- United States

- /

- Software

- /

- NasdaqGS:CYBR

CyberArk Software (NasdaqGS:CYBR) Unveils New Identity Security Solutions

Reviewed by Simply Wall St

CyberArk Software (NasdaqGS:CYBR) experienced a 12% rise in its stock price over the past week, aligning with broader market trends where a 7% increase was observed. This performance coincides with the company's latest announcements, including the introduction of new identity security solutions and strategic partnerships to tackle emerging AI-related security risks. These developments underscore CyberArk's proactive approach in addressing evolving cybersecurity challenges, which might have bolstered investor confidence. Despite market volatility, driven by fluctuating earnings reports and ongoing trade policy uncertainties, CyberArk's advancements in security offerings could have provided a counterweight, positively influencing its stock movement.

We've identified 1 warning sign for CyberArk Software that you should be aware of.

The recent introduction of new identity security solutions and strategic partnerships by CyberArk Software could reinforce its positioning within the identity security market. These developments align with the company's strategy to integrate Venafi and Zilla Security, potentially boosting revenue through cross-selling and market expansion as forecasted in the analysis. This proactive stance in addressing AI-related security risks may enhance investor sentiment.

Over a longer period, CyberArk's total shareholder return has been very large at 257.44% over the past five years, which illustrates a robust performance compared to the recent one-year increase of 7.5% in the US market and 7.6% in the US Software industry. The reported advancements might also impact future earnings forecasts, with ongoing integration efforts creating potential for both growth and complexity in operations. Despite the current share price of US$321.69 being below the analyst consensus target of US$435.58, suggesting a potential upside, achieving the desired financial outcomes depends on executing these integrations successfully.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CYBR

CyberArk Software

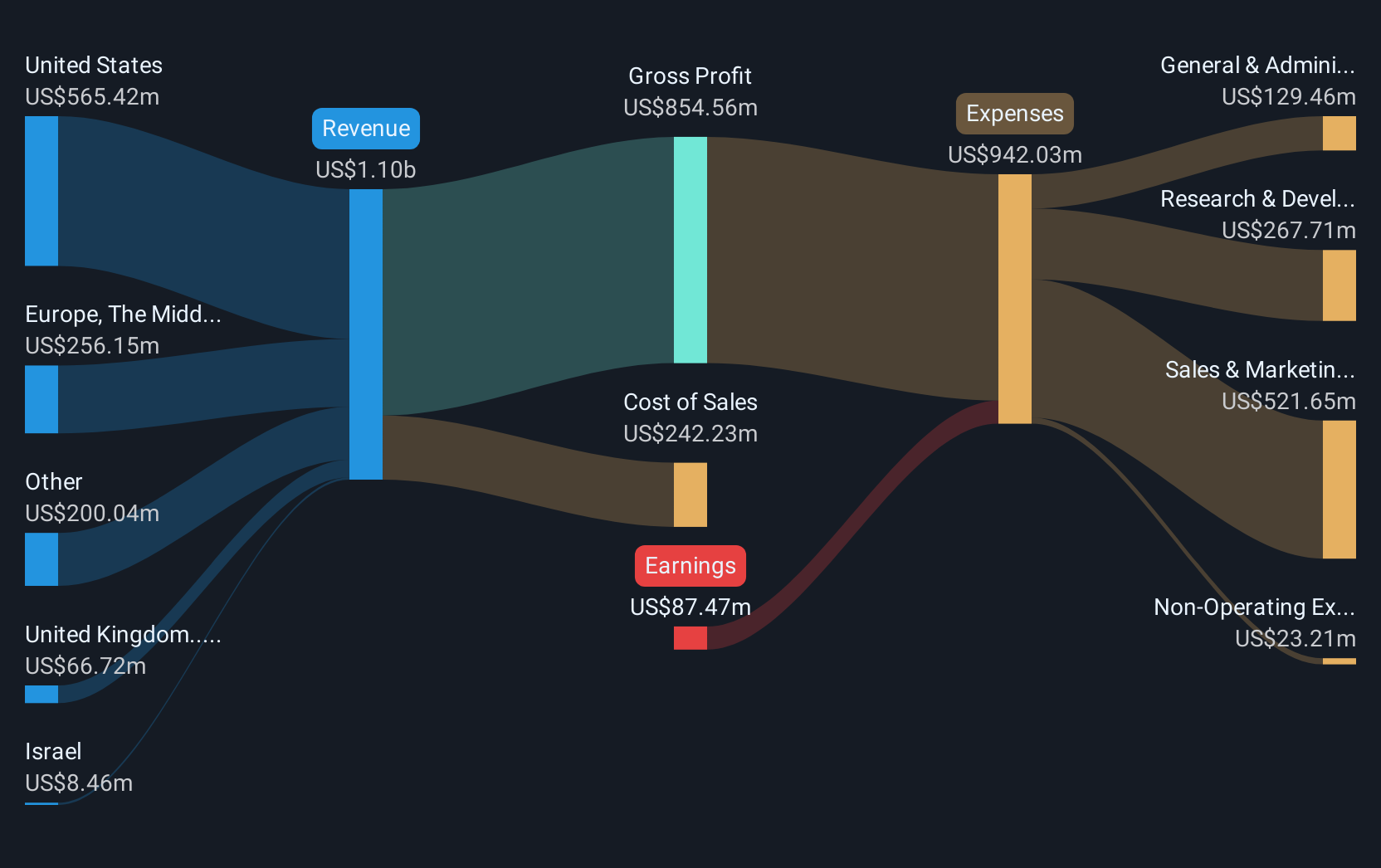

Develops, markets, and sells software-based identity security solutions and services in the United States, Israel, the United Kingdom, Europe, the Middle East, Africa, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion