- United States

- /

- Software

- /

- NasdaqGS:CVLT

Assessing Commvault Systems (CVLT) Valuation As Geo Shield Targets Sovereign Cloud And Data Security Demand

Why Commvault Geo Shield Matters for CVLT Shareholders

Commvault Systems (CVLT) has introduced Commvault Geo Shield, a data protection offering aimed at customers that need strict control over data location, operational oversight, and encryption keys in cloud environments.

The launch focuses on organizations with sovereign and compliance-driven requirements, adding options such as local and sovereign hyperscaler regions, partner-operated sovereign services, and private sovereign cloud deployments for sensitive workloads.

See our latest analysis for Commvault Systems.

At a share price of $87.54, Commvault’s 7 day share price return of 7.07% contrasts with a 30 day share price return decline of 29.50% and a 1 year total shareholder return decline of 50.97%. However, the 3 year total shareholder return of 37.79% and 5 year total shareholder return of 25.99% indicate longer term holders have still seen gains, so recent momentum has been fading despite product updates like Geo Shield drawing fresh attention to the story.

If Geo Shield has you thinking about the broader data and AI opportunity, this could be a good moment to check out 59 profitable AI stocks that aren't just burning cash as a starting list of ideas.

With Geo Shield targeting regulated cloud workloads and Commvault shares trading 39% below the average analyst price target, investors now face a key question: is the recent share price drop a buying opportunity, or is future growth already priced in?

Most Popular Narrative: 38% Undervalued

Commvault Systems most followed narrative pegs fair value at about $140.33 per share compared with the last close at $87.54, setting up a wide valuation gap investors will want to understand.

Analysts have reset their price expectations for Commvault Systems, trimming the fair value estimate from about $175 to roughly $140 as they incorporate lower Street price targets, slightly higher discount rates, modestly softer revenue growth assumptions and a reduced future P/E, partly balanced by higher projected profit margins.

Curious what justifies that gap between price and fair value? The narrative leans heavily on healthier margins, steady revenue growth and a premium future earnings multiple to support its case.

Result: Fair Value of $140.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there are clear pressure points here, including reliance on large, lumpy deals, as well as the risk that new customer growth lags expansion within the existing base.

Find out about the key risks to this Commvault Systems narrative.

Another Angle On CVLT’s Valuation

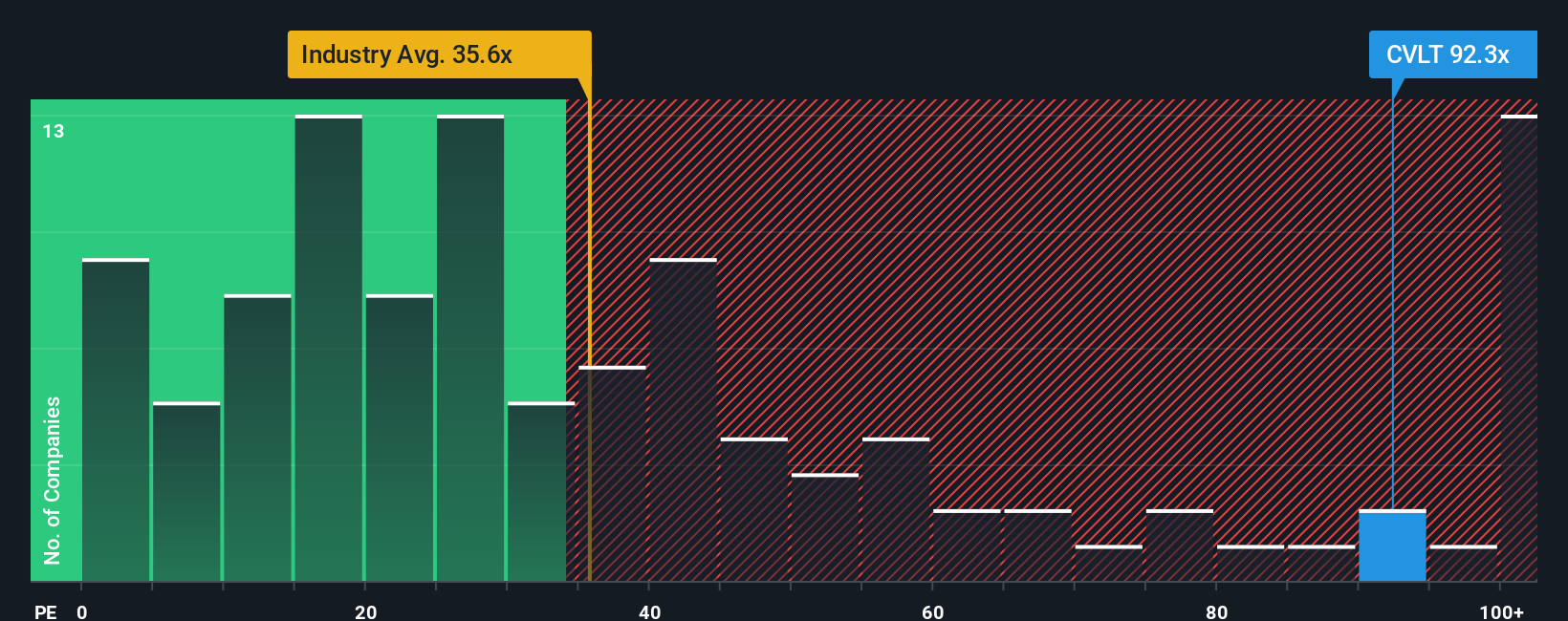

The narrative suggests CVLT is 38% undervalued, but the current P/E of 44.2x tells a different story. That is richer than the US Software industry at 28x, its peer average at 26.5x, and even the fair ratio of 34.1x. This hints at valuation risk if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Commvault Systems Narrative

If you are not fully on board with this view or simply prefer to rely on your own analysis, you can build a tailored story around the same data in just a few minutes, starting with Do it your way.

A great starting point for your Commvault Systems research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Commvault has sharpened your focus, do not stop here. Broaden your watchlist with other ideas that could fit your style and risk comfort.

- Target value opportunities by reviewing 51 high quality undervalued stocks that pair quality fundamentals with prices that may not fully reflect them.

- Prioritize resilience by scanning 83 resilient stocks with low risk scores designed to highlight companies with more stable risk profiles.

- Hunt for potential future leaders by checking our screener containing 24 high quality undiscovered gems that many investors may be overlooking.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CVLT

Commvault Systems

Provides a cyber resilience platform for protecting and recovering data and cloud-native applications in the Americas and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

Storytel’s Second Act: From Market Land Grab to High Margin Ecosystem

Inotiv NAMs Test Center

Delta loses shine after warning of falling travel demand, but still industry leader

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

The Strategic Revaluation of Adobe: A Critical Analysis of Market Sentiment

Trending Discussion

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.