- United States

- /

- IT

- /

- NasdaqGS:CTSH

Cognizant (CTSH): Margin Compression Sparks Debate on Growth Narrative Despite Discounted Valuation

Reviewed by Simply Wall St

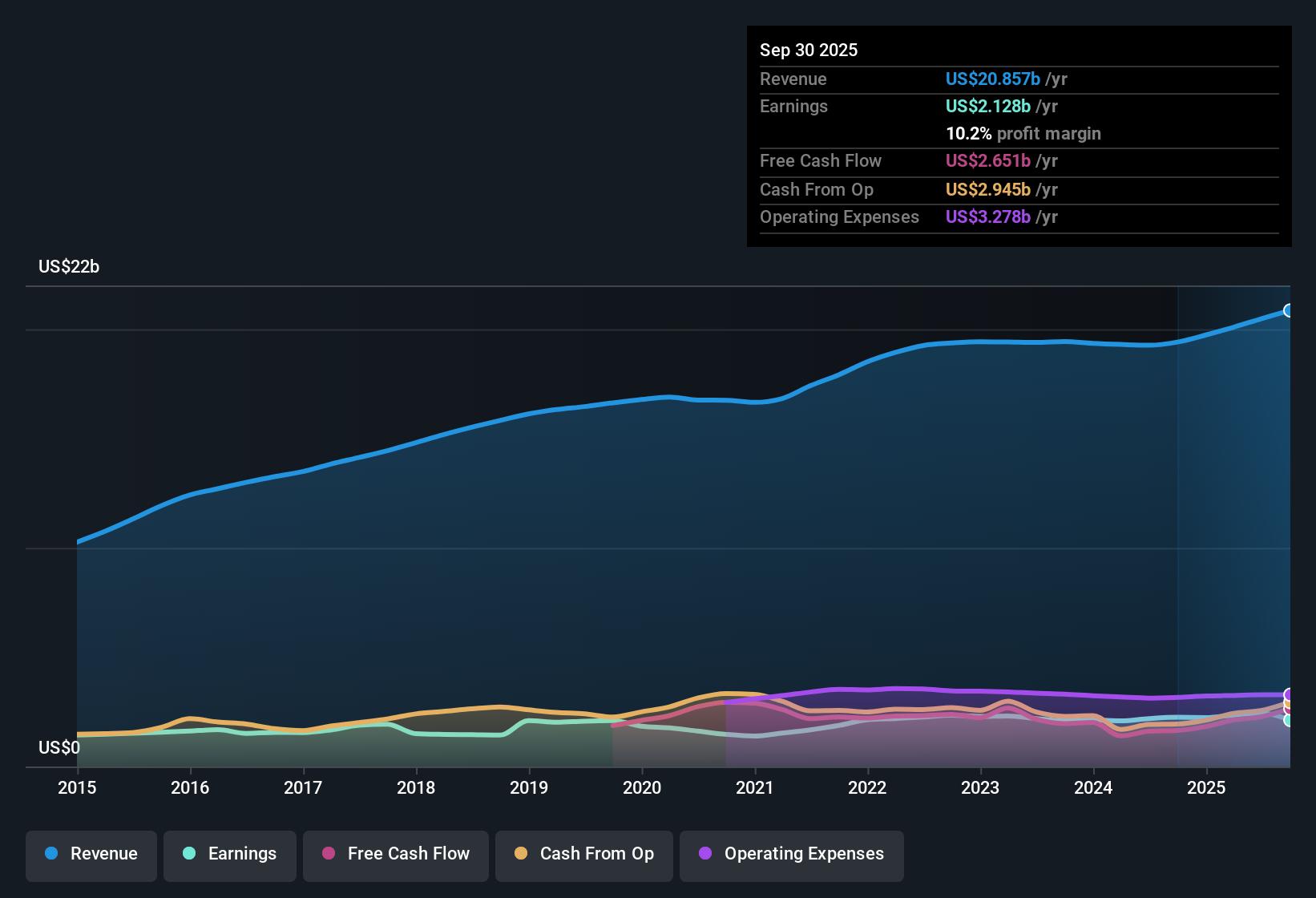

Cognizant Technology Solutions (CTSH) posted annual earnings growth of 6.9% over the past five years, with EPS now projected to climb 11.78% per year going forward. Meanwhile, annual revenue growth is expected at 4.6%, which trails behind the broader US market's 10.3% pace. Net profit margin has tightened to 10.2% from last year's 11.6%, indicating some margin compression even as the company remains focused on quality results.

See our full analysis for Cognizant Technology Solutions.Next up, we will see how these earnings results compare when set against the major narratives shaping investor sentiment on Simply Wall St. This will highlight where expectations align and where surprises may be found.

See what the community is saying about Cognizant Technology Solutions

Profit Margin Dips, But AI Gains Support Resilience

- The net profit margin narrowed to 10.2% from 11.6% last year, putting pressure on overall profitability even as headline earnings grew.

- Analysts' consensus view highlights that investments in proprietary AI, automation, and outcome-based digital services are expected to soften margin pressures and open new sources of high-quality, recurring revenue.

- Consensus narrative notes that a strategic focus on large-scale digital transformation and rapid adoption of automation should continue to bolster market share and help absorb margin volatility.

- Expansion in AI-driven consulting and improved developer productivity is cited as a key lever for sustaining future margin improvements, even in the face of tightening near-term profit rates.

- Stronger earnings durability from long-term digital contracts challenges the notion that margin compression alone undermines the growth story. The consensus expects net margins to rise to 12.5% within three years.

- This ongoing transition to higher-value projects and new-gen outsourcing positions Cognizant to weather structural changes in demand, despite temporary operational headwinds.

Discounted Valuation Stands Out Versus Peers

- Cognizant’s price-to-earnings ratio is 16.6x, significantly below the US IT industry average of 29.3x and its peer group’s 21.8x, with shares trading at $72.19 compared to a DCF fair value of $118.35.

- Analysts' consensus view underscores that a sustained valuation gap represents a strong upside scenario if Cognizant delivers on recurring earnings growth and executes its AI-led strategy.

- The current share price stands at a notable discount, nearly 39% below its DCF fair value, while analysts assign an average price target of $84.82, indicating potential for re-rating as positive earnings momentum builds.

- Consensus also calls out that the undervaluation provides downside protection, especially given Cognizant’s stronger-than-average earnings quality and no signs of material insider selling.

Steady Revenue Growth Lags Broader Market

- Annualized revenue is projected to rise 4.6%, which, while solid, sits well below the broader US market’s expected growth rate of 10.3% per year.

- Analysts' consensus narrative acknowledges that while Cognizant’s revenue trajectory is more conservative than peers, long-term digital transformation contracts and expanding platform capabilities offer greater earnings stability.

- Bears may point to muted top-line growth versus market averages, but consensus sees greater visibility and durability in multi-year digital deals as a counterweight to headline growth concerns.

- The transition to recurring, higher-margin revenue streams could gradually close the growth gap as traditional consulting cycles are replaced by next-gen digital offerings.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Cognizant Technology Solutions on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on these figures? In just minutes, you can shape your personal narrative and see where your interpretation leads. Do it your way

A great starting point for your Cognizant Technology Solutions research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

While Cognizant consistently generates profits, its relatively slow revenue growth and recent margin compression suggest it may lag the broader market momentum.

If you want to focus on dependable performance, use our stable growth stocks screener (2110 results) to find companies with steadier earnings and revenue growth in changing markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CTSH

Cognizant Technology Solutions

A professional services company, provides consulting and technology, and outsourcing services in North America, Europe, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion