s story and potential, captured in a set of financial assumptions, such as future revenue, margins, and fair value, that align with how you think the business will play out over the coming years.

Narratives let you connect the big picture (what you believe about Datadog’s market, growth, and risks) directly to a forecast and valuation number, making the reasoning behind an investment decision clear and transparent. On Simply Wall St’s Community page, millions of investors use Narratives to share their views, compare fair values to the current price, and see how new developments (like earnings releases or M&A rumors) update the story in real time.

For example, some investors may use a bullish Narrative, expecting enterprise cloud migration and AI to accelerate Datadog’s growth, which could justify a fair value as high as $200 per share. Others may be more cautious, focusing on rising costs and increased competition, leading to a fair value closer to $105. Narratives help you see both sides and understand where your own view fits in, empowering you to decide when Datadog is a buy, hold, or sell based on your unique conviction.

Do you think there's more to the story for Datadog? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DDOG

Datadog

Operates an observability and security platform for cloud applications in the United States and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

EU#4 - Turning Heritage into the World’s Strongest Luxury Empire

The "Easy Money" Is Gone: Why Alphabet Is Now a "Show Me" Story

Recently Updated Narratives

Delta loses shine after warning of falling travel demand, but still industry leader

Project Ixian Accelerated Rollout will Drive Valuation Expansion to £0.0150.

EU#5 - From Industrial Giant to the Digital Operating System of the Real World

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

The Strategic Revaluation of Adobe: A Critical Analysis of Market Sentiment

Trending Discussion