- United States

- /

- IT

- /

- NasdaqGS:CTSH

Should Cognizant’s (CTSH) AI-Powered Offerings and Buybacks Reshape Its Competitive Edge?

Reviewed by Sasha Jovanovic

- Cognizant Technology Solutions recently reported third-quarter 2025 results, unveiling US$5.42 billion in sales and net income of US$274 million, alongside fresh earnings guidance and extensive share buyback updates.

- A significant expansion in AI-driven offerings, including Business Resilience-as-a-Service with Rubrik, advances in large language model fine-tuning, and new patents, underscores Cognizant’s focus on integrating AI and business resilience across its portfolio.

- We’ll now consider how Cognizant’s enhanced AI innovation and resilience solutions may influence its future market positioning and investment case.

Find companies with promising cash flow potential yet trading below their fair value.

Cognizant Technology Solutions Investment Narrative Recap

To be a Cognizant shareholder, you need to believe the company can successfully reinvent its core services through AI-driven solutions, proprietary platforms, and resilient enterprise offerings, while navigating the risks of automation’s potential revenue impact and competitive pricing pressures. The latest quarterly update confirmed steady revenue growth and highlighted continued investment in AI, but also revealed a meaningful dip in net income, making profitability trends the most important near-term catalyst, with wage and margin pressures remaining the top risk. On balance, recent news does not fundamentally alter these priorities, but keeps the spotlight on execution and margin sustainability.

Among Cognizant’s recent announcements, the expanded partnership with Rubrik to provide Business Resilience-as-a-Service is especially relevant. As AI adoption broadens and clients’ operational risks rise, offerings that directly address data integrity and continuity could help Cognizant shift more business toward high-value, recurring revenue streams, supporting both the company’s growth catalysts and its focus on resilient margins.

By contrast, investors should be especially aware of ongoing wage inflation and staffing retention pressures, as these could quickly weigh on margins if AI-driven productivity gains do not keep pace with costs...

Read the full narrative on Cognizant Technology Solutions (it's free!)

Cognizant Technology Solutions is projected to reach $23.5 billion in revenue and $2.9 billion in earnings by 2028. This forecast is based on an annual revenue growth rate of 4.7% and a $0.5 billion increase in earnings from the current level of $2.4 billion.

Uncover how Cognizant Technology Solutions' forecasts yield a $84.39 fair value, a 18% upside to its current price.

Exploring Other Perspectives

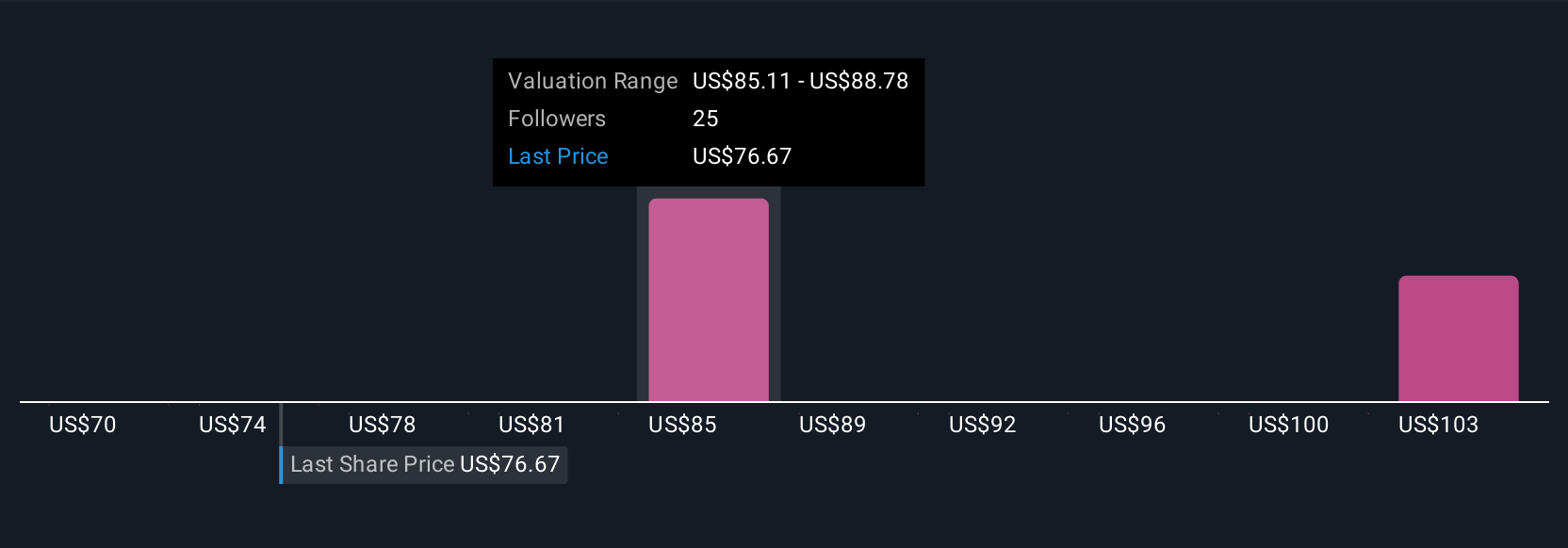

Eight Simply Wall St Community fair value estimates for Cognizant range from US$66.06 to US$117.68, capturing sharply different outlooks. With wage inflation and retention still a prominent risk, now is a time to see how your view compares.

Explore 8 other fair value estimates on Cognizant Technology Solutions - why the stock might be worth as much as 64% more than the current price!

Build Your Own Cognizant Technology Solutions Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cognizant Technology Solutions research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Cognizant Technology Solutions research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cognizant Technology Solutions' overall financial health at a glance.

Contemplating Other Strategies?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CTSH

Cognizant Technology Solutions

A professional services company, provides consulting and technology, and outsourcing services in North America, Europe, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives