If you want to know who really controls CSP Inc. (NASDAQ:CSPI), then you'll have to look at the makeup of its share registry. Generally speaking, as a company grows, institutions will increase their ownership. Conversely, insiders often decrease their ownership over time. Warren Buffett said that he likes "a business with enduring competitive advantages that is run by able and owner-oriented people." So it's nice to see some insider ownership, because it may suggest that management is owner-oriented.

CSP is not a large company by global standards. It has a market capitalization of US$33m, which means it wouldn't have the attention of many institutional investors. Our analysis of the ownership of the company, below, shows that institutional investors have bought into the company. Let's delve deeper into each type of owner, to discover more about CSP.

View our latest analysis for CSP

What Does The Institutional Ownership Tell Us About CSP?

Institutional investors commonly compare their own returns to the returns of a commonly followed index. So they generally do consider buying larger companies that are included in the relevant benchmark index.

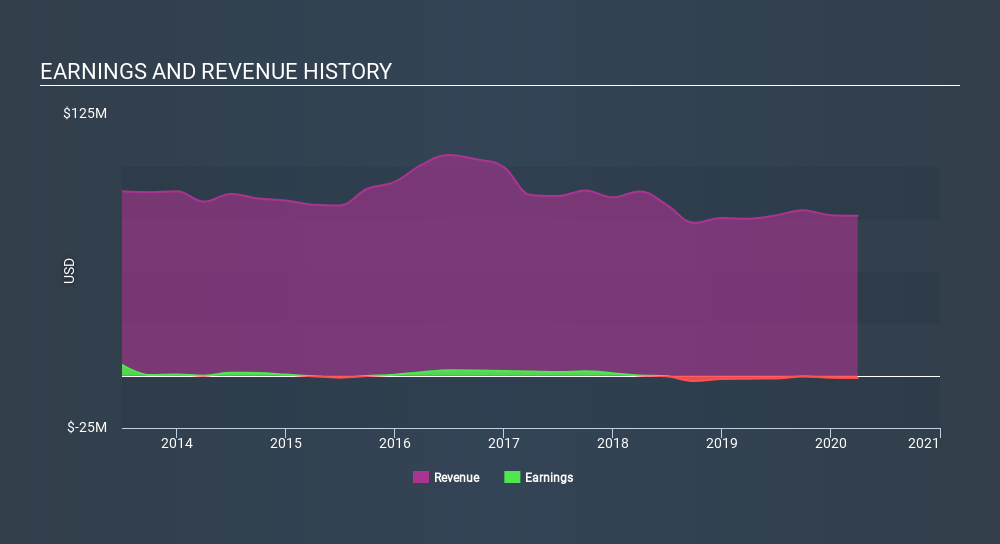

CSP already has institutions on the share registry. Indeed, they own 29% of the company. This can indicate that the company has a certain degree of credibility in the investment community. However, it is best to be wary of relying on the supposed validation that comes with institutional investors. They too, get it wrong sometimes. It is not uncommon to see a big share price drop if two large institutional investors try to sell out of a stock at the same time. So it is worth checking the past earnings trajectory of CSP, (below). Of course, keep in mind that there are other factors to consider, too.

It looks like hedge funds own 5.7% of CSP shares. That worth noting, since hedge funds are often quite active investors, who may try to influence management. Many want to see value creation (and a higher share price) in the short term or medium term. The company's largest shareholder is Joseph Nerges, with ownership of 9.5%, The second and third largest shareholders are Victor Dellovo and Dimensional Fund Advisors L.P., each holding around 6.9% of the shares outstanding. Victor Dellovo also happens to hold the title of Chief Executive Officer.

On studying the facts and figures more closely, we found that 9 of the top shareholders account for 54% of the register, implying that along with larger shareholders, there are a few smaller shareholders, thereby balancing out each others interests somewhat.

Researching institutional ownership is a good way to gauge and filter a stock's expected performance. The same can be achieved by studying analyst sentiments. Our information suggests that there isn't any analyst coverage of the stock, so it is probably little known.

Insider Ownership Of CSP

While the precise definition of an insider can be subjective, almost everyone considers board members to be insiders. The company management answer to the board; and the latter should represent the interests of shareholders. Notably, sometimes top-level managers are on the board, themselves.

Insider ownership is positive when it signals leadership are thinking like the true owners of the company. However, high insider ownership can also give immense power to a small group within the company. This can be negative in some circumstances.

It seems insiders own a significant proportion of CSP Inc.. Insiders own US$11m worth of shares in the US$33m company. It is great to see insiders so invested in the business. It might be worth checking if those insiders have been buying recently.

General Public Ownership

With a 32% ownership, the general public have some degree of sway over CSPI. This size of ownership, while considerable, may not be enough to change company policy if the decision is not in sync with other large shareholders.

Next Steps:

While it is well worth considering the different groups that own a company, there are other factors that are even more important. Take risks, for example - CSP has 5 warning signs (and 1 which makes us a bit uncomfortable) we think you should know about.

If you would prefer check out another company -- one with potentially superior financials -- then do not miss this free list of interesting companies, backed by strong financial data.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About NasdaqGM:CSPI

CSP

Develops and markets IT integration solutions, security products, managed IT services, cloud services, network adapters, and cluster computer systems for commercial and defense customers worldwide.

Excellent balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives