- United States

- /

- IT

- /

- NasdaqGS:CTSH

Cognizant Technology Solutions (NasdaqGS:CTSH) Expands AI Capabilities With Pegasystems Partnership and Open-Sources Neuro AI

Reviewed by Simply Wall St

Cognizant Technology Solutions (NasdaqGS:CTSH) saw a significant 18% increase in its share price over the past month, coinciding with pivotal developments. The company expanded its collaboration with Pegasystems Inc. to drive AI services and cloud transformation, and open-sourced its Neuro AI Multi-Agent Accelerator, focusing on innovation in AI systems. Despite the broader market experiencing a 1.1% decline, these advancements in AI and strategic partnerships have potentially bolstered Cognizant's stock performance. The ongoing buyback program and quarterly dividend may have also contributed positively, aligning shareholder interests with the favorable market sentiment in the tech sector.

The recent collaboration between Cognizant Technology Solutions and Pegasystems, along with advancements in AI technology, holds significant potential to enhance the company's strategic narrative focused on innovation and operational efficiency. By open-sourcing the Neuro AI Multi-Agent Accelerator, Cognizant may bolster its technological capabilities, potentially influencing future revenue and earnings forecasts positively. The ongoing buyback program and dividend payments further align shareholder interests with these growth initiatives.

Over a five-year period, Cognizant's total return, including share price appreciation and dividends, amounted to 55.73%. This longer-term perspective highlights consistent shareholder gains, positioned against a recent one-year performance where Cognizant exceeded the US market's 11.1% return yet underperformed the US IT industry's 29.1% return.

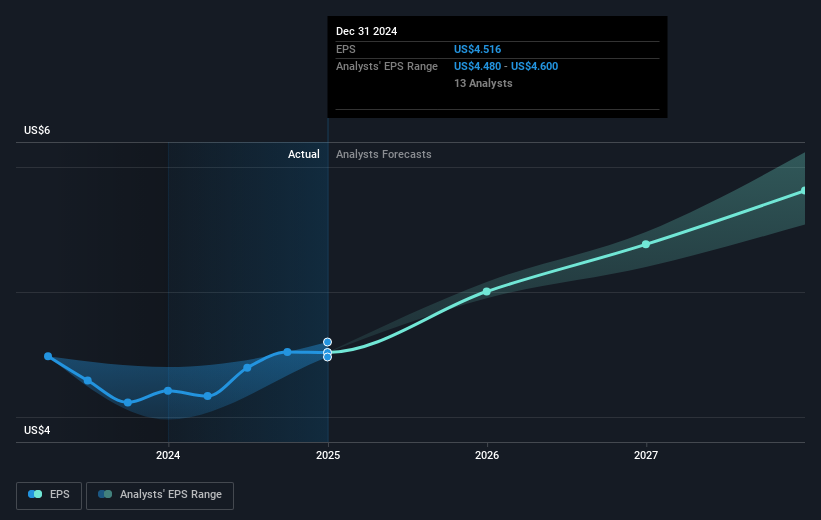

Given today's share price of US$77.64, Cognizant is trading at a 10.3% discount to the consensus price target of US$86.55. This gap suggests that analysts anticipate further internal optimizations and external partnerships will support higher future valuations. Despite the anticipated growth, the consensus anticipates earnings to increase 6.6% annually, below the overall US market growth forecast of 14.3% per annum. With analysts projecting earnings to reach US$2.9 billion by 2028, the news around AI and partnerships could become integral to realizing these forecasts.

Review our growth performance report to gain insights into Cognizant Technology Solutions' future.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CTSH

Cognizant Technology Solutions

A professional services company, provides consulting and technology, and outsourcing services in North America, Europe, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives