- United States

- /

- IT

- /

- NasdaqGS:CTG

Returns On Capital At Computer Task Group (NASDAQ:CTG) Have Hit The Brakes

What trends should we look for it we want to identify stocks that can multiply in value over the long term? One common approach is to try and find a company with returns on capital employed (ROCE) that are increasing, in conjunction with a growing amount of capital employed. Ultimately, this demonstrates that it's a business that is reinvesting profits at increasing rates of return. However, after briefly looking over the numbers, we don't think Computer Task Group (NASDAQ:CTG) has the makings of a multi-bagger going forward, but let's have a look at why that may be.

Understanding Return On Capital Employed (ROCE)

For those that aren't sure what ROCE is, it measures the amount of pre-tax profits a company can generate from the capital employed in its business. The formula for this calculation on Computer Task Group is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.095 = US$11m ÷ (US$180m - US$60m) (Based on the trailing twelve months to October 2021).

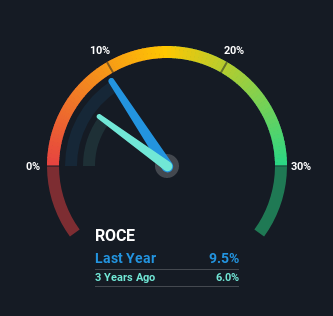

Thus, Computer Task Group has an ROCE of 9.5%. In absolute terms, that's a low return and it also under-performs the IT industry average of 14%.

Check out our latest analysis for Computer Task Group

Above you can see how the current ROCE for Computer Task Group compares to its prior returns on capital, but there's only so much you can tell from the past. If you'd like, you can check out the forecasts from the analysts covering Computer Task Group here for free.

What Can We Tell From Computer Task Group's ROCE Trend?

There are better returns on capital out there than what we're seeing at Computer Task Group. The company has consistently earned 9.5% for the last five years, and the capital employed within the business has risen 28% in that time. Given the company has increased the amount of capital employed, it appears the investments that have been made simply don't provide a high return on capital.

What We Can Learn From Computer Task Group's ROCE

In summary, Computer Task Group has simply been reinvesting capital and generating the same low rate of return as before. Investors must think there's better things to come because the stock has knocked it out of the park, delivering a 100% gain to shareholders who have held over the last five years. Ultimately, if the underlying trends persist, we wouldn't hold our breath on it being a multi-bagger going forward.

If you're still interested in Computer Task Group it's worth checking out our FREE intrinsic value approximation to see if it's trading at an attractive price in other respects.

While Computer Task Group isn't earning the highest return, check out this free list of companies that are earning high returns on equity with solid balance sheets.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:CTG

Computer Task Group

Computer Task Group, Incorporated, together with its subsidiaries, offers information and technology-related services in North America and Europe.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

Sogeclair's Outlook Will See a 18x Future PE in Five Years

The Grid Modernizer: Leidos and the $2.4 Billion Bet on Sovereign AI and Energy

EU#6 - From Political Experiment to Global Aerospace Power

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.