Vic Dellovo became the CEO of CSP Inc. (NASDAQ:CSPI) in 2012, and we think it's a good time to look at the executive's compensation against the backdrop of overall company performance. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

See our latest analysis for CSP

Comparing CSP Inc.'s CEO Compensation With the industry

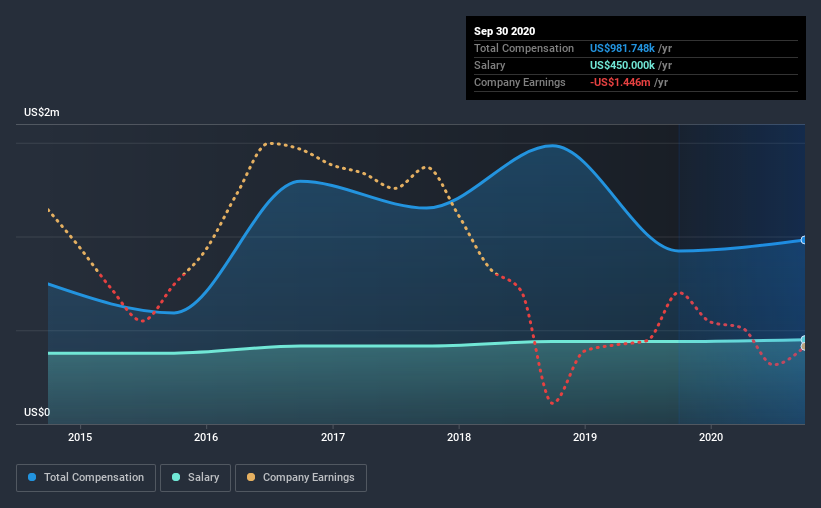

Our data indicates that CSP Inc. has a market capitalization of US$42m, and total annual CEO compensation was reported as US$982k for the year to September 2020. That's a modest increase of 6.4% on the prior year. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at US$450k.

On comparing similar-sized companies in the industry with market capitalizations below US$200m, we found that the median total CEO compensation was US$432k. Hence, we can conclude that Vic Dellovo is remunerated higher than the industry median. Furthermore, Vic Dellovo directly owns US$2.9m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | US$450k | US$440k | 46% |

| Other | US$532k | US$483k | 54% |

| Total Compensation | US$982k | US$923k | 100% |

Talking in terms of the industry, salary represented approximately 14% of total compensation out of all the companies we analyzed, while other remuneration made up 86% of the pie. According to our research, CSP has allocated a higher percentage of pay to salary in comparison to the wider industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

CSP Inc.'s Growth

Over the last three years, CSP Inc. has shrunk its earnings per share by 67% per year. It saw its revenue drop 22% over the last year.

Few shareholders would be pleased to read that EPS have declined. This is compounded by the fact revenue is actually down on last year. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has CSP Inc. Been A Good Investment?

Since shareholders would have lost about 38% over three years, some CSP Inc. investors would surely be feeling negative emotions. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

In Summary...

As we noted earlier, CSP pays its CEO higher than the norm for similar-sized companies belonging to the same industry. Unfortunately, this doesn't look great when you see shareholder returns have been negative over the last three years. Arguably worse, we've been waiting for positive EPS growth for the last three years. Overall, with such poor performance, shareholder's would probably have questions if the company decided to give the CEO a raise.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. We identified 4 warning signs for CSP (1 shouldn't be ignored!) that you should be aware of before investing here.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

If you’re looking to trade CSP, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGM:CSPI

CSP

Develops and markets IT integration solutions, security products, managed IT services, cloud services, network adapters, and cluster computer systems for commercial and defense customers worldwide.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion