Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We can see that CSP Inc. (NASDAQ:CSPI) does use debt in its business. But should shareholders be worried about its use of debt?

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out the opportunities and risks within the US IT industry.

How Much Debt Does CSP Carry?

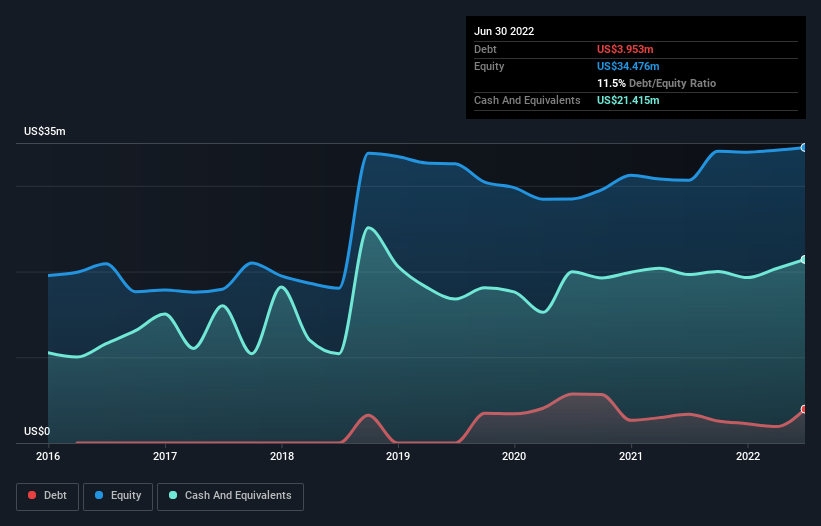

The image below, which you can click on for greater detail, shows that at June 2022 CSP had debt of US$3.95m, up from US$3.36m in one year. But on the other hand it also has US$21.4m in cash, leading to a US$17.5m net cash position.

A Look At CSP's Liabilities

We can see from the most recent balance sheet that CSP had liabilities of US$22.0m falling due within a year, and liabilities of US$8.06m due beyond that. Offsetting this, it had US$21.4m in cash and US$21.3m in receivables that were due within 12 months. So it can boast US$12.7m more liquid assets than total liabilities.

This surplus liquidity suggests that CSP's balance sheet could take a hit just as well as Homer Simpson's head can take a punch. On this view, lenders should feel as safe as the beloved of a black-belt karate master. Simply put, the fact that CSP has more cash than debt is arguably a good indication that it can manage its debt safely. There's no doubt that we learn most about debt from the balance sheet. But it is CSP's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Over 12 months, CSP made a loss at the EBIT level, and saw its revenue drop to US$48m, which is a fall of 11%. That's not what we would hope to see.

So How Risky Is CSP?

Although CSP had an earnings before interest and tax (EBIT) loss over the last twelve months, it made a statutory profit of US$770k. So when you consider it has net cash, along with the statutory profit, the stock probably isn't as risky as it might seem, at least in the short term. With mediocre revenue growth in the last year, we're don't find the investment opportunity particularly compelling. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. These risks can be hard to spot. Every company has them, and we've spotted 3 warning signs for CSP (of which 1 is concerning!) you should know about.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:CSPI

CSP

Develops and markets IT integration solutions, security products, managed IT services, cloud services, network adapters, and cluster computer systems for commercial and defense customers worldwide.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026