- United States

- /

- Software

- /

- NasdaqGS:CTXS

If You Had Bought Citrix Systems (NASDAQ:CTXS) Shares Five Years Ago You'd Have Made 79%

Generally speaking the aim of active stock picking is to find companies that provide returns that are superior to the market average. Buying under-rated businesses is one path to excess returns. To wit, the Citrix Systems share price has climbed 79% in five years, easily topping the market return of 50% (ignoring dividends). However, more recent returns haven't been as impressive as that, with the stock returning just 0.6% in the last year , including dividends .

View 2 warning signs we detected for Citrix Systems

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

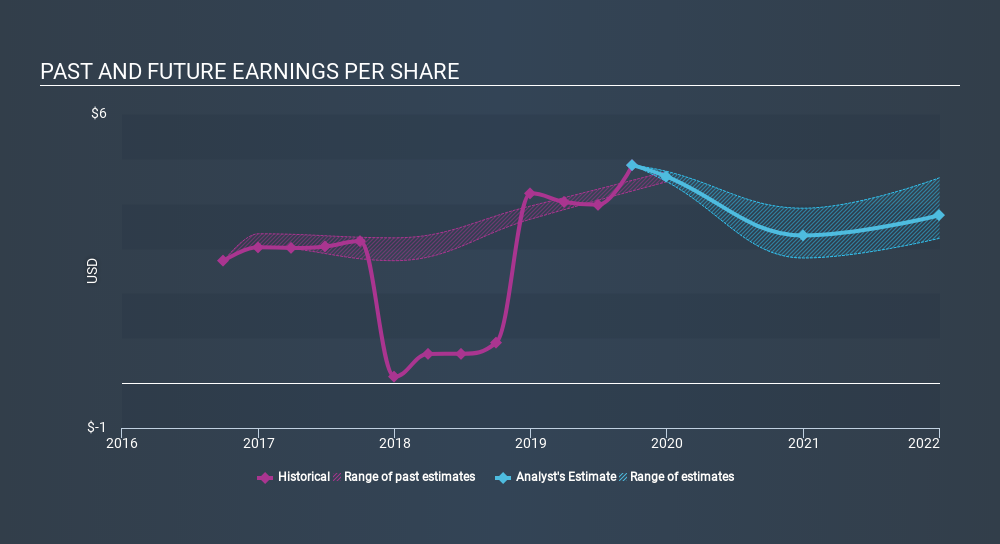

During five years of share price growth, Citrix Systems achieved compound earnings per share (EPS) growth of 24% per year. The EPS growth is more impressive than the yearly share price gain of 12% over the same period. Therefore, it seems the market has become relatively pessimistic about the company.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

While share prices often depend primarily on earnings, they can be sensitive to an investment's risk level as well. For example, we've discovered 2 warning signs for Citrix Systems (of which 1 is major) which any shareholder or potential investor should be aware of.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. In the case of Citrix Systems, it has a TSR of 128% for the last 5 years. That exceeds its share price return that we previously mentioned. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

Citrix Systems provided a TSR of 0.6% over the last twelve months. But that was short of the market average. It's probably a good sign that the company has an even better long term track record, having provided shareholders with an annual TSR of 18% over five years. It may well be that this is a business worth popping on the watching, given the continuing positive reception, over time, from the market. Before spending more time on Citrix Systems it might be wise to click here to see if insiders have been buying or selling shares.

We will like Citrix Systems better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NasdaqGS:CTXS

Citrix Systems

Citrix Systems, Inc., an enterprise software company, provides workspace, app delivery and security, and professional services worldwide.

Fair value with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives