- United States

- /

- IT

- /

- NasdaqGS:CTSH

Cognizant Technology Solutions (NASDAQ:CTSH) Has A Rock Solid Balance Sheet

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, Cognizant Technology Solutions Corporation (NASDAQ:CTSH) does carry debt. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we think about a company's use of debt, we first look at cash and debt together.

How Much Debt Does Cognizant Technology Solutions Carry?

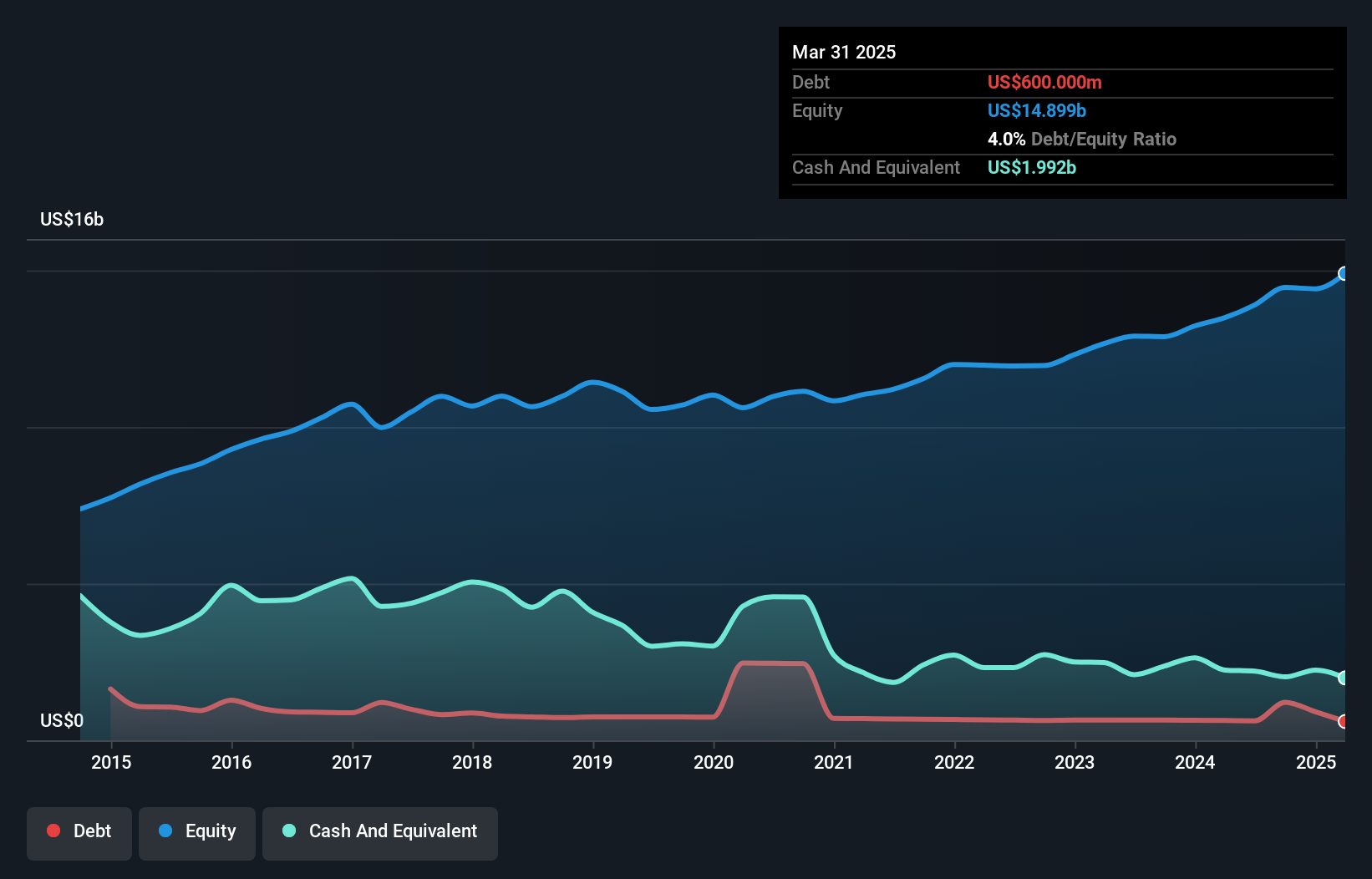

As you can see below, Cognizant Technology Solutions had US$600.0m of debt at March 2025, down from US$631.0m a year prior. However, its balance sheet shows it holds US$1.99b in cash, so it actually has US$1.39b net cash.

A Look At Cognizant Technology Solutions' Liabilities

The latest balance sheet data shows that Cognizant Technology Solutions had liabilities of US$3.41b due within a year, and liabilities of US$1.66b falling due after that. Offsetting these obligations, it had cash of US$1.99b as well as receivables valued at US$4.24b due within 12 months. So it can boast US$1.16b more liquid assets than total liabilities.

This surplus suggests that Cognizant Technology Solutions has a conservative balance sheet, and could probably eliminate its debt without much difficulty. Simply put, the fact that Cognizant Technology Solutions has more cash than debt is arguably a good indication that it can manage its debt safely.

View our latest analysis for Cognizant Technology Solutions

The good news is that Cognizant Technology Solutions has increased its EBIT by 5.4% over twelve months, which should ease any concerns about debt repayment. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Cognizant Technology Solutions can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. While Cognizant Technology Solutions has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Over the most recent three years, Cognizant Technology Solutions recorded free cash flow worth 69% of its EBIT, which is around normal, given free cash flow excludes interest and tax. This free cash flow puts the company in a good position to pay down debt, when appropriate.

Summing Up

While it is always sensible to investigate a company's debt, in this case Cognizant Technology Solutions has US$1.39b in net cash and a decent-looking balance sheet. The cherry on top was that in converted 69% of that EBIT to free cash flow, bringing in US$2.1b. So we don't think Cognizant Technology Solutions's use of debt is risky. We'd be very excited to see if Cognizant Technology Solutions insiders have been snapping up shares. If you are too, then click on this link right now to take a (free) peek at our list of reported insider transactions.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:CTSH

Cognizant Technology Solutions

A professional services company, provides consulting and technology, and outsourcing services in North America, Europe, and internationally.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

EU#4 - Turning Heritage into the World’s Strongest Luxury Empire

The "Easy Money" Is Gone: Why Alphabet Is Now a "Show Me" Story

Recently Updated Narratives

Great dividend but share numbers have increased 100% in last 12 months!!

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion