- United States

- /

- Software

- /

- NasdaqGS:CVLT

A Fresh Valuation Look at Commvault Systems (CVLT) Following Recent Share Price Pullback

Reviewed by Simply Wall St

Commvault Systems (CVLT) has caught investors’ attention lately, with shares showing a modest daily gain but lagging over the past month. This shift has some market watchers reassessing the company’s recent performance and underlying growth story.

See our latest analysis for Commvault Systems.

Commvault’s share price has tumbled nearly 26% over the past month and is down 16% year-to-date, signaling that recent investor confidence is cooling despite solid business growth. However, with a three-year total shareholder return of 98%, long-term holders have fared well even as short-term momentum fades.

If this shift has you rethinking your approach, it could be the perfect time to broaden your investing horizons and discover fast growing stocks with high insider ownership

Given this recent pullback, is Commvault now offering investors an attractive entry point with its solid fundamentals? Or is the current stock price simply reflecting expectations for future growth already?

Most Popular Narrative: 34.6% Undervalued

According to the most widely followed narrative, Commvault Systems' fair value sits far above the last close of $127.38. This reflects a sharp divergence between analyst expectations and the market price. High-quality recurring revenues and ambitious financial targets are fueling the bullish scenario, even as investors digest recent volatility.

Rapid expansion and successful cross-sell/upsell momentum within the SaaS (Metallic) platform, evidenced by 63% SaaS ARR growth, a 45% increase in multi-product customers, and 125% SaaS net dollar retention, point to continued improvement in the quality and predictability of future revenues. These trends directly support margin expansion and higher earnings visibility.

Want to know the financial engine behind this optimism? The fair value here hinges on analyst projections of surging margins and bold top-line growth. Curious about which assumptions push that valuation sky-high? Uncover the precise growth forecasts and future profit multiples now.

Result: Fair Value of $194.70 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shorter contract durations and a declining margin outlook could present challenges for Commvault’s ability to deliver on these optimistic forecasts.

Find out about the key risks to this Commvault Systems narrative.

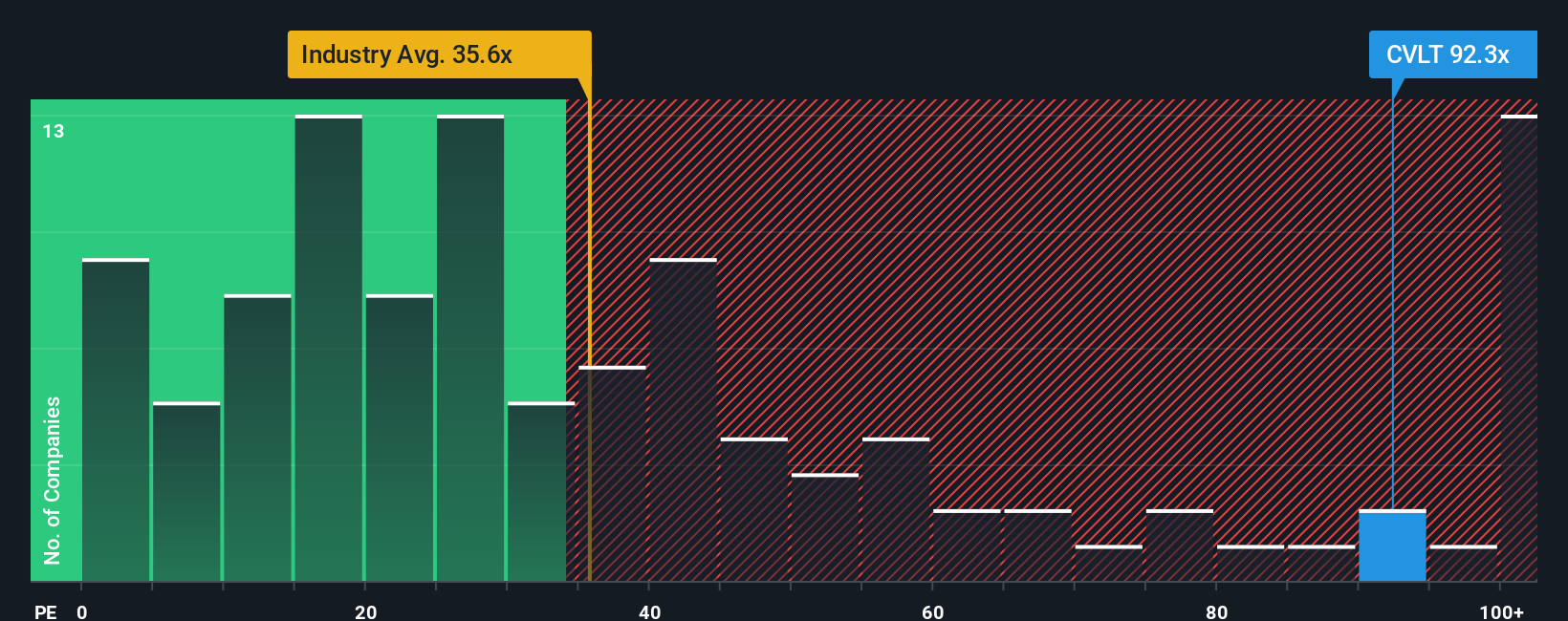

Another View: Valuation by Market Multiples

Looking at Commvault through the lens of the price-to-earnings ratio, things feel different. The company's P/E sits at 70x, sharply above the US software industry average of 31.5x, and much higher than the fair ratio of 34.4x. Compared to peers (average 25.4x), this suggests the market is baking in a lot of future growth and optimism. This introduces real valuation risk if results disappoint. Is the stock’s premium truly justified, or does this set the stage for volatility?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Commvault Systems Narrative

If you see things differently or want to dig into the data yourself, it takes just a few minutes to craft your own perspective here, so why not Do it your way

A great starting point for your Commvault Systems research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Why limit your investing game plan to just one company? Take action now to uncover more opportunities and gain the edge with advanced stock ideas from our powerful screener.

- Fuel your growth strategy by tapping into these 879 undervalued stocks based on cash flows that show strong fundamentals but haven't caught everyone’s attention yet.

- Target reliable income and bring stability to your portfolio with these 16 dividend stocks with yields > 3% featuring attractive yields above 3%.

- Position yourself ahead of the curve in groundbreaking tech by accessing these 26 quantum computing stocks making waves in quantum computing and innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CVLT

Commvault Systems

Provides a cyber resilience platform for protecting and recovering data and cloud-native applications in the Americas and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives