- United States

- /

- Software

- /

- NasdaqGS:CVLT

Can Commvault (CVLT) Leverage Its Lumen Partnership to Strengthen AI-Driven Data Resilience?

Reviewed by Sasha Jovanovic

- In late October 2025, Lumen Technologies and Commvault unveiled an expanded partnership, integrating Lumen’s secure global network with Commvault’s cyber resilience platform and launching several AI-driven product innovations, including conversational data management and Data Rooms for AI-ready backup activation.

- This integration not only enhances data protection but also provides proven operational savings and compliance capabilities, signaling a shift in how enterprises can securely leverage backup data for advanced analytics and AI.

- We’ll explore how Commvault’s AI-powered enhancements for cyber resilience and data accessibility influence the company's investment outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Commvault Systems Investment Narrative Recap

Commvault investors need confidence in the company's ability to capitalize on expanding demand for cyber resilience and data management, especially as integration with Lumen Technologies advances next-generation, AI-driven solutions. While this news supports the view that partnerships and product innovation can drive enterprise adoption, a key near-term catalyst, it does not materially shift the primary risk of margin pressure as more revenue shifts to SaaS and subscription, potentially impacting future earnings quality. Investor focus remains on how efficiently Commvault can balance top-line growth with sustainable profitability in the evolving cloud market.

The introduction of Commvault’s new conversational resilience tools, enabling natural language management of data protection tasks, aligns closely with this partnership. This announcement is particularly relevant, as it showcases Commvault’s drive to simplify and automate cyber resilience at scale, reinforcing their position as a leader in enterprise data protection while directly supporting adoption and cross-sell momentum across regulated industries.

Yet, in contrast, investors should be aware that the shift toward SaaS-based recurring revenue brings the risk of margin compression as...

Read the full narrative on Commvault Systems (it's free!)

Commvault Systems' outlook anticipates $1.5 billion in revenue and $173.1 million in earnings by 2028. This is based on a forecasted annual revenue growth rate of 12.2% and an earnings increase of $92 million from current earnings of $81.1 million.

Uncover how Commvault Systems' forecasts yield a $194.70 fair value, a 53% upside to its current price.

Exploring Other Perspectives

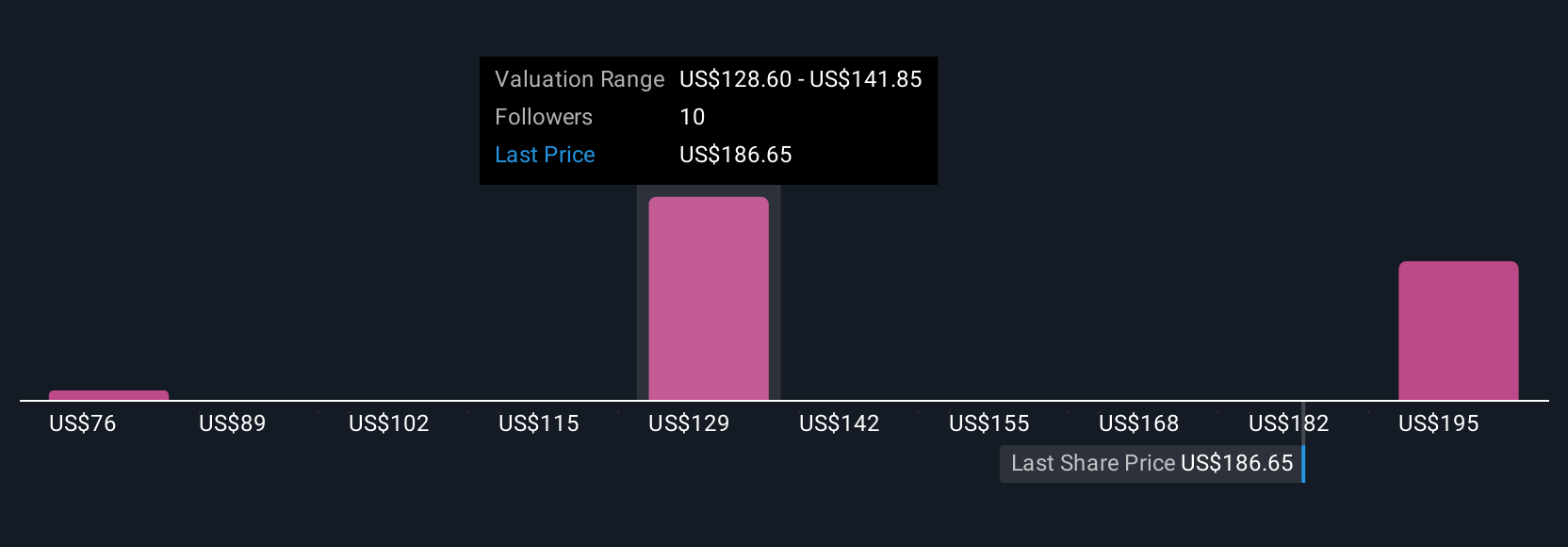

Simply Wall St Community members estimate Commvault’s fair value between US$75.61 and US$207.79 across four diverse analyses. With SaaS revenue growth introducing both opportunity and risk, your view on future profitability may differ widely from others, see how your expectations compare.

Explore 4 other fair value estimates on Commvault Systems - why the stock might be worth 41% less than the current price!

Build Your Own Commvault Systems Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Commvault Systems research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Commvault Systems research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Commvault Systems' overall financial health at a glance.

No Opportunity In Commvault Systems?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CVLT

Commvault Systems

Provides a cyber resilience platform for protecting and recovering data and cloud-native applications in the Americas and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives