- United States

- /

- Software

- /

- NasdaqGS:CVLT

It Looks Like Shareholders Would Probably Approve Commvault Systems, Inc.'s (NASDAQ:CVLT) CEO Compensation Package

Key Insights

- Commvault Systems will host its Annual General Meeting on 8th of August

- CEO Sanjay Mirchandani's total compensation includes salary of US$645.0k

- The total compensation is similar to the average for the industry

- Over the past three years, Commvault Systems' EPS grew by 71% and over the past three years, the total shareholder return was 100%

The performance at Commvault Systems, Inc. (NASDAQ:CVLT) has been quite strong recently and CEO Sanjay Mirchandani has played a role in it. Shareholders will have this at the front of their minds in the upcoming AGM on 8th of August. This would also be a chance for them to hear the board review the financial results, discuss future company strategy and vote on any resolutions such as executive remuneration. In light of the great performance, we discuss the case why we think CEO compensation is not excessive.

View our latest analysis for Commvault Systems

How Does Total Compensation For Sanjay Mirchandani Compare With Other Companies In The Industry?

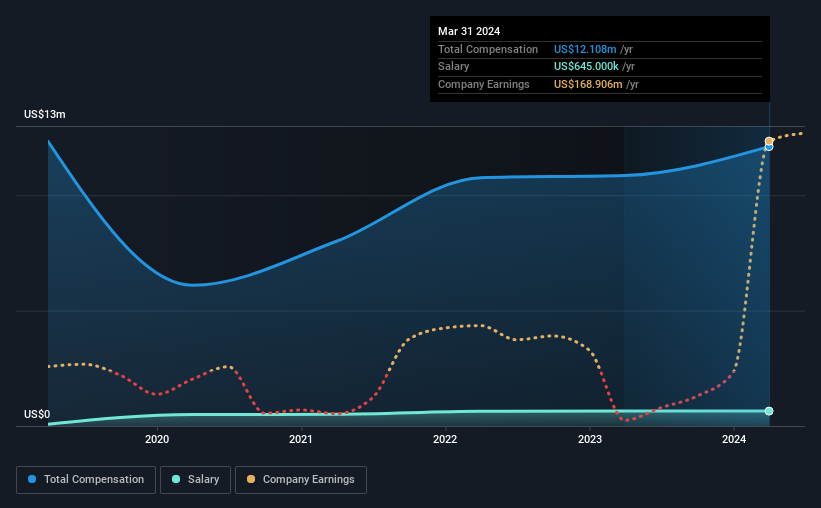

According to our data, Commvault Systems, Inc. has a market capitalization of US$6.7b, and paid its CEO total annual compensation worth US$12m over the year to March 2024. We note that's an increase of 12% above last year. We think total compensation is more important but our data shows that the CEO salary is lower, at US$645k.

For comparison, other companies in the American Software industry with market capitalizations ranging between US$4.0b and US$12b had a median total CEO compensation of US$9.9m. So it looks like Commvault Systems compensates Sanjay Mirchandani in line with the median for the industry. Furthermore, Sanjay Mirchandani directly owns US$34m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | US$645k | US$645k | 5% |

| Other | US$11m | US$10m | 95% |

| Total Compensation | US$12m | US$11m | 100% |

On an industry level, around 15% of total compensation represents salary and 85% is other remuneration. In Commvault Systems' case, non-salary compensation represents a greater slice of total remuneration, in comparison to the broader industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

Commvault Systems, Inc.'s Growth

Over the past three years, Commvault Systems, Inc. has seen its earnings per share (EPS) grow by 71% per year. In the last year, its revenue is up 10%.

This demonstrates that the company has been improving recently and is good news for the shareholders. This sort of respectable year-on-year revenue growth is often seen at a healthy, growing business. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Commvault Systems, Inc. Been A Good Investment?

Boasting a total shareholder return of 100% over three years, Commvault Systems, Inc. has done well by shareholders. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

To Conclude...

Some shareholders will probably be more lenient on CEO compensation in the upcoming AGM given the pleasing performance of the company recently. However, despite the strong growth in earnings and share price growth, the focus for shareholders would be how the company plans to steer the company towards sustainable profitability in the near future.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. We identified 2 warning signs for Commvault Systems (1 is a bit concerning!) that you should be aware of before investing here.

Important note: Commvault Systems is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CVLT

Commvault Systems

Provides a cyber resilience platform for protecting and recovering data and cloud-native applications in the Americas and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

The Future of Social Sharing Is Private and People Are Ready

EU#3 - From Philips Management Buyout to Europe’s Biggest Company

Booking Holdings: Why Ground-Level Travel Trends Still Favor the Platform Giants

A fully integrated LNG business seems to be ignored by the market.

Recently Updated Narratives

Otokar is the first choice for tactical armored land vehicles to meet Europe's defense industry needs.

Palantir: Redefining Enterprise Software for the AI Era

Microsoft - A Fundamental and Historical Valuation

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

AMZN: Acceleration In Cloud And AI Will Drive Margin Expansion Ahead

Trending Discussion

MPAA often has inventory and core-related timing issues. While this quarter’s problems may ease, similar issues have recurred historically and can persist for several quarters. It's not a one-off, it's a structural part of their business. Core returns are simply estimates: How many customers will actually return the original part; how quickly they'll do so; how many are useable; what they're worth, etc. MPAA predicts X sales in a quarter and Y core returns and its reserves, inventory values, etc. are based on that. If they expect a 90% core return rate and only 80% come back it doesn't change cash but they have to write down inventory and increase cost of goods sold which impacts EPS. They've also cited inventory buildup at key customers multiple times in the past. The assumption the latest backlog will all shift into future quarters this year with no impact on pricing, etc. seems more like wishful thinking. Retailer X was slated to buy $10m in parts this quarter but finds they have a lot more inventory on hand than they anticipated so they pushed the order. Realistically there are likely to be SKU cuts, reduction in safety stock on others, etc. Assuming that all $10m will come in this year plus the regular replenishment seems pretty unrealistic. MPAA also has a shaky track record when it comes to new lines and the supposed impact on business. If you look at the EV testing solutions hype back around 2020 that was supposed to diversify them beyond traditional reman and be a higher margin business that would grow with EV adoption. But it has never turned into a material contributor. The debt reduction and stock buy backs are meaningful but IMHO this narrative takes a very optimistic view of things.